Radisson Mining {TSX.V: RDS} announced that drill hole OB-17-48 has successfully extended the Vintage zone by additional 125 metres along strike at their O’Brien gold project.

The project is located along the Cadillac Break halfway between Rouyn-Noranda and Val d’Or in Quebec, Canada.

.

.

2017-10-18 05:21 ET – News Release

Mr. Mario Bouchard reports

.

RADISSON EXTENDS THE VINTAGE ZONE TO 325 M ALONG STRIKE WITH AN INTERCEPT OF 9.7 G/T GOLD OVER 2.9 M AT THE O’BRIEN PROJECT

.

Hole OB-17-48 has successfully extended the Vintage zone by additional 125 metres along strike at Radisson Mining Resources Inc.’s O’Brien gold project.

.

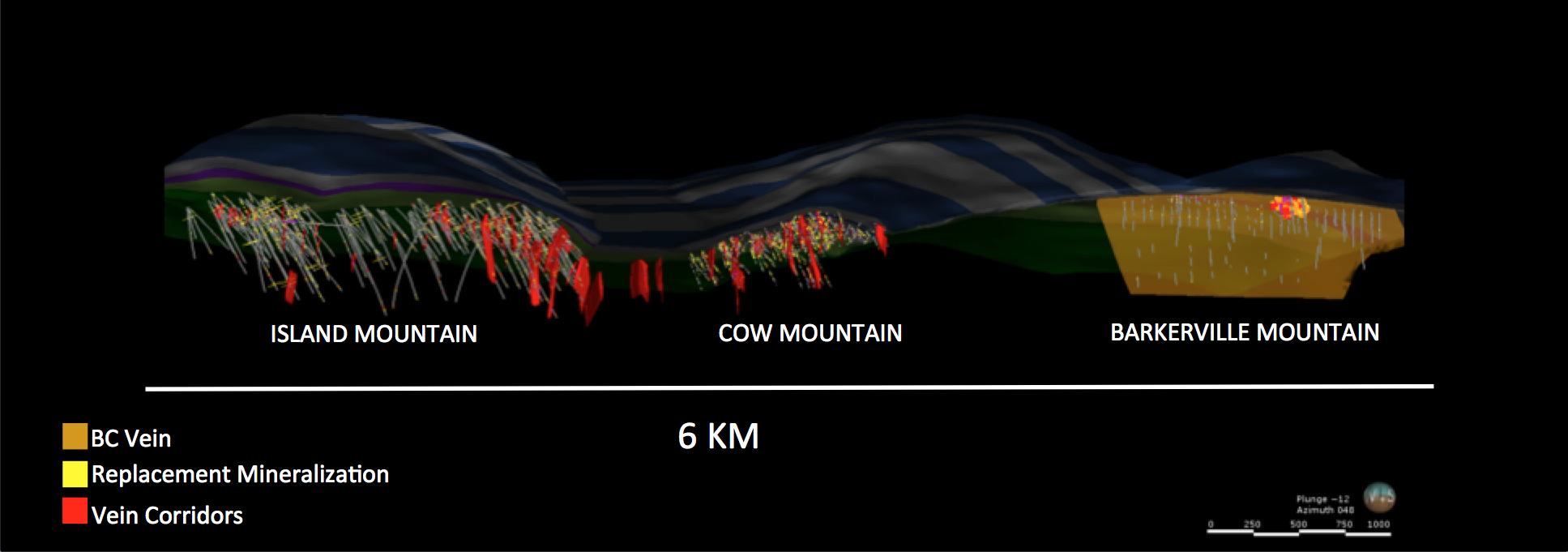

The project is located along the Cadillac Break halfway between Rouyn-Noranda and Val d’Or in Quebec, Canada. The Vintage zone is parallel to, and to the north of, the bulk of current resources at the O’Brien project. The zone is located only 85 metres north of the Cadillac Break in a context that is similar to producing and historical mines in the Cadillac mining camp. The structure has been traced by drilling on over a 325 m strike length from east to west, vertical height of up to 360 m and remains open in all directions.

.

