Inovio Zika Vaccine Prevents Persistence of Virus and Damage in Male Reproductive Tract in Study.

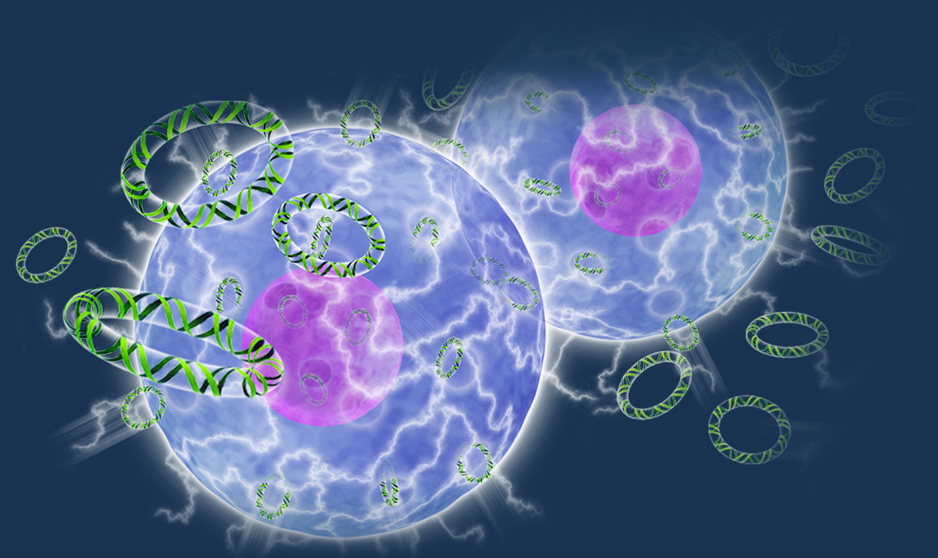

Inovio Pharmaceuticals, Inc. {NASDAQ: INO} today announced its DNA-based Zika vaccine (GLS-5700) protected against Zika virus-induced damage to testes and sperm, and prevented persistence of the virus in the reproductive tract of all vaccinated male mice challenged with a high dose of the Zika virus.

.

Inovio Zika Vaccine Prevents Persistence of Virus and Damage in Male Reproductive Tract in Pre-Clinical Study.

.

Zika DNA vaccine may protect against sexual transmission.

.PLYMOUTH MEETING, Pa. – June 7, 2017 – Inovio Pharmaceuticals, Inc. {NASDAQ: INO} today announced its DNA-based Zika vaccine (GLS-5700) protected against Zika virus-induced damage to testes and sperm, and prevented persistence of the virus in the reproductive tract of all vaccinated male mice challenged with a high dose of the Zika virus.

.This preclinical study data was published in Nature Communications in an article entitled, “DNA Vaccination Protects Mice Against Zika Virus-Induced Damage to the Testes,” written by Inovio scientists and collaborators.

.

Dr. Gary Kobinger, lead author of the study and Director of the Centre for Research in Infectious Diseases at Laval University in Quebec City, Canada, said, “Given that we know that Zika virus infection can involve the male reproductive tract and persist in humans for several months after onset of infection, this preclinical data warrants further examination as a potential means to reduce Zika virus infection of the male reproductive tract and the risk of sexual transmission of the virus.”

.

Results from a previous preclinical study with GLS-5700 were published in Nature Partner Journals (npj) Vaccines and demonstrated that a single dose of Inovio’s Zika vaccine protected 100% of mice from infection, brain damage and death after exposure to the virus. Specifically, vaccinated mice were protected from degeneration in the cerebral cortex and hippocampal areas of the brain while un-vaccinated mice showed significant degeneration of the brain after Zika infection. In addition, a single dose of Inovio’s Zika vaccine also provided 100% protection from the virus in a study of non-human primates.

.

In the first-ever human study of a Zika vaccine, Inovio reported that in its phase I study (ZIKA-001), after a three dose vaccine regimen with GLS-5700 high levels of binding antibodies were measured (ELISA) in 100% (39 of 39) of evaluated subjects. Moreover, two doses or a single dose of vaccine generated a robust antibody response in 95% (37 of 39) and 40% (16 of 40) of evaluated subjects, respectively.

.Inovio’s second phase I study of 160 subjects in Puerto Rico (ZIKA-002) will complete enrollment this month. In this randomized, placebo-controlled, double-blind trial, 80 subjects received vaccine and 80 subjects received placebo. The study is evaluating the safety, tolerability and immunogenicity of GLS-5700 and assessing differences in Zika infection rates between the arms as an exploratory signal of vaccine efficacy.

.

Dr. J. Joseph Kim, Inovio’s President and CEO, said, “This published data suggests another avenue of potential protection against the Zika virus. While detrimental effects on sperm and fertility have not yet been reported in Zika-infected human males, persistence of Zika in semen and sperm and sexual transmission by males has been documented. This new preclinical data suggests that our Zika vaccine may represent an opportunity to limit the potential for sexual transmission of the virus. In addition to our ongoing ZIKA-001 and 002 clinical studies, we are planning for a larger phase 2 study in our efforts to bring our Zika vaccine to patients.”

.

Inovio is developing its Zika vaccine, GLS-5700, with GeneOne Life Science, Inc. (KSE: 011000) and academic collaborators from the U.S. and Canada who are also collaborating to advance clinical development of Inovio’s Ebola and MERS vaccines.

.

About Zika Virus

First identified in Uganda in 1947, Zika virus subsequently spread to equatorial Asia and in recent years through the South Pacific, Hawaii, South America, Central America, and Caribbean. In 2016, local mosquito-borne transmission occurred in North America in Florida and Texas. Zika virus is a flavivirus, a family of viruses including yellow fever, dengue, and West Nile virus which are introduced to people through mosquito bites.

.Unlike other flaviviruses, Zika virus can be sexually transmitted. As of December 2016, 68 countries and territories reported continuing mosquito-borne transmission of the Zika virus, compared to 33 countries stated by WHO in their first Zika situation report in February 2016.

.

The most common symptoms of Zika virus infection are fever, rash, joint pain, and conjunctivitis. Zika is associated with birth defects, most notably microcephaly, which arise from infection during pregnancy. Microcephaly manifests as incomplete brain development and an abnormally small head. Recent reports suggest Zika may also be associated with other neurological abnormalities and abnormalities in other systems including ocular and cardiac. In adults Zika virus infection is associated with Guillain-Barre syndrome, which causes muscle weakness of the limbs and in severe cases may cause almost total paralysis including the inability to breathe.

.

No vaccine or therapy currently exists for the prevention or treatment of Zika virus infection.

.

About Inovio Pharmaceuticals, Inc.

Inovio is taking immunotherapy to the next level in the fight against cancer and infectious diseases. They are the only immunotherapy company that has reported generating T cells in vivo in high quantity that are fully functional and whose killing capacity correlates with relevant clinical outcomes with a favourable safety profile.

.With an expanding portfolio of immune therapies, the company is advancing a growing preclinical and clinical stage product pipeline. Partners and collaborators include MedImmune, Regeneron Pharmaceuticals, Genentech, GeneOne Life Science, Plumbline Life Sciences, ApolloBio Corporation, The Wistar Institute, Laval University, University of Pennsylvania, Drexel University, DARPA, NIH, HIV Vaccines Trial Network, National Cancer Institute, and U.S. Military HIV Research Program.

.

For more information, please visit www.inovio.com

CONTACT:

Bernie Hertel

+1 858-410-3101

bhertel@inovio.com

.