Silver Bull Resources announces two new high grade mineralised zones

Silver Bull Resources, Inc. {TSX: SVB announced that it has identified two new zones of high grade sulphide mineralisation at its Sierra Mojada Project in Coahuila, Northern Mexico.

.

| January 10, 2018 |

Vancouver, British Columbia — Silver Bull Resources, Inc. {TSX: SVB} is pleased to announce it has identified two new zones of high grade sulphide mineralisation at its Sierra Mojada Project in Coahuila, Northern Mexico.

- Highlights from the channel sampling program include:

- Sample N342057 @ 30.7% Zinc, 124g/t Silver, 15.8% Lead, 0.26% Copper.

- Sample N342060 @ 27.5% Zinc, 80.5g/t Silver, 4.18% Lead, 0.18% Copper.

- Sample N342068 @ 27.2% Zinc, 149g/t Silver, 14.5% Lead, 0.26% Copper.

- Sample N342072 @ 26.6% Zinc, 160g/t Silver, 9.23% Lead, 0.33% Copper.

- Sample N342063 @ 25.3% Zinc, 105g/t Silver, 4.13% Lead, 0.09% Copper.

- Sample N342069 @ 22.2% Zinc, 101g/t Silver, 16.05% Lead, 0.15% Copper.

- Sample N342071 @ 22.1% Zinc, 182g/t Silver, 9.79% Lead, 0.49% Copper.

- Sample N342075 @ 21.8% Zinc, 159g/t Silver, 17.6% Lead, 0.36% Copper.

- Sample N342064 @ 20.7% Zinc, 146g/t Silver, 4.58% Lead, 0.12% Copper.

- Sample N342083 @ 20.6% Zinc, 104g/t Silver, 0.18% Lead, 0.37% Copper.

- Sample N342067 @ 20.2% Zinc, 69.5g/t Silver, 4.23% Lead, 0.12% Copper.

- Sample N342074 @ 19.45% Zinc, 90.2g/t Silver, 7.47% Lead, 0.13% Copper.

- Sample N342058 @ 17.25% Zinc, 175g/t Silver, 3.34% Lead, 0.53% Copper.

- Sample N342051 @ 15.65% Zinc, 53.9g/t Silver, 4.91% Lead, 0.17% Copper.

- Sample N342061 @ 14.6% Zinc, 37.9g/t Silver, 2.94% Lead, 0.13% Copper.

- Sample N342059 @ 13.9% Zinc, 32.8g/t Silver, 2.53% Lead, 0.07% Copper.

- Sample N342073 @ 13.55% Zinc, 41.1g/t Silver, 3.03% Lead, 0.06% Copper.

- Sample N342078 @ 11.7% Zinc, 606g/t Silver, 2.16% Lead, 0.40% Copper.

- Sample N342065 @ 11.55% Zinc, 113g/t Silver, 4.85% Lead, 0.23% Copper.

- Sample N342070 @ 11.25% Zinc, 18.2g/t Silver, 1.05% Lead, 0.02% Copper.

- Sample N342052 @ 10.2% Zinc, 49.7g/t Silver, 2.3% Lead, 0.06% Copper.

- Sample N342053 @ 7.12% Zinc, 25g/t Silver, 1.44% Lead, 0.02% Copper.

- Sample N342066 @ 6.77% Zinc, 90g/t Silver, 1.20% Lead, 0.40% Copper.

- The new sulphide zones were identified in 350 meters of previously inaccessible historical underground workings that were recently reconditioned by Silver Bull.

- The new sulphide zones lie to the west of Silver Bull’s recent drilling along an east-west trend which includes diamond core intercepts of 9 meters @ 20.7% Zinc, 98g/t Silver, 1.0% Lead and 0.26% Copper and 16 meters @ 396g/t Silver and 1.61% Copper.

- The new zones lie within a 1.4 kilometer long east-west trending “chargeability high” identified through a gradient Induced Polarization (IP) survey. The chargeability anomaly remains open towards the west and coincides with a convex “roll over” in the sole of a thrust fault identified through drilling and underground mapping.

