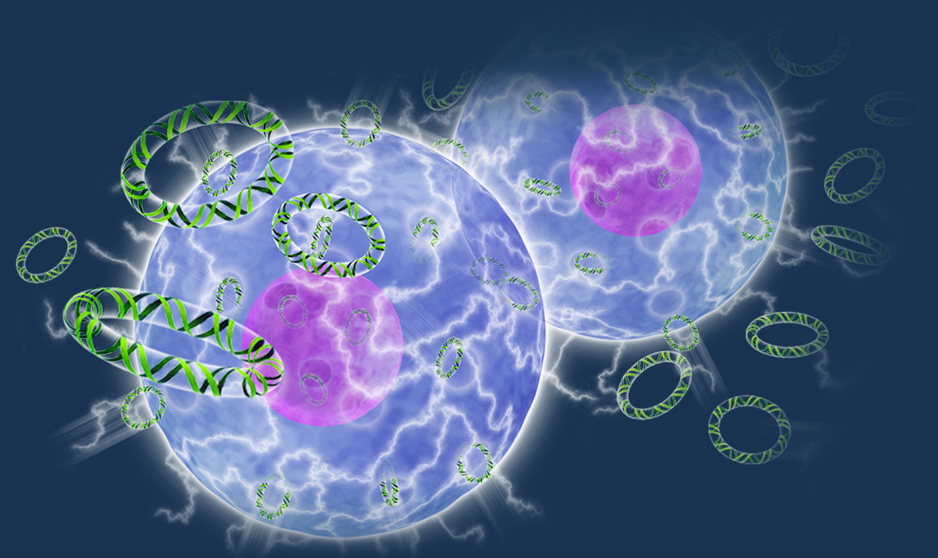

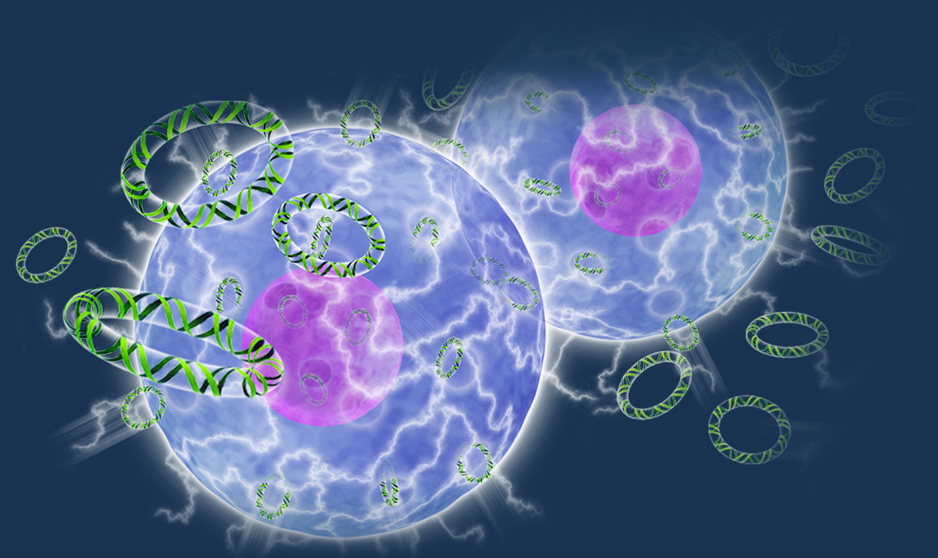

Inovio Pharmaceuticals, Inc. {NASDAQ:INO} has initiated a phase 1b/2a immuno-oncology trial in patients with newly diagnosed glioblastoma (GBM) designed to evaluate cemiplimab (also known as REGN2810), a PD-1 inhibitor developed by Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN).

.

.

In

Inovio Pharmaceuticals Initiates Immuno-Oncology Clinical Study for Glioblastoma in Combination with Regeneron’s PD-1 Inhibitor

Phase 1b/2a clinical trial combines Regeneron’s PD-1 inhibitor cemiplimab and Inovio’s T cell activator INO-5401 in brain cancer

PLYMOUTH MEETING, Pa. November 1, 2017 – Inovio Pharmaceuticals, Inc. {NASDAQ:INO} today initiated a phase 1b/2a immuno-oncology trial in patients with newly diagnosed glioblastoma (GBM) designed to evaluate cemiplimab (also known as REGN2810), a PD-1 inhibitor developed by Regeneron Pharmaceuticals, Inc. {NASDAQ:REGN}, in combination with Inovio’s INO-5401 T cell activating immunotherapy encoding multiple antigens and INO-9012, an immune activator encoding IL-12.

.

The open-label trial of 50 patients will be conducted at approximately 30 U.S. sites, and the primary endpoints are safety and tolerability. The study will also evaluate immunological impact, progression-free survival and overall survival.

.

GBM is a devastating disease for both patients and caregivers. It is the most aggressive brain cancer and its prognosis is extremely poor, despite a limited number of new therapies approved over the last 10 years. The median overall survival for patients receiving standard of care therapy is approximately 15 months and the average five-year survival rate is less than three percent.

.

