Terrace Energy {TSX.V: TZR} CEO Dave Gibbs announces that “the company have reacted to lower oil prices and taken steps to adjust its capital budget and development plans in response to the drop in commodity prices”.

Gibbs added “we believe that current oil prices are not the result of a sudden and precipitous change in long term fundamentals but rather the result of geopolitics. As a consequence, it is highly probable oil prices will”

Terrace provides revised guidance in response to crude oil prices

VANCOUVER, Dec. 15, 2014 – Terrace Energy Corp. {TSXV: TZR} provides the following update to its shareholders and convertible noteholders.

Dave Gibbs, the Company’s President and Chief Executive Officer commented: “The Company has taken steps to adjust its capital budget and development plans in response to the drop in commodity prices. While these adjustments will slow the projected results of operations in the near term, they will not impact the in situ proven, probable and prospective reserves, which underlie the long term value of the Company.

With these reasonable and prudent adjustments to its 2015 exploration and development plans, the Company can continue to build its production and reserve base while protecting its liquidity to meet its financial obligations. We believe that current oil prices are not the result of a sudden and precipitous change in long term fundamentals but rather the result of geopolitics. As a consequence, it is highly probable oil prices will recover in the foreseeable future.”

STS Olmos Project

Terrace STS LLC, a wholly-owned subsidiary of Terrace (“Subco”), owns the Company’s interest in the STS Olmos Project. The Project has significant proved and probable oil and natural gas reserves, as set out in the Company’s Form 51-101 F1 report dated January 31, 2014, which allowed the Company to secure project development financing.

In June, 2014, Subco entered into a US$75 million senior unsecured term credit facility, which is non-recourse to Terrace. US$50 million of this facility is available to the project at the Subco’s discretion. In August, 2014, Subco made an initial draw of US$25 million to fund its development plans. Subco is in compliance with all of the covenants set out in the lending agreement.

The Company and its partner initiated a “pad drilling” development program in August, 2014. Drilling operations are completed on the first three-well pad, the Section 6 pad in McMullen County. All three wells successfully encountered the target zones. Fracking operations began in late November and will be completed and flowback operations will commence this week. Drilling operations are also completed on the second three-well pad, the Section 5 pad in LaSalle County. All three of these wells also successfully encountered the target zones. We are currently finalizing the location and preparing to move the rig to a third location. Fracking operations on the Section 5 pad will commence in early 2015, pending equipment availability.

The Company now plans to maintain a single rig program for 2015 and continue to drill three-well pads in order to optimize the cycle from first capital to first production. Based on this development strategy and current prices, capital expenditures for the project in 2015 are expected to be approximately $25 million, of which approximately one-half will be drawn from the credit facility and one-half from net operating cash flows. It is important to note that the Company’s predictive models are conservatively based on risk-weighted type curves generated from approximately 75% of the observed performance of the initial eight delineation wells previously put into production. The current drilling program incorporates significantly longer laterals and an enhanced frac design, which are expected to materially improve well performance and reserve recovery.

Northwest AWP Field

As previously announced, the initial well in this project, the Quintanilla OL 1-H well, was successfully completed in October 2014. After 60 days of production, the operator announced total production of 18,592 barrels of oil and 19,040 mcf of gas. The well is currently producing at a rate of 388 bopd, 456 mcfd (464 boepd) on a 13/64ths choke. The Company holds a 33% working interest in this well and the associated 199 net mineral acres as well as an option to acquire a 33% interest in the offsetting mineral leases totalling approximately 3,600 net mineral acres.

This project is an extension of our STS Olmos Project and its future development may, at the Company’s discretion, be funded through the Company’s credit facility.

The Company expects to exercise its option to acquire the offset acreage and drill a total of four development wells in 2015. The mineral leases in this project are held by other production at deeper horizons. Thus, the Company and its partners have flexibility to manage the timing of development drilling without external leasehold obligation pressures.

Mr. Gibbs commented: “The STS Olmos is material to the Company’s future. The Company intends to continue the development of project acreage using the credit facility with the expectation of increasing oil and gas reserves. At current oil pricing, there is sufficient capital available under the credit facility to fund the planned development of the Project throughout its expected life.”