The channel samples outlined in this news release target two new zones of sulphide mineralisation recently identified by accessing and reconditioning underground workings not previously accessible to Silver Bull.

.

Continuous chip samples up to 2 meters in length were taken along the walls of the underground workings. The purpose of the program was to extend the mineralisation of the known sulphide zone, and better understand the geology and controls on the mineralisation, and confirm the overall grades of the sulphide grades historically mined at Sierra Mojada.

.

Approximately 350 meters of “new” underground workings were opened up and 39 initial channel samples taken. Twenty one (21) samples recorded values over 10% zinc with a peak value of 30.7% zinc, Twenty one (21) samples recorded values over 100g/t silver with a peak value of 606g/t silver, and nine (9) samples recorded values over 5% lead with a peak value of 17.6% lead. A summary of the results are shown in the table below.

| Sample ID | Interval (m) | Zinc (%) | Silver (g/t) | Lead (%) | Copper (%) |

|---|---|---|---|---|---|

| N342051 | 0.8 | 15.65 | 53.9 | 4.91 | 0.17 |

| N342052 | 1.3 | 10.2 | 49.7 | 2.3 | 0.06 |

| N342053 | 1 | 7.12 | 25 | 1.44 | 0.02 |

| N342054 | 0.7 | 5.38 | 95 | 6.87 | 0.43 |

| N342055 | 0.9 | 1.16 | 39.3 | 0.10 | 0.13 |

| N342056 | 1.1 | 2.09 | 46.4 | 0.53 | 0.23 |

| N342057 | 0.8 | 30.7 | 124 | 15.75 | 0.26 |

| N342058 | 1.8 | 17.25 | 175 | 3.34 | 0.53 |

| N342059 | 1.7 | 13.9 | 32.8 | 2.53 | 0.07 |

| N342060 | 0.8 | 27.5 | 80.5 | 4.18 | 0.18 |

| N342061 | 0.8 | 14.6 | 37.9 | 2.94 | 0.13 |

| N342062 | 0.7 | 6.23 | 6.7 | 0.49 | 0.02 |

| N342063 | 0.6 | 25.3 | 105 | 4.13 | 0.09 |

| N342064 | 0.9 | 20.7 | 146 | 4.58 | 0.12 |

| N342065 | 1.1 | 11.55 | 113 | 4.85 | 0.23 |

| N342066 | 1.2 | 6.77 | 90 | 1.20 | 0.44 |

| N342067 | 1.15 | 20.2 | 69.5 | 4.23 | 0.12 |

| N342068 | 1 | 27.2 | 149 | 14.5 | 0.26 |

| N342069 | 1.1 | 22.2 | 101 | 16.05 | 0.15 |

| N342070 | 1.1 | 11.25 | 18.2 | 1.05 | 0.02 |

| N342071 | 2 | 22.1 | 182 | 9.79 | 0.49 |

| N342072 | 0.8 | 26.6 | 160 | 9.23 | 0.33 |

