Uranium Energy Corp. (NYSE: UEC} announced that, further to its news release dated May 9, 2017, the Company has completed its acquisition of the fully permitted Reno Creek in-situ recovery (“ISR”) project located in the Powder River Basin, Wyoming.

Corpus Christi, TX, August 10, 2017 – Uranium Energy Corp. (NYSE: UEC} is pleased to announce that, further to its news release dated May 9, 2017, the Company has completed its acquisition of the fully permitted Reno Creek in-situ recovery (“ISR”) project located in the Powder River Basin, Wyoming (“Reno Creek” or the “Project”).

Transaction Highlights

Strengthens UEC’s pipeline of low-cost ISR uranium projects with the addition of Reno Creek, located in the prolific Powder River Basin in Wyoming.Reno Creek hosts an NI 43-101 Measured and Indicated resource* of 27.47 million tons grading 0.041% U3O8 yielding 21.98 million lbs. U3O8 at a grade-thickness (GT) cutoff of 0.20.The NI 43-101 resource report also indicates potential to expand the resource with additional drilling.

A Source and Byproduct Materials License for Reno Creek was issued in February 2017 from the U.S Nuclear Regulatory Commission (“NRC”), supported by a Final Environmental Impact Statement and Record of Decision, to permit production of up to 2 million lbs. U3O8 per year.Strategically located within the Powder River Basin in Wyoming, a uranium mining-friendly state with excellent infrastructure and an experienced labor force

.A Pre-Feasibility Study (“PFS”)** on Reno Creek completed in 2014 demonstrated strong project economics with low capital and operating costs consistent with ISR projects in Wyoming. A new and optimized PFS is in progress and will be completed by UEC.Cumulative project expenditures to date at Reno Creek total approximately $60 million.Creates a new partnership with respected mining private equity firm Pacific Road Resources Funds, who now own approximately 9.5% of UEC’s common shares.

Amir Adnani, President & CEO, stated: “We are very pleased to have completed an acquisition of this scale on an advanced, fully permitted, low cost ISR project in the prolific Powder River Basin of Wyoming. We will continue to advance and optimize the Project in order to position it for turn-key development once the uranium market signals a recovery. Reno Creek is an exceptional addition to the UEC uranium mining portfolio near the bottom of the cycle.”

Transaction Details

The acquisition was completed pursuant to the previously announced share purchase agreement (the “Agreement”) with each of the original Pacific Road Resources Funds (“PRRF”) and, by tag-along right, Bayswater Uranium Corporation (“BHI”, and together with PRRF the “Vendors”), to acquire all of the issued and outstanding shares of Reno Creek Holdings Inc. (“RCHI”).

Under the terms of the Agreement, the Company has now provided to the Vendors, in return for PRRF’s (97.27%) and BHI’s (2.73%) ownership in RCHI (the “Transaction”), the following:

14,392,927 common shares of the Company (the “Share Consideration”);11,308,728 warrants of the Company (the “Warrant Consideration”; and each a “Warrant”), with each Warrant entitling the holder to acquire one share of the Company at an exercise price of $2.30 per share for a period of five years from closing. The Warrants have an accelerator clause which provides that, in the event that the closing price of UEC’s common shares on its principally traded exchange is equal to or greater than $4.00 per share for a period of 20 consecutive trading days, UEC may accelerate the expiry date of the Warrants to within 30 days by providing written notice to the holders; anda 0.5% net profits interest royalty, capped at $2.5 million (the “NPI Consideration”, and together with the Share Consideration and the Warrant Consideration, the “Consideration”);In addition to the Consideration for RCHI, the Company has now also issued an aggregate of a further 594,981 common shares to the Vendors in settlement of both certain reimbursable expenses which were incurred by the Vendors respecting the Project since the execution of the Agreement and for certain insurance costs incurred by UEC/RCHI at closing.

As a result of the completion of the Transaction PRRF and BHI now collectively own approximately 9.67% of UEC’s shares outstanding and both parties have agreed to certain voting and resale conditions pursuant to the terms of the Agreement.