Maverick County Project

The Company and its partner, BlackBrush Oil & Gas, LP, have the right, through the BlackBrush Terrace LP (“BTLP”), to earn a 50% working interest in certain oil and gas leases covering approximately 147,000 gross mineral acres, in Maverick County Texas, indirectly from Shell Oil. The acreage to be acquired includes potential reserves in the newly emerging Pearsall Shale Trend as well as the Eagle Ford Shale, Buda Limestone and several other intervals of Cretaceous age formations which have been proven productive on a regional basis. As previously disclosed, the BTLP may secure the working interest through a combination of cash payments, which have been made, and drilling obligations.

The BTLP has successfully renegotiated the drilling obligations under the farmout agreement predominantly to amend the required targets and timing of future wells necessary to fulfil the remaining earning requirements. Under the revised agreement, the BTLP has the flexibility to choose locations, set objectives and govern timing of operations under a blanket requirement to spend approximately $25 million per year until the total required drilling carry of $104 million has been spent. To-date, BTLP has spent approximately $32 million.

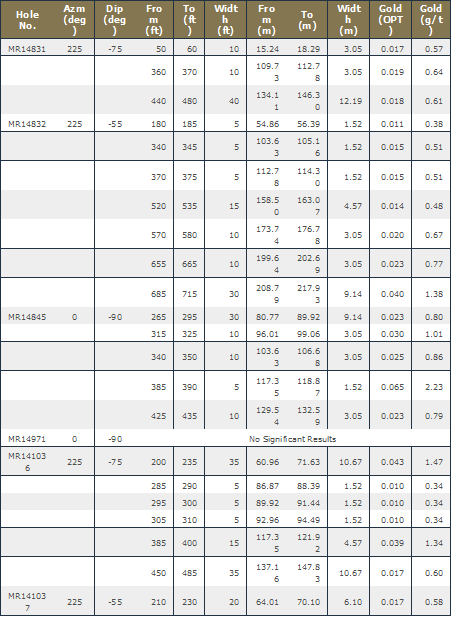

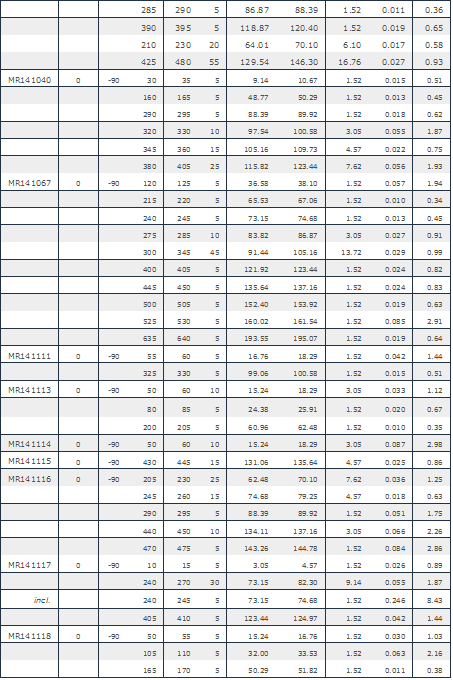

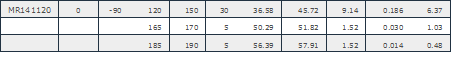

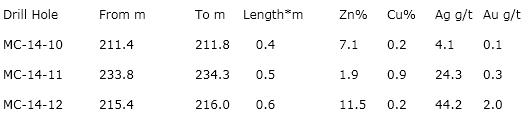

In 2014, BTLP drilled four critical evaluation wells including two horizontal wells to evaluate the Buda Limestone potential on the southern portion of the ranch and two vertical stratigraphic tests to evaluate several formations from Austin Chalk through Georgetown in a portion of the ranch penetrated by a large Serpentine Plug (volcanic feature). The results of the drilling phase of each of these wells are encouraging. Data collected from these wells are currently under evaluation and completion strategies are being developed. Completions for each of these wells will be included in the 2015 drilling obligation budget.

Further capital expenditures on the project are not required until mid-2015. By design, the BTLP partnership agreement allows for adjusting the ownership interests of the limited partnership by introducing third party investors into the partnership and/or allowing either partner to disproportionately fund future capital requirements. In light of the current economic environment, the Company has begun meeting with prospective investors to fund Terrace’s share of capital obligations for 2015. If successful, the Company’s partnership interest will be reduced and its current obligations carried.