| N342073 | 0.75 | 13.55 | 41.1 | 3.03 | 0.06 |

| N342074 | 0.65 | 19.45 | 90.2 | 7.47 | 0.13 |

| N342075 | 1.2 | 21.8 | 159 | 17.6 | 0.36 |

| N342076 | 0.8 | 3.7 | 461 | 2.06 | 0.55 |

| N342077 | 0.7 | 1.23 | 514 | 1.18 | 1.19 |

| N342078 | 0.7 | 11.7 | 606 | 2.16 | 0.40 |

| N342079 | 1.3 | 2.92 | 116 | 0.75 | 0.35 |

| N342080 | 1.2 | 0.66 | 59.9 | 0.11 | 0.20 |

| N342081 | 1 | 0.46 | 53.5 | 0.17 | 0.18 |

| N342082 | 0.8 | 2.19 | 160 | 1.24 | 0.36 |

| N342083 | 1 | 20.6 | 104 | 0.18 | 0.37 |

| N342084 | 1.2 | 1.54 | 98.5 | 2.56 | 0.08 |

| N342085 | 0.9 | 1.57 | 251 | 5.02 | 0.25 |

| N342086 | 1.1 | 2.61 | 242 | 0.77 | 0.37 |

| N342087 | 1.1 | 1.49 | 182 | 0.36 | 0.31 |

| N342088 | 1 | 0.44 | 178 | 0.21 | 0.27 |

| N342089 | 1.5 | 0.33 | 154 | 0.18 | 0.20 |

The Sulphide Zone: A continuous underground channel sampling program conducted by Silver Bull during the month of August 2017 identified a series of east-west trending high angle structure hosting sulphide mineralisation (announced in a news release on 11 September 2017). Results from the continuous channel sampling program yielded 31.5 meters grading at 22.36% zinc, 134.5g/t silver, 2.05% lead, 0.21% copper and 10.5 meters @ 432g/t silver, 1.15% zinc, 0.05% lead, 1.22% and was the target of the 2017 drill program. The newly discovered sulphide mineralisation outlined in this news release is interpreted to be an extension this this mineralisation and will be targeted with drilling in the first quarter of 2018.

.

The Drill Program: Silver Bull is utilizing a company owned Termite drill rig to target the sulphide mineralisation. The Termite is capable of drilling up to 100 meters of NQ diamond core and five drill stations are presently planned with more expected to be added as the drill program progresses. 25 drillholes were completed in 2017 totaling 1086 meters of drilling and continued results from this program are expected shortly.

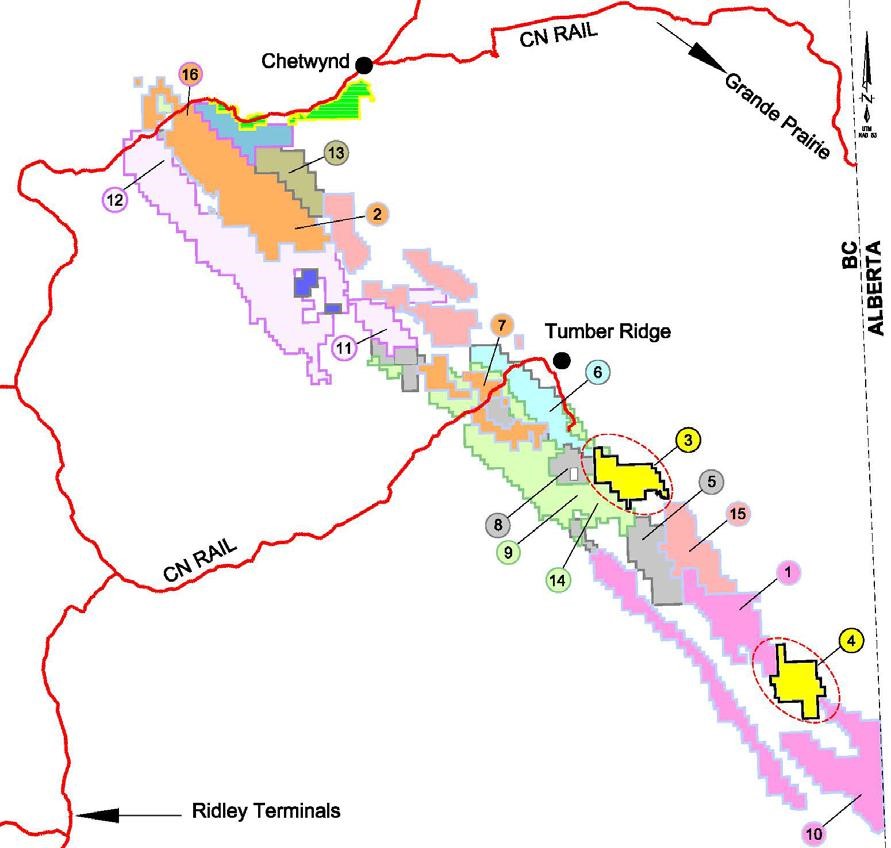

Figure 1. Location of the new sulphide zones of mineralization in relation to the area drilled underground in 2017 and the previously defined oxide 43-101 resource at Sierra Mojada.

