The Company has also filed a NI 43-101 technical report for its Crucero Project located in the Department of Puno, southeast Peru.

.

.

Vancouver, British Columbia – February 22, 2018 – GoldMining Inc. {TSX.V: GOLD} is pleased to announce BRI Mineração Ltda. , a wholly-owned subsidiary of the Company, has entered into a royalty purchase agreement with certain royalty holders (the “Vendors“) on the Cachoeira Project. In addition, further to its press release dated January 16, 2018, the Company has filed a National Instrument 43-101 (“NI 43-101”) technical report (the “Technical Report”) for its Crucero Project located in the Department of Puno, southeastern Peru.

.

Paulo Pereira, President of GoldMining, commented: “We are pleased to have reached an agreement with several of the royalty holders on the Cachoeira Project, which extinguishes a portion of the current advance royalty payment, as well as making it more attractive in the future when the deposit is developed or sold. In 2018, we will continue to look at innovative ways to advance our portfolio of resource-stage gold projects in the Americas to maximize value for our shareholders”.

.

Royalty Purchase Agreement

Pursuant to the Agreement, BRI will acquire the Vendors’ 66.66% interest in the existing 4.0% net production royalty (the “Royalty“) on the Company’s Cachoeira Project, in consideration (the “Consideration“) for US$133,320 payable in cash to the Vendors, and 698,161 common shares of the Company.

.

The common shares of the Company to be issued under the transaction are subject to a four month and one day hold period and certain resale restrictions pursuant to the terms of the Agreement.

.

Crucero Technical Report

The Technical Report, dated effective December 20, 2017, is titled “Technical Report on the Crucero Property, Carabaya Province, Peru”. The Technical Report was authored by Mr. Greg Z. Mosher, M.Sc., P.Geo. of Global Mineral Resource Services, who is a qualified person within the meaning of NI 43-101 and is independent of the Company.

The Technical Report includes the following resource estimate for the Crucero Project at a 0.4 g/t gold cut-off (Tables 1 to 3).

.

Table 1: NI 43-101 indicated resource estimate for the A1 deposit.

| Gold Cut-off |

Tonnage |

Grade |

Contained Metal |

| (g/t) |

(Mt) |

Gold (g/t) |

Gold (Moz) |

| 2.0 |

876,000 |

2.3 |

64,000 |

| 1.0 |

13,504,000 |

1.4 |

606,000 |

| 0.8 |

19,617,000 |

1.2 |

783,000 |

| 0.6 |

25,378,000 |

1.1 |

912,000 |

| 0.4 |

30,653,000 |

1.0 |

993,000 |

| 0.2 |

33,019,000 |

1.0 |

1,013,000 |

| 0.0 |

33,341,000 |

0.9 |

1,013,000 |

.

.

Table 2: NI 43-101 inferred resource estimate for the A1 deposit.

| Gold Cut-off |

Tonnage |

Grade |

Contained Metal |

| (g/t) |

(Mt) |

Gold (g/t) |

Gold (Moz) |

| 2.0 |

827,000 |

2.4 |

63,000 |

| 1.0 |

14,265,000 |

1.4 |

656,000 |

| 0.8 |

21,662,000 |

1.3 |

874,000 |

| 0.6 |

28,958,000 |

1.1 |

1,038,000 |

| 0.4 |

35,779,000 |

1.0 |

1,147,000 |

| 0.2 |

38,706,000 |

0.9 |

1,173,000 |

| 0.0 |

39,479,000 |

0.9 |

1,174,000 |

.

.

Table 3: Assumptions utilised to establish the conceptual pit for the purposes of the above resource estimate.

| Parameter |

Value |

Unit |

| Gold Price |

1,500 |

US$/oz |

| Mine Operating Cost (Mineralization and Waste) |

1.60 |

US$/t mined |

| Process Operating Cost |

16.00 |

US$/t milled |

| Overall Pit Slope |

47 |

Degrees |

.

.

The Crucero Project occurs within the Puno Orogenic Belt, which is host to orogenic gold deposits and associated extensive alluvial deposits in eastern Peru and Bolivia. The Project is road accessible by paved road from Juliaca to the town of Crucero, approximately 150 km to the northeast, with the remaining 50 km to the site by gravel road. High-power electrical lines pass within 8 km of the property.

.

The A1 deposit, as currently defined by trenching and drilling, strikes northwest and dips vertically to steeply to the northeast. The deposit is approximately 750 m long by 100 m in width and has been traced to a vertical depth of 400 m, but most of the drilling is confined to within 250 m of surface. The deposit is open at depth and along strike to the northwest and southeast. The structurally controlled gold mineralization is associated with sulphide veins hosted within strongly deformed metasedimentary rocks.

.

Historic exploration programs have focused on the A1 deposit, however geophysical and geochemical surveys have identified additional targets for follow-up exploration.

.

