Inovio {NYSE: INO} reported their Second Quarter Financial Results.

Revenue and expenses were both higher due to the Roche partnership and costs incurred in preparation for future clinical trials.

Cash on hand is $109 million, sufficient for working capital requirements until 2017.

Inovio Pharmaceuticals Reports 2014 Second Quarter Financial Results

HPV Immune Therapy VGX-3100 to Advance into Phase III

Inovio Pharmaceuticals, Inc. (NYSE: INO) today reported financial results for the quarter ended June 30, 2014.

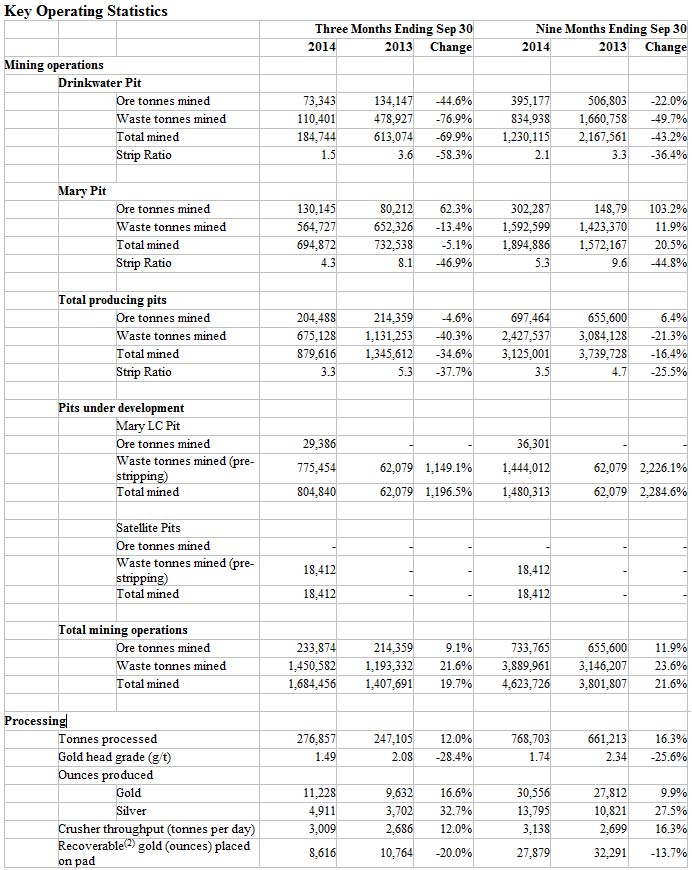

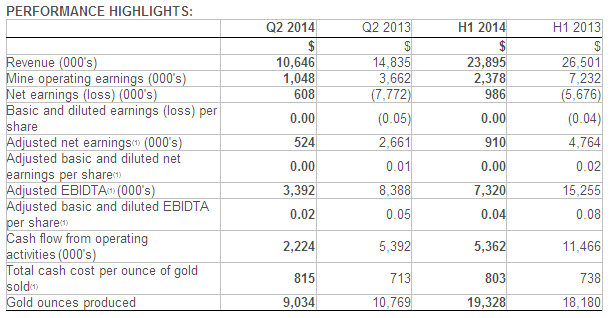

Total revenue was $3.8 million and $6.2 million for the three and six months ended June 30, 2014, compared to$786,000 and $2.2 million for the same periods in 2013.

Total operating expenses were $14.0 million and $26.3 million for the three and six months ended June 30, 2014, compared to $6.5 million and $14.5 million for the same periods in 2013.

The loss from operations prior to other income (expenses) for the three and six monthsended June 30, 2014, was$10.2 million, or $0.17 per share, and $20.2 million, or $0.35 per share, compared to $5.7 million, or $0.13 per share, and $12.3 million, or $0.29 per share, for the same periods in 2013.

The net loss attributable to common stockholders for the three and six months ended June 30, 2014, was $10.7 million, or $0.18 per share, and $21.5 million, or $0.37 per share, compared to $10.9 million, or $0.24 per share, and $19.7 million, or $0.47 per share, for the same periods in 2013.