Dr. J. Joseph Kim, Inovio’s President and Chief Executive Officer, said, “Inovio is successfully executing on its immuno-oncology strategy through both combination and in monotherapy trials. Our clinical partnerships and collaborations with MedImmune, Genentech and Regeneron each provide for clinical evaluation of Inovio immunotherapies combined with checkpoint inhibitors, given a strong scientific rationale to combine an immunotherapy, which generates antigen-specific killer T cells, with a checkpoint inhibitor which augments T cell activity. I believe that INO-5401, a three antigen product targeting WT-1, PSMA and hTERT, offers great potential to address multiple cancers. Our INO-5401 combination study in GBM, as well as its sister study in advanced bladder cancer, represents an important opportunity for Inovio and its collaborators to address significant unmet medical need.”

,

Under a May 2017 agreement between Inovio and Regeneron, the combination trial will be solely conducted and funded by Inovio, based upon a mutually agreed upon trial design, and Regeneron will supply cemiplimab. Inovio and Regeneron will jointly conduct immunological analyses in support of the study. Regeneron, as part of their immuno-oncology collaboration with Sanofi, is developing cemiplimab both as a monotherapy and in combination with other therapies for the treatment of various cancers.

.

About Glioblastoma

Glioblastoma, also known as glioblastoma multiforme (GBM), is the most common and aggressive type of brain cancer. GBM is usually found in the area of the brain which controls some of the most advanced processes, such as speech and emotions. GBM treatment is often limited by the tumor location and ability of a patient to tolerate surgery. Consequently, it is a particularly difficult cancer to treat. Worldwide there are an estimated 240,000 cases of brain and nervous system tumors per year; GBM is the most common and most lethal of these tumors.

.

About INO-5401

INO-5401 includes Inovio’s SynCon® antigens for WT1, hTERT and PSMA and has the potential to be a powerful cancer immunotherapy in combination with checkpoint inhibitors. The National Cancer Institute previously highlighted WT1, hTERT and PSMA among a list of attractive cancer antigens, designating them as high priorities for cancer immunotherapy development. WT1 was at the top of the list. The hTERT antigen relates to 85 percent of cancers, and WT1 and PSMA antigens are also widely prevalent in many cancers.

.

About Inovio Pharmaceuticals, Inc.

Inovio is taking immunotherapy to the next level in the fight against cancer and infectious diseases. We are the only immunotherapy company that has reported generating T cells in vivo in high quantity that are fully functional and whose killing capacity correlates with relevant clinical outcomes with a favorable safety profile. With an expanding portfolio of immune therapies, the company is advancing a growing preclinical and clinical stage product pipeline. Partners and collaborators include MedImmune, The Wistar Institute, University of Pennsylvania, DARPA, GeneOne Life Science, Plumbline Life Sciences, ApolloBio Corporation, Drexel University, NIH, HIV Vaccines Trial Network, National Cancer Institute, U.S. Military HIV Research Program, and Laval University.

.

For more information, please visit www.inovio.com

.

CONTACT:

Investors/Media:

Jeff Richardson. – +1 267-440-4211, jrichardson@inovio.com

* * *

This press release contains certain forward-looking statements relating to our business, including our plans to develop electroporation-based drug and gene delivery technologies and DNA vaccines, our expectations regarding our research and development programs, including the planned initiation and conduct of clinical trials and the availability and timing of data from those trials, and the sufficiency of our capital resources. Actual events or results may differ from the expectations set forth herein as a result of a number of factors, including uncertainties inherent in pre-clinical studies, clinical trials and product development programs, the availability of funding to support continuing research and studies in an effort to prove safety and efficacy of electroporation technology as a delivery mechanism or develop viable DNA vaccines including INO-5401 and INO-9012, our ability to support our pipeline of SynCon® active immunotherapy and vaccine products, the ability of our collaborators to attain development and commercial milestones for products we license and product sales that will enable us to receive future payments and royalties, the adequacy of our capital resources, the availability or potential availability of alternative therapies or treatments for the conditions targeted by the company or its collaborators, including alternatives that may be more efficacious or cost effective than any therapy or treatment that the company and its collaborators hope to develop, issues involving product liability, issues involving patents and whether they or licenses to them will provide the company with meaningful protection from others using the covered technologies, whether such proprietary rights are enforceable or defensible or infringe or allegedly infringe on rights of others or can withstand claims of invalidity and whether the company can finance or devote other significant resources that may be necessary to prosecute, protect or defend them, the level of corporate expenditures, assessments of the company’s technology by potential corporate or other partners or collaborators, capital market conditions, the impact of government healthcare proposals and other factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2016, our Form 10-Q for the period ended June 30, 2017, and other regulatory filings we make from time to time. There can be no assurance that any product candidate in Inovio’s pipeline will be successfully developed, manufactured or commercialized, that final results of clinical trials will be supportive of regulatory approvals required to market licensed products, or that any of the forward-looking information provided herein will be proven accurate. In addition, the forward-looking statements included in this press release represent Inovio’s views as of the date hereof. Inovio anticipates that subsequent events and developments may cause its views to change. However, while Inovio may elect to update these forward-looking statements at some point in the future, the company specifically disclaims any obligation to do so, except as may be required by law. These forward-looking statements should not be relied upon as representing Inovio’s views as of any date subsequent to the date of this release.