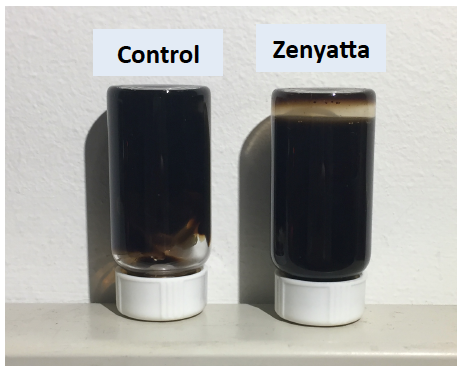

Zenyatta Ventures Ltd. {TSX-V: ZEN} announced significant results from the cement-based composite test work that was recently conducted by Ben-Gurion University of the Negev in Israel. BGU tested the performance of Zenyatta graphene oxide in a new cement/concrete admixture and the results demonstrated a remarkable reinforcing effect, with a compressive strength enhancement of 34%

.

.

THUNDER BAY, Ontario, Feb. 01, 2018 – Zenyatta Ventures Ltd. {TSX-V: ZEN} announces significant results from the cement-based composite test work that was recently conducted by Ben-Gurion University of the Negev (“BGU”) in Israel. BGU tested the performance of Zenyatta graphene oxide (“GO”) in a new cement/concrete admixture and the results demonstrated a remarkable reinforcing effect, with a compressive strength enhancement of 34% and a flexural strength enhancement of 62% over normal cement paste.

.

Dr. Oren Regev, Associate Professor in the Department of Chemical Engineering at BGU, stated “These enhancements are among the highest reported in the literature for nanocarbon-loaded matrices (Carbon nanotubes, graphene nanoplatelets and other GO available in the market), suggesting that Zenyatta GO is extremely attractive for cement nano-reinforcement.”

.

Aubrey Eveleigh, President and CEO for Zenyatta stated, “These exceptional independent test results have exceeded our expectations. The concrete industry, and composites in general, can represent a large and valuable end use market for our graphene material. An advanced nanomaterial, like graphene, can offer a game-changing solution to an existing product in the construction marketplace. The increase in concrete performance would allow for a better and wider range of infrastructure such as specialized roads, bridges, taller buildings, marine structures, tunnels, precast units and especially construction in natural disaster areas.”

.

Zenyatta previously announced that BGU demonstrated that the addition of the Company’s graphene into concrete achieved a faster curing time and a superior mechanical performance that inhibits premature failure and tolerates large forces like those produced during earthquakes or explosions. The Company will target the reduction of very expensive additives that are currently used to produce high performance concrete. These additives include fibers, fly ash and silica fume.

.

Also, this new graphene enhanced admixture has the potential to reduce the amount of cement that will be used in concrete for construction, thereby considerably cutting carbon dioxide (CO₂) emissions related to its production. Cement production for the concrete industry is a significant contributor of CO₂ which is a major greenhouse gas. In 2015, a total of 4.1 billion tonnes of cement was produced globally (Source: USGS). Approximately 25% of this total is in the use of Ultra-High Performance Concrete and High Performance Concrete which have the same ingredients as normal concrete but with special high-cost additives.

.

Zenyatta, BGU and Larisplast have received grant funding from the Canada-Israel Industrial R&D Foundation under the Ontario-Israel Collaboration Program for this pilot scale test. Upon successful completion of testing, an Agreement between the Parties contemplates the potential formation of a new corporation (‘Newco’) jointly owned (50/50) by Zenyatta and Larisplast for the purposes of marketing this new specialised admixture product. Zenyatta would be the exclusive provider of purified graphite to Newco and any other party working with Larisplast on this technology. The Company will provide additional detailed information related to this project once all parties are in a position to do so.

.

Graphene was first produced in 2004 at the University of Manchester by Andre Geim and Konstantin Novoselov who were jointly awarded the Nobel Prize in Physics in 2010 “for groundbreaking experiments regarding the two-dimensional material graphene.” Graphene (or Carbon) is a single sheet of pure graphite that is one atom thick, flexible, transparent, light, stronger than diamonds or steel and is highly conductive. Graphene is making inroads in diverse industries, including transportation, medicine, electronics, energy, construction, defence and desalination. So far, one obstacle to its widespread use is the high manufacturing cost for high-quality graphene. A lower-cost approach is to use high-purity natural graphite, like Zenyatta’s material, as the starting point to produce graphene by mechanical methods or GO by a chemical method. The GO that was used in this test work was produced from Zenyatta’s high-purity graphite by Dr. Chen’s research group at Lakehead University.

.

Larisplast is an industry leader in Israel specializing in the field of concrete admixtures. The company develops, produces, markets and distributes high quality products and materials for Israel’s concrete industry according to strict Israeli standards. Larisplast operates on a nationwide basis in Israel and is currently developing international markets and distribution channels.

.