The $0.2 million and $1.8 million increase in net loss attributable to common stockholders for the three and six months ended June 30, 2014, compared with the same periods in 2013 resulted primarily from an increase in R&D and clinical development expenses as well as non-cash stock-based compensation.

Dr. J. Joseph Kim, President and CEO, said, “Our second quarter marked a historical step for Inovio with the reporting of positive efficacy data from our HPV immunotherapeutic phase II study. We are extremely pleased with the comprehensive data outcomes of this study, including an impressive level of complete CIN 2/3 clearance, and their implications for VGX-3100 to potentially fulfill a significant unmet need as a non-surgical first-line treatment alternative for these cervical precancers. We are now in a position every biotechnology company hopes to reach, which is to have a product candidate with the merit to advance into a phase III registration study on the path toward commercialization. We are now making that commitment with VGX-3100.

“Apart from the positive outcome for our HPV franchise, this exciting data opens many new doors for the advancement and expansion of our broad cancer and infectious disease immune therapy developments. We are on the right path toward creating important and valuable therapies to help mankind.”

Revenue

The increase in revenue for the comparable periods primarily consisted of development fees paid by Roche for work conducted towards our partnership with Roche.

Operating Expenses

Research and development expenses for the three and six months ended June 30, 2014, were $9.6 million and$17.8 million, compared to $4.4 million and $9.5 million for the same periods in 2013. The increase for the three and six-month periods was primarily related to work conducted under our Roche partnership, an increase in non-cash stock-based compensation, and expenses relating to preparations for future clinical trials. General and administrative expenses for the three and six months ended June 30, 2014, were $4.3 million and $8.5 millionversus $3.0 million and $6.0 million for the same periods in 2013.

Capital Resources

As of June 30, 2014, cash and cash equivalents, short-term investments and restricted cash were $109.0 millioncompared with $52.7 million as of December 31, 2013. This increase was primarily due to the net proceeds from our March 2014 financing and warrants and options exercised during the period.

As of June 30, 2014, the company had 60.3 million shares outstanding and 66.7 million fully diluted.

Based on management’s projections and analysis, the Company believes that cash, cash equivalents and short-term investments are sufficient to meet its planned working capital requirements through the end of 2017. The Company plans to raise additional cash as necessary to fund the phase III development of VGX-3100.

Inovio’s balance sheet and statement of operations is provided below. Form 10-Q providing the complete 2014 second quarter financial report can be found at: http://ir.inovio.com/secfilings.

Corporate Update

Clinical Development

Subsequent to the quarter, Inovio released top line efficacy data from its randomized, placebo-controlled, double-blind phase II clinical trial (HPV-003) for VGX-3100, its SynCon® immunotherapy against HPV-caused precancers and cancers delivered with its CELLECTRA® electroporation device. Treatment was randomized 3:1 between the VGX-3100 and placebo groups, and was stratified by age and severity of CIN. The primary endpoint, histologic regression, was evaluated 36 weeks after the first treatment. In the per protocol analysis of this three-immunization regimen, CIN 2/3 resolved to CIN 1 or no disease in 53 of 107 (49.5%) women treated with VGX-3100 compared to 11 of 36 (30.6%) who received placebo. This difference was statistically significant (p<0.025). The intent to treat result was also statistically significant. There was also a high level of complete CIN 2/3 clearance.

This trial also demonstrated virological clearance of HPV 16 or 18 from the cervix in conjunction with histopathological regression of cervical dysplasia to CIN 1 or no disease, a secondary endpoint of the trial, in 43 of 107 (40.2%) VGX-3100 recipients compared to 5 of 35 (14.3%) placebo recipients (p<0.025). Robust T cell activity was detected in subjects who received VGX-3100 compared to those who received placebo.

Detailed study findings will be submitted for publication in a peer-reviewed scientific journal.

Persistent and untreated cervical precancers lead to cervical cancer. Currently the only available treatment for cervical precancers is surgery. There is a significant unmet need for an immunotherapy for high grade cervical precancers caused by HPV that, unlike current surgical procedures, does not pose risk of causing pre-term births, and may also eliminate HPV throughout the body (not just at the surgical treatment site) and reduce the risk of new or recurrent precancers. Such a non-surgical treatment would provide an appealing alternative to caregivers and their patients. The various outcomes described by the comprehensive phase II data set combined with the broad advantages of VGX-3100 as a non-surgical approach therefore create a unique opportunity for this HPV immunotherapy as a first-line treatment alternative.