Mr. Gibbs commented: “Maverick County represents significant long term value to the Company. Management believes the project has development potential in multiple target zones, which would create a large inventory of prospective drilling locations. However, it is presently in the Company’s best interest to secure an investment partner to reduce its share of future risk and related financial obligations.”

Big Wells Project

The Company currently controls rights to earn a 100% working interest in a farmout agreement covering rights to explore and develop the Buda Limestone Formation in 10,130 acres in Dimmit and Zavala Counties, Texas. The Company has completed its first well, the Price #1H, which validated the geologic concept for this project and established the presence of commercially producible hydrocarbons. Testing is underway and results will be announced in due course.

In order to maintain its rights under the farmout agreement, the Company will be required to drill three additional wells in 2015 on the project acreage at a gross cost of approximately $12 million. The Company is in discussions with several industry participants to sell a 50% interest in the project in order to fund most or all of its 2015 capital commitments. If successful, we would expect that any remaining capital requirements would be paid from project cash flow.

This strategy is entirely consistent with the Company’s overall business model of acquiring projects and establishing value at a high working interest, then inviting capital providers in at the project level. The Company always expected to reduce its interest to a 50% working interest in this project as it moves towards delineation and development.

Mr. Gibbs commented: “The Big Wells Project represents significant upside potential for the Company. Our initial evaluation work has confirmed the presence of commercially producible hydrocarbons and structural features conducive to large scale development. We expect this project to build material cash flow and value as delineation work progresses.”

Mr. Gibbs finally commented: “We believe our comprehensive plan will allow the Company to weather the recent storm that struck the energy sector and once again prosper when oil prices recover. I wish to remind everyone that the Company’s board of directors, its senior management and its employees are significant shareholders and noteholders. We will continue to work diligently towards protecting and enhancing the value of our aligned interests.”

About Terrace Energy

Terrace Energy is an oil & gas development stage company that is focused on unconventional oil extraction in onshore areas of the United States.

ON BEHALF OF THE BOARD OF DIRECTORS

“Dave Gibbs”

Dave Gibbs, CEO

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Forward-Looking Information

This press release includes forward-looking information and forward-looking statements (together, “forward-looking information”) within the meaning of applicable Canadian and United States securities laws. Forward-looking information includes, but is not limited to: information regarding plans for the development of the Company’s projects and the timing thereof, including expectations of successfully securing partnership and funding arrangements atMaverick County and Big Wells and expectations regarding achieving key successes and milestones over the next several months. Users of forward-looking information are cautioned that actual results may vary materially from the forward-looking information disclosed in this press release. The material risk factors that could cause actual results to differ materially from the forward-looking information contained in this press release include changes to the Company’s ability to access infrastructure in the vicinity of its projects at a reasonable price; changing costs for and availability of required goods and services; regulatory changes; risks relating to disagreements or disputes with joint venture partners, including any failure of a joint venture partner to fund its obligations; volatility in market prices for oil and natural gas; and all of the other risks and uncertainties normally associated with the exploration for and development and production of oil and gas, including geologic uncertainties, unforeseen drilling hazards, geological, technical, drilling and processing problems, accidents and adverse weather conditions. The forward-looking information contained in this press release represents management’s best judgment of future events based on information currently available; however, there can be no assurances that the project will achieve the economic returns cited nor that initial test results are indicative of long term stable production rates. The material assumptions used to develop the forward-looking information include: that the Company will be able to access infrastructure in the vicinity of its projects on reasonable terms; that the Company will be able to access the goods and services necessary in order to conduct further exploration, development and production at its projects on reasonable terms; that regulatory requirements will not change in any material respect; and that other aspects of the Company’s operations will not be affected by unforeseen events. Statements regarding future drilling locations are based on geologic interpretations which are subject to revision as further data is developed. The Company does not assume the obligation to update any forward-looking information, except as required by applicable law.

SOURCE Terrace Energy Corp.

For further information: terrace@terraceenergy.net; www.terraceenergy.net; Canadian Address: Suite 1012-1030 W Georgia St., Vancouver B.C. V6E 2Y3, Ph: 604 282-7897 Fax: 604 629-0418; US Address: Suite 400-202 Travis Street, Houston Texas 77002, Ph: 713 227-0010