Catalyst Metals Posts Strong Half Year Results

Catalyst Metals (ASX: CYL)

Reported its financial results for the half-year ended 31 December 2025.

Catalyst’s record half-year result was driven by a strong operating performance at Plutonic, with December quarterly production being the highest recorded under Catalyst ownership.

.

.

| Catalyst Metals | ASX : CYL | |

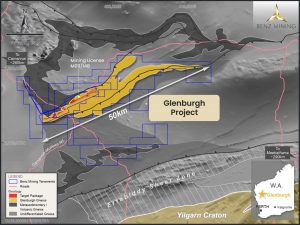

| Stage | Exploration / development | |

| Metals | Copper / Gold | |

| Market cap | A$1.92 Billion @ A$7.37 | |

| Location | Murchison, Victoria, Australia | |

| Website | www.catalystmetals.com.au |

.

Catalyst Metals Financial Results Half-year ended 31 December 2025

Catalyst Metals Limited (Catalyst or the Company) (ASX:CYL) is pleased to report its financial results for the half-year ended 31 December 2025.

Catalyst’s record half-year result was driven by a strong operating performance at Plutonic, with December quarterly production being the highest recorded under Catalyst ownership.

These operating results and a realised gold price of A$5,855/oz (FY2025 H1: A$3,817/oz) saw revenue from Plutonic increase by 50% to A$267m (FY2025 H1: A$178m).

Net operating cashflows of A$134m (FY2025 H1: A$89m excluding Henty Gold Mine) were largely re-invested into exploration and progressing the development of Trident and K2. These are the third and fourth, of five mines, to be developed on the Plutonic Gold Belt as part of Catalyst’s organic growth strategy of increasing annual production to ±200koz of gold.

Catalyst ended the year with A$338m in liquidity, comprising cash and bullion of A$238m and an undrawn A$100m debt facility.

Highlights

• Net profit before tax from continuing operations of A$130m (before one-off legal

settlement cost of A$49m) vs A$63m in prior half-year

• EBITDA of A$145m vs A$76m in prior half-year

• Net profit after tax and extraordinary items of A$60m vs A$43m in prior half-year

• Gold sales of 45,586oz at a realised price of A$5,855/oz compared to 46,746oz3 sold at A$3,817/oz in the prior half-year

• Sales revenue was A$267m vs A$178m in prior half-year

• The half-year to 31 December can be characterised as follows:

• Catalyst’s