Qualified Person

The resource estimate disclosed herein on the Crucero Project was prepared for GoldMining by Mr. Greg Z. Mosher, B.Sc., M.Sc., P.Geo., of Global Mineral Resource Services (the “Qualified Person”). Mr. Mosher is recognized as a qualified person as defined in NI 43-101, is independent of the Company and has reviewed and approved the disclosure regarding the resource estimate for the Crucero Project disclosed herein.

Paulo Pereira, President of GoldMining Inc. has reviewed and approved the technical information contained in this news release. Mr. Pereira holds a Bachelors degree in Geology from Universidade do Amazonas in Brazil, is a Qualified Person as defined in National Instrument 43-101 and is a member of the Association of Professional Geoscientists of Ontario.

.

Cautionary Note

Investors are cautioned not to assume that any part or all of the mineral deposits in the “measured”, “indicated” and “inferred” categories will ever be converted into mineral reserves with demonstrated economic viability or that inferred mineral resources will be converted to the measured and/or indicated categories through further drilling. In addition, the estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of pre-feasibility or feasibility studies.

.

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on the acquisition and development of gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, U.S.A., Brazil, Colombia and Peru. Additionally, GoldMining owns a 75% interest in the Rea Uranium Project, located in the Western Athabasca Basin of Alberta, Canada.

.

For additional information, please contact:

GoldMining Inc.

Amir Adnani, Chairman

Garnet Dawson, CEO

Telephone: (855) 630-1001

Email: info@goldmining.com

.

This document contains certain forward-looking statements that reflect the current views and/or expectations of GoldMining with respect to its business and future events, including expectations and future plans respecting its acquisition strategy and the completion of the acquisition of the royalty interest, and future plans respecting the Project and statements with respect to the details of the mineral resource estimate. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the markets in which GoldMining operates, including: (i) that the acquisition of the royalty interest will complete as contemplated and that the conditions under the Agreement will be satisfied, and (ii) the inherent risks involved in resource estimation and the exploration and development of mineral properties, the uncertainties involved in resource estimation and interpreting drill results and other exploration data, the potential for delays in exploration or development activities, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with GoldMiningꞌs expectations, accidents, equipment breakdowns, title and permitting matters, labour disputes or other unanticipated difficulties with or interruptions in operations, fluctuating metal prices, unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Project. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: that the parties may not satisfy all of the conditions under the Agreement, the inherent risks involved in the exploration and development of mineral properties and uncertainties relating to the availability and costs of financing needed in the future. These risks, as well as others, including those set forth in GoldMiningꞌs filings with Canadian securities regulators, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward looking information, will prove to be accurate. GoldMining does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

.

Neither the TSX Venture Exchange, nor its Regulation Services Providers (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

.

![]() Condor Gold {AIM: CNR / TSX: COG} announced that it has formally submitted an amendment to an Environmental and Social Impact Assessment to the Ministry of Environment and Natural Resources in Nicaragua, to redesign the open pit without resettling 1,000 people.

Condor Gold {AIM: CNR / TSX: COG} announced that it has formally submitted an amendment to an Environmental and Social Impact Assessment to the Ministry of Environment and Natural Resources in Nicaragua, to redesign the open pit without resettling 1,000 people.