Reno Creek ISR Project Overview

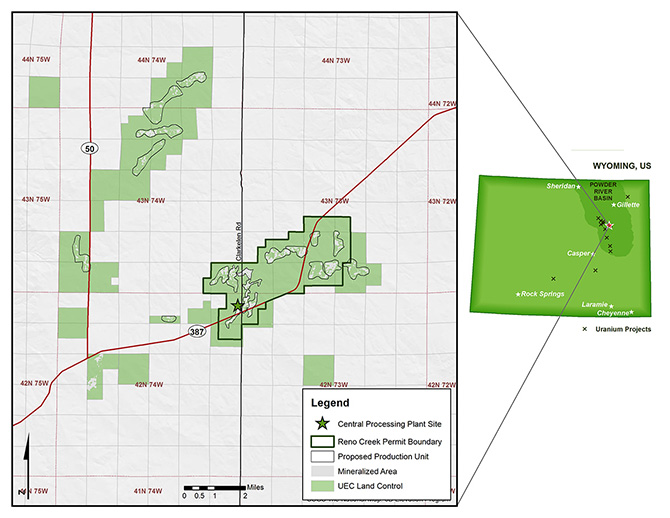

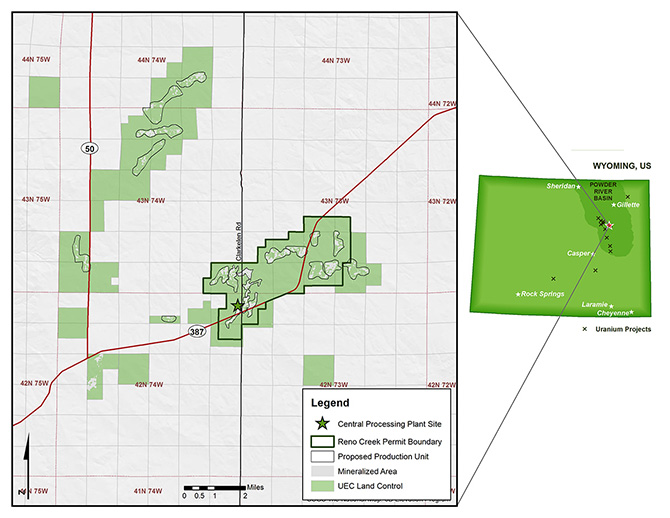

The Reno Creek ISR Project is located in the Powder River Basin, Campbell County, Wyoming, approximately 80 miles northeast of Casper. The Vendors undertook significant project advancement since 2010 when they acquired the project, including expenditures targeting land acquisition, resource development, a pre-feasibility study, and permitting, which culminated in the NRC issuing a Source and Byproduct Materials License to construct and operate an ISR uranium facility in February 2017.

The Source and Byproduct Materials License was the last major permit required to proceed with development of the Project. The permits allow Reno Creek to process up to 2 million pounds of uranium a year from five resource units: North Reno Creek, Southwest Reno Creek, Moore, Bing, and Pine Tree. Within the five resource units are 16 proposed production units and associated wellfields, header houses, and a central processing plant.

History of the Project

Substantial historical exploration, development, and project permitting work has been completed on the Reno Creek property, beginning in the late 1960s and continuing to present. Approximately 10,000 exploration drill holes have been completed by various operators over time, who continued to advance the project by drilling and growing land and mineral interests to nearly 16,000 acres by 2007. Since the Vendors took control of the Project, mineral and surface land holdings have grown to approximately 22,000 acres, including a 40-acre company-owned central processing plant site.

Summary of Mineral Resources*

In July 2016, the Vendors commissioned an updated Technical Report completed by Behre Dolbear & Company (USA), Inc. on Reno Creek titled “Technical Report and Audit of Resources of the Reno Creek ISR Project, Campbell County, Wyoming, USA” (the “Current Technical Report”). Over $60 million has been expended on the Project to date, including completion of more than 10,000 drill holes. Data from drilling, including survey coordinates, collar elevations, depths, and grade of uranium intercepts, have been incorporated into the database that forms the current resource estimate at Reno Creek (Table 1).

Table 1(1)

Class Tons(millions) Weighted AverageThickness (feet) Weighted AverageGrade (% U3O8) Pounds U3O8(millions)Measured & Indicated 27.47 12.3 0.041 21.98Inferred 1.36 10.6 0.034 0.931 Cut-off of greater or equal to 0.20 grade x thickness per intercept

The inferred resources are found principally in underexplored portions of the Reno Creek property, along extensive identified redox fronts. The authors of the July 2016 Reno Creek resource estimate recommend continuing exploration along these trends, with the expectation of further contributions to the reported resource base, given that known mineralization occurs in a continuous sandstone present across all of the Reno Creek, Moore, and Bing resource units.

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and was reviewed by Clyde L. Yancey, P.G., Vice President-Exploration for the Company, a Qualified Person under NI 43-101.

Advisors and Counsel

Haywood Securities Inc. acted as financial advisor to the Company. McMillan LLP and Holland & Hart LLP acted as legal advisors to the Company and Osler, Hoskin & Harcourt LLP acted as legal advisor to PRRF.

About Uranium Energy Corp

Uranium Energy Corp is a U.S.-based uranium mining and exploration company. The Company’s fully-licensed Hobson Processing Facility is central to all of its projects in South Texas, including the Palangana ISR mine, the permitted Goliad ISR project and the development-stage Burke Hollow ISR project.

In Wyoming, UEC controls the permitted Reno Creek ISR project. Additionally, the Company controls a pipeline of advanced-stage projects in Arizona, Colorado, New Mexico and Paraguay. The Company’s operations are managed by professionals with a recognized profile for excellence in their industry, a profile based on many decades of hands-on experience in the key facets of uranium exploration, development and mining.

About Pacific Road Resources Funds

The Pacific Road Resources Funds are private equity funds investing in the global mining industry. They provide expansion and buyout capital for mining projects, mining related infrastructure and mining services businesses located throughout the world.

The team is located in Sydney, Australia and Vancouver, Canada.

Contact Uranium Energy Corp Investor Relations at: info@uraniumenergy.com

,