Press release highlights

- Hole OB-17-48 extended the Vintage zone by over 125 m along strike with intercept of 9.7 grams per tonne gold over 2.9 m at 208 m below surface. Assays are pending for the final portion of hole OB-17-48.

- The Vintage zone has been traced over a strike length of 325 m and vertical height of up 360 m.

- Additional drill results are expected from hole OB-17-49 completed in vertical extension of hole OB-17-42, which returned 13.7 g/t Au over 1.5 m (see Oct. 3, 2017, press release).

.

Mario Bouchard, President and Chief Executive Officer, commented: “Current exploration results continue to increase the overall dimension of the Vintage zone. The zone as now been traced on over 325 m and remains open in all directions. Due to its high-grade potential and proximity to current resources, the Vintage zone has the potential to be an important part of O’Brien’s exploration and development plan. As we await final results from the drill program completed this summer on the Vintage zone, we are currently planning a drill program in order to test lateral and at depth extension of this zone.”

.

DRILLING RESULTS SUMMARY

Drill hole From To Length Au

(m) (m) (m) (g/t)

OB-17-46 86.0 88.5 2.5 4.4

Including 88.0 88.5 0.5 15.9

OB-17-48 208.6 211.5 2.9 9.7

OB-17-48 260.0 260.5 0.5 Pending

Results are presented as down hole widths; true widths are

estimated between 55 to 70 per cent of down hole thickness.

.

Vintage zone exploration program

As the company is waiting for final results from the drill program completed on the Vintage zone, review of current results and historical exploration programs from the Vintage zone is progressing in order to define a second phase exploration program.

.

The Vintage zone is a parallel zone of the O’Brien project located approximately 85 m north of the Cadillac Break in the Cadillac Group of metasediments comprising sequence of polymictic conglomerate, banded iron formation (BIF) and grauwacke. In comparison, current resources of 36E and Kewagama zones are located in the Piche group, south of the Cadillac Break. The Vintage zone saw small historical exploration programs, which were never followed upon. In 2017, the company established several high-priority exploration drill targets through historical data compilation in this area of the O’Brien gold project. The first six drill holes that tested these targets were completed over a strike length of 325 m. The new info added to the few available historical information helps to demonstrate the continuity and the favourable geometry of the Vintage zone. All intercepts remain open in all direction.

.

2017 drill program completed at 20,000 metres, 10,500 metres in assays pending

.

Furthermore, the company announces that it has completed the drill program planned in 2017 to approximate total of 20,000 m. The drill program was completed with two main objectives. An approximate total of 15,000 m were completed for resource expansion from surface to a depth of 500 m. As a second objective, the approximate 5,000 m exploration drill program completed, focused on high-priority exploration targets defined outside the main sector of current resources of the O’Brien gold project, including the Vintage zone.

.

There are currently 20 drill holes in assays pending for a total an approximate total of 10,500 m.

.

All drill cores in this campaign are NQ in size. Assays were completed on sawn half-cores, with the second half kept for future reference. The samples were analyzed using standard fire assay procedures with atomic absorption (AA) finish at Swastika Laboratories Ltd., in Swastika, Ont. Samples yielding a grade higher than 5 five g/t were analyzed a second time by fire assay with gravimetric finish at the same laboratory. Samples containing visible gold were analyzed with metallic sieve procedure. Standard reference materials and blank samples were inserted prior to shipment for quality assurance and quality control (QA/QC) program.

.

Qualified person

Tony Brisson, PGeo, independent consultant, acts as a qualified person as defined in National Instrument 43-101, and has reviewed and approved the technical information in this press release.

.

About Radisson Mining Resources Inc.

Radisson is a Quebec-based mineral exploration company. The O’Brien project, cut by the regional Larder-Lake-Cadillac fault, is Radisson’s flagship asset. The project hosts the former O’Brien mine, considered to have been the Abitibi greenstone belt’s highest-grade gold producer during its production (1,197,147 tonnes at 15.25 g/t Au for 587,121 ounces of gold from 1926 to 1957; InnovExplo, April, 2015).

We seek Safe Harbor.