PDAC 2018

PDAC 2018

Strongbow Resources {TSX.V: SBW}

Strongbow Resources {TSX.V: SBW}

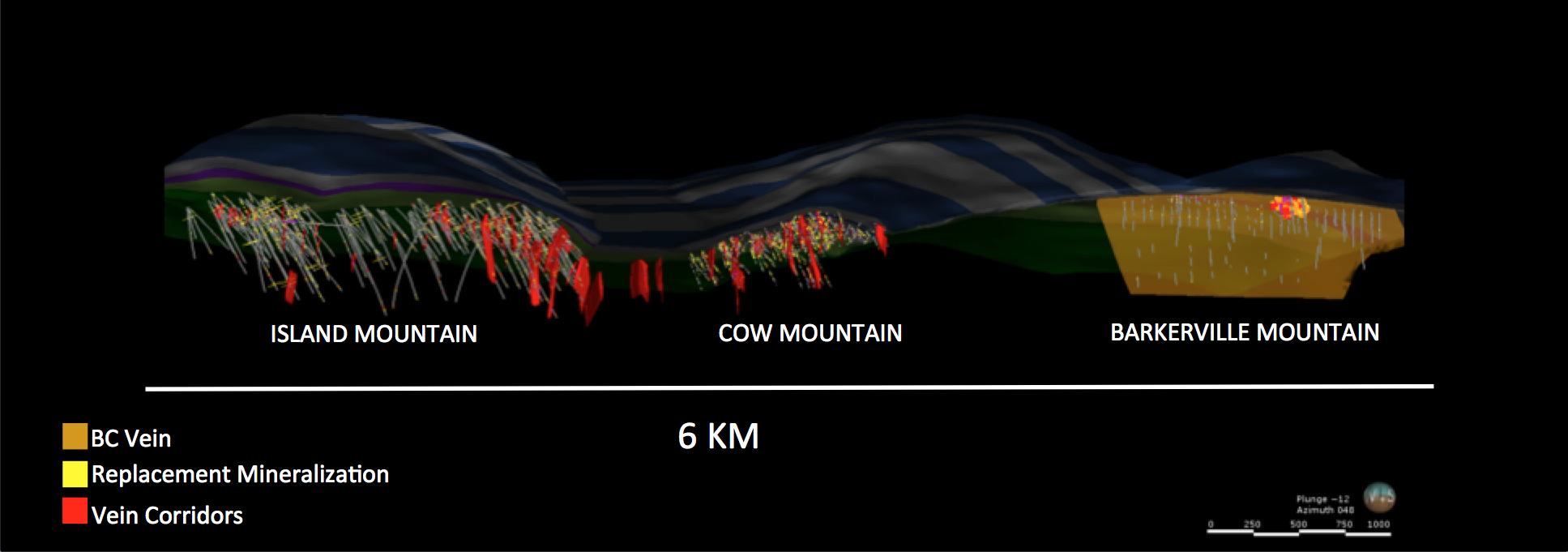

GoldMining Inc. {TSX-V: GOLD}

GoldMining Inc. {TSX-V: GOLD}

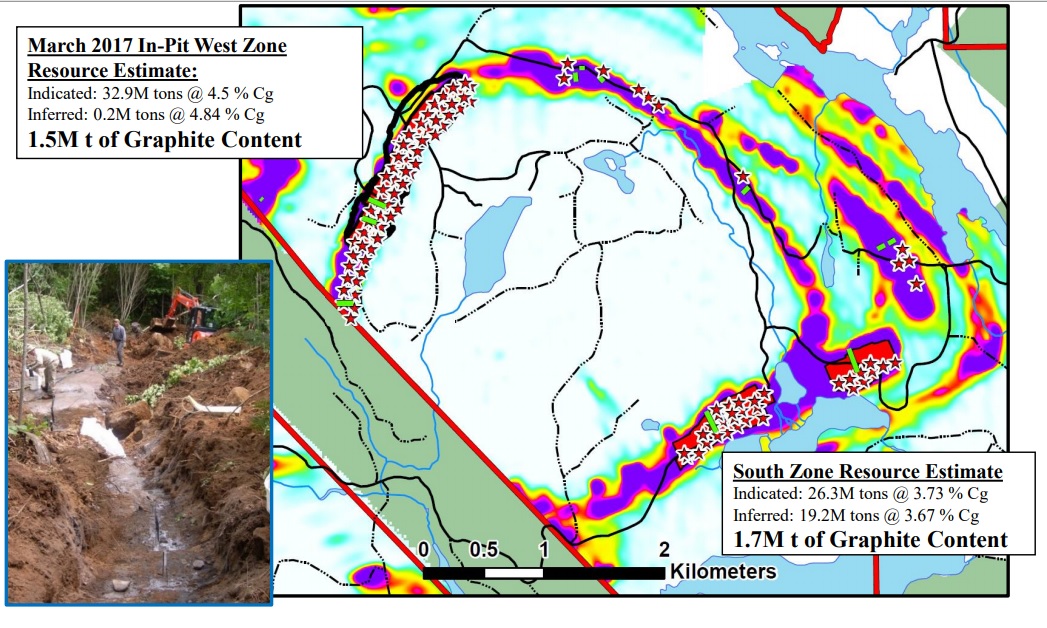

Silver Bull Resources, Inc. {TSX: SVB}

Silver Bull Resources, Inc. {TSX: SVB}

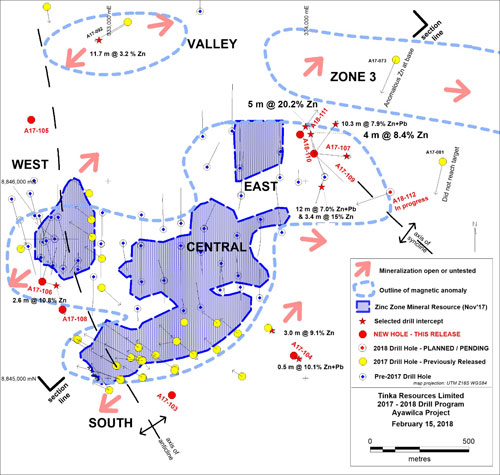

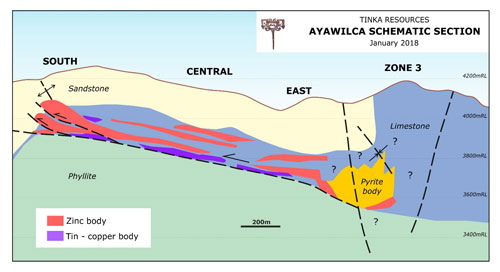

Tinka Resources Ltd. {TSX.V: TK}

Tinka Resources Ltd. {TSX.V: TK}

Komet Resources {TSX.V: KMT}

Komet Resources {TSX.V: KMT}