Figure 2. Location of the new sulphide zones in relation to the area of sulphide mineralization drilled in 2017 and hole B11144, which intersected 8.45 meters @ 17% Zinc, 5.45% lead, and 60g/t silver. All known sulphide occurrences are located in an east-west trending chargeability high identified in an Induced Polarization geophysics survey. This geophysics anomaly is over 1.4 kilometers in length and is open to the west.

Figure 3. Plan View map of the underground workings and sample locations for the initial channel sampling program. The area shown in red represents 350 meters of newly accessed historical workings. Silver Bull intends to move the termite drill rig west along these workings targeting the extension of the sulphide mineralisation drilled in 2017.

.

Tim Barry, President, CEO and director of Silver Bull states, “350 meters of historical workings were opened up along the east-west trend of the sulphide mineralisation we drilled in 2017. This channel sampling program clearly shows the continuation of high grade mineralisation towards the west. Our underground geological mapping shows a number of high angle structures up to 2 meters wide containing sulphide mineralisation grading up to 1,300 grams per ton silver, 42% zinc, 18% lead, and 13% copper that appear to feed into the overlying oxide zone. Our plan for the first part of 2018 is to walk our drill rig along these newly opened up east-west underground workings with the view of demonstrating continuity of the mineralization. The exceptionally high zinc numbers we see in the new area is consistent with what we see in other areas we drilled in 2017 and presents an exciting new target. In addition to the continued drilling along the sulphide trend we expect to have additional results from our 2017 drill program out to the market shortly”.

.

About the Sierra Mojada deposit: Sierra Mojada is an open pittable oxide deposit, as disclosed in the NI43-101 “Technical Report on the Resources of the Sierra Mojada Project Coahuila, Mexico” dated June 8, 2015, with a NI43-101 compliant measured and indicated “global” resource of 58.7 million tonnes grading 3.6% zinc and 50g/t silver at a $13.50 NSR cutoff giving 4.670 billion pounds of zinc and 90.8 million ounces of silver. Included within the “global” resource is a measured and indicated “high grade zinc zone” within the Lerchs-Grossman (LG) Optimized Pit of 10.03 million tonnes with an average grade of 11% zinc at a 6% cutoff, giving 2.426 billion pounds of zinc, and a measured and indicated “high grade silver zone” of 19 million tonnes with an average grade of 102.5g/t silver at a 50g/t cutoff giving 62.6 million ounces of silver. Mineralisation remains open in the east, west, and northerly directions. Approximately 60% of the current 3.2 kilometer mineralised body is at or near surface before dipping at around 6 degrees to the east.

.

Sample Analysis and QA/QC: All samples have been analyzed at ALS Chemex in North Vancouver, BC, Canada. Samples are first tested with the “ME-ICP41m” procedure which analyzes for 35 elements using a near total aqua regia digestion. Samples with silver values above 100ppm are re-analysed using the Ag-GRA21 procedure which is a fire assay with a gravimetric finish. Samples with zinc, lead, and copper values above 10,000ppm (1%) are re-analyzed using the AA46 procedure which is a near total aqua regia digestion with an atomic absorption finish.

.

A rigorous procedure is in place regarding sample collection, chain of custody and data entry. Certified standards and blanks, as well as duplicate samples are routinely inserted into all sample shipments to ensure integrity of the assay process.

.

About Silver Bull: Silver Bull is a mineral exploration company whose shares are listed on the Toronto Stock Exchange and trade on the OTCQB in the United States, and is based out of Vancouver, Canada. The “Sierra Mojada” project is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc.

.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

.

.