BGU is a research leader in alternative energy, robotics and nano-technology while playing a critical role in transforming Israel’s high-tech growth. Specifically, the BGU research group focuses on carbon nanotubes and graphene product derivatives for new applications. The Advanced Technologies Park (ATP), adjacent to BGU is home to many multi-national high-tech companies, such as EMC, Oracle, Hewlett Packard, and Deutsche Telekom, which are leveraging the R&D expertise of BGU mainly through B. G. Negev Technologies and Applications Ltd. (“BGN”). BGN is the technology transfer and commercialisation company for development of university technologies with industry partners.

.

BGU’s expertise in nanoscience is advancing new materials to convert light and heat into electrical energy, to produce lightweight cars and planes of unprecedented strength. Researchers are developing incredibly small transistors to power computers, membranes for desalinating water, graphene surfaces loaded with specific drugs for delivery to targeted diseased cells, graphene reinforcement in cement-based materials and hydrogen storage device as a key enabling technology for the advancement of hydrogen and fuel cell technologies.

.

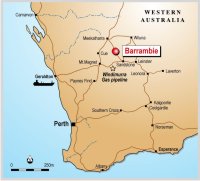

Zenyatta continues to develop its rare igneous-hosted Albany graphite deposit in Ontario, Canada. The Company’s highly crystalline graphite deposit is fluid-derived rather than the typical and abundant sedimentary flake-type graphite deposits. Albany is the largest and only graphite project of its kind in the world. The unusual geologic mode of formation accounts for the favourable purity, crystallinity and particle size of graphite found in the Albany deposit. Dr. Andrew Conly (Professor, Geology at Lakehead University) observed, “Evidence has shown that Zenyatta has discovered a unique sub-class of a hydrothermal graphite deposit unlike any other. Igneous breccia-hosted graphite deposits like Albany are very rare, and to the best of my knowledge, none are currently being mined or even in an advanced stage of exploration globally. The far more common flake-type (sedimentary) graphite deposits form through a completely different geological process.”

.

The Albany graphite deposit is situated 30 km north of the Trans-Canada Highway, power line and natural gas pipeline near the communities of Constance Lake First Nation and Hearst. A rail line is located 50 km away with an all-weather road approximately 10 km from the graphite deposit.

.

Mr. Aubrey Eveleigh, P.Geo., Zenyatta’s President and CEO, is the “Qualified Person” for the purposes of National Instrument 43-101 and has reviewed, prepared and supervised the preparation of the technical information contained in this news release. Information Sources: LafargeHolcim, US Geological Survey (‘USGS’), US Environmental Protection Agency, US Department of Transportation, Freedonia Group, Marca Espana, Macleans Magazine, UCLA newsroom and personal communication with local engineering firms.

For Further information please visit the Company’s website: www.zenyatta.ca

Email: info@zenyatta.ca

.

CAUTIONARY STATEMENT: This analysis does not represent a statistically large sample size. Furthermore, these positive results are preliminary and do not mean that Zenyatta can extract and process Albany graphite or graphene for applications on an economic basis. Without a formal independent feasibility study, there is no assurance that the operation will be economic. Zenyatta has completed a Preliminary Economic Assessment regarding the Albany Project (the ‘PEA’) in support of its development work (see Zenyatta press release of 1 June 2015). The PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward looking information and Zenyatta cautions readers that forward looking information is based on certain assumptions and risk factors that could cause actual results to differ materially from the expectations of Zenyatta included in this news release. This news release includes certain “forward-looking statements”, which often, but not always, can be identified by the use of words such as “potential”, “believes”, “anticipates”, “expects”, “estimates”, “may”, “can”, “could”, “would”, “will”, or “plan”. These statements are based on information currently available to Zenyatta and Zenyatta provides no assurance that actual results will meet management’s expectations. Forward-looking statements include estimates and statements with respect to Zenyatta’s future plans, objectives or goals, to the effect that Zenyatta or management expects a stated condition or result to occur, including the expected timing for release of a pre-feasibility study, the expected uses for graphite in the future, and the future uses of the graphite from Zenyatta’s Albany deposit. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of metallurgical processing, ongoing exploration, project development, reclamation and capital costs of Zenyatta’s mineral properties, and Zenyatta’s financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as, but are not limited to: failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the inability to identify target markets and satisfy the product criteria for such markets; the inability to complete a prefeasibility study; the inability to enter into offtake agreements with qualified purchasers; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry; and those risks set out in Zenyatta’s public documents filed on SEDAR. This list is not exhaustive of the factors that may affect any of Zenyatta’s forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on Zenyatta’s forward-looking statements. Although Zenyatta believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Zenyatta disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

.

![]() Raddison Mining {TSX.V: RDS} completed a deal with Galway Metals {TSX.V GVM} to sell their 100% interest in 14 unpatented minerals claims located in the northern Abitibi, in exchange for shares and options.

Raddison Mining {TSX.V: RDS} completed a deal with Galway Metals {TSX.V GVM} to sell their 100% interest in 14 unpatented minerals claims located in the northern Abitibi, in exchange for shares and options.

Bitcoin $BTC

Bitcoin $BTC