Inovio has consequently committed to advancing VGX-3100 into a phase III registration study with target patient characteristics and a treatment regimen similar to the phase II study. The Company expects to complete its end-of-phase-II meeting with the FDA in 2015 and begin treating women in a phase III study in early 2016.

Inovio is also broadening its therapeutic HPV franchise to include other precancers caused by HPV infection such as vulvar, vaginal, and other anogenital neoplasia as well as cancers of the cervix, head & neck, and anogenital areas. During the quarter, Inovio initiated two separate phase I/IIa clinical studies of VGX-3100 against HPV-caused cervical cancer and head and neck cancer. Both of these studies incorporate an immune activator, DNA-based IL-12, which has been shown to further boost already high levels of antigen-specific T cells generated by the vaccine. This combination is designated INO-3112. These studies reflect our intent and concerted effort to become the leader of immune therapeutics targeting HPV-related diseases, with their significant global medical implications and costs.

Inovio will independently advance the clinical programs for VGX-3100, including the phase III study for CIN 2/3, and its broader HPV franchise for associated diseases but will consider partnering opportunities that serve to maximize the long term financial benefit to the Company and its shareholders.

Beyond the direct clinical implications for VGX-3100, the phase II efficacy results are a breakthrough for the field of immunotherapies by demonstrating a clear clinical effect of an active immunotherapy agent in a randomized, placebo controlled study. They de-risk and will broadly contribute to the advancement of our product and business development strategy.

Inovio previously stated that it expected a phase I study of its prostate cancer immunotherapy, INO-5150, to be initiated in 3Q 2014. This phase I study was designed to study safety and immunogenicity of INO-5150 (encoded for PSA and PSMA antigens) in a biochemically relapsed prostate cancer population. In a strategic review, Rocheand Inovio determined that castrate resistant prostate cancer is a more favorable setting for timely development and potential integration of immunomodulatory drugs from Roche’s pipeline. The development team consequently decided to reposition this study to a phase Ia/Ib study in this population.

As part of this decision, the team determined that strategically it would be more proactive and timely to immediately assess a more comprehensive set of parameters and combinations of (i) INO-5150, (ii) additional new prostate cancer antigens that the team has been developing under the Roche/Inovio research collaboration, and (iii) Roche’s portfolio of immunomodulatory drugs including checkpoint inhibitors. The team is working to complete a phase Ia/Ib multi-arm study design reflecting this strategy and anticipates initiating this study in 2015.

Inovio intends to initiate a phase I study for its global, multi-clade PENNVAX®-GP preventive and therapeutic HIV DNA vaccine candidate late 2014. The development of this product was funded in part by a $25 million contract from the NIH. Phase I data from Inovio’s PENNVAX®-B preventive HIV DNA vaccine (targeting only clade B viruses) in non-infected subjects showed best-in-class T cell responses.

Inovio plans to initiate an exploratory human study for INO-1400, its hTERT DNA immunotherapy, for breast, lung and pancreatic cancers in the second half of 2014. hTERT is over-expressed in 85% of cancers. As a result, this immunotherapy has the potential to serve as a “universal” immune therapeutic agent for cancer. INO-1400 represents the first of several new broadly-applicable cancer-specific antigens in Inovio’s growing oncology product development arsenal that we intend to advance into human studies.

Preclinical Development

In 2Q, Inovio announced that data from a rhesus monkey study of INO-8000, its multi-antigen DNA immunotherapy targeting hepatitis C genotypes 1a and 1b, was published in Human Vaccines & Immunotherapeutics in a paper entitled, “Strong HCV NS3/4a, NS4b, NS5a, NS5b-specific cellular immune responses induced in rhesus macaques by a novel HCV genotype 1a/1b consensus DNA vaccine.” This paper highlighted the killing effect of the antigen-specific T cells stimulated by Inovio’s multi-antigen SynCon®immunotherapy. INO-8000 (a.k.a. VGX-6500) is being studied in a phase I/IIa clinical trial in Korea in collaboration with GeneOne Life Sciences, Inc. Inovio plans to launch a related multi-site study in the US.

Data from a preclinical study of our multi-antigen DNA immunotherapy for tuberculosis (TB) was published inHuman Vaccines and Immunotherapy in a paper entitled: “Multivalent TB vaccines targeting the esx gene family generate potent and broad cell-mediated immune responses superior to BCG.” Results from this study indicated that this DNA vaccine is highly immunogenic and induces robust broad-spectrum T cell responses with the ability to surpass BCG (the current live-attenuated TB vaccine)-induced esx-specific T cell responses on a stand-alone basis or in a prime boost regimen using a BCG prime followed by a DNA vaccine boost.

At the 17th Annual Meeting of the American Society of Gene & Cell Therapy in Washington, DC, Inovio presented preclinical study data of our DNA-based therapeutic monoclonal antibody (mAb) targeting Chikungunya virus (CHIKV). In this presented study, Inovio demonstrated that the treatment of the animals with Inovio’s anti-CHIKV mAb plasmids protected 100% of the treated animals from a lethal injection of CHIKV virus while 100% of the control animals died. The treated animals were spared of virus-related morbidity, as measured by weight loss and lethargy. Inovio also demonstrated that the serum of transfected animals exhibited the specific ability to bind to the CHIKV envelope antigen and this serum possessed CHIKV-neutralizing activity.

Subsequent to the quarter, data was published from a mice study of Inovio’s DNA immunotherapy for C. difficile, a bacterial infection that causes severe intestinal distress and symptoms such as diarrhea, nausea, colitis, sepsis, and even death. This immune therapy, delivered with electroporation, produced high levels of neutralizing antibodies that protected 100% of mice and non-human primates from a lethal dose of C. difficile toxin. The data was published in the Journal of Infection and Immunity in a paper titled, “An Optimized, Synthetic DNA Vaccine Encoding the Toxin A and Toxin B Receptor Binding Domains of Clostridium difficile Induces Protective Antibody Responses In Vivo.” This vaccine is being tested in collaboration with Dr. Michele Kutzler at Drexel University. Clostridium difficile infection is a major source of morbidity and mortality in the US, with half a million and approximately 30,000 deaths annually and a significant related healthcare cost.

Corporate Development

In 2Q, Inovio expanded its existing license agreement with the University of Pennsylvania, adding exclusive worldwide rights to technology and intellectual property for novel synthetic therapies against cancer, infectious diseases and new immune activators. This amendment broadens and strengthens the Company’s patent protection covering candidate products for dengue fever, H7N9 influenza, additional HPV serotypes and additional cancer antigens. The amended agreement also provides Inovio global rights to DNA-based synthetic antibodies, immune activators (IL-21, IL-23 & IL-33), and immune therapies for Middle East Respiratory Syndrome (MERS) and tuberculosis.

Inovio’s 91%-owned subsidiary, VGX Animal Health, Inc. (VAH), concluded an agreement for the sale of its animal health assets to Plumbline Life Sciences, Inc. (PLS) of Korea. The assets transferred include an exclusive license with Inovio for animal applications of its growth hormone releasing hormone (GHRH) technology and animal DNA vaccines plus a non-exclusive license to Inovio electroporation delivery systems for these applications. VGX Animal Health will receive $2 million in cash in multiple payments and 20% of the outstanding shares of PLS. VAH’s 20% equity ownership position in PLS will be maintained without dilution up to $10 million of additional equity fundraising by PLS. Inovio will receive milestone payments and royalties on product sales and retains the human applications of its GHRH technology.

Inovio acquired worldwide rights (excluding China) for novel technology to generate inducible regulatory T cells, with applications such as Alzheimer’s disease and multiple sclerosis. This technology is based on patent-protected and published discoveries from Dr. Bin Wang, a professor at Fudan University’s Shanghai Medical College, and his collaborators. Inovio will make clinical and regulatory milestone payments to the University.

Inovio continues to work toward partnerships with other large pharmaceutical companies interested in Inovio SynCon® immunotherapy and vaccine products.

On June 5, 2014, Inovio implemented a 1-for-4 reverse split of the Company’s common stock. At the end of the second quarter, Inovio was added to the Russell Global, Russell 2000® and Russell Microcap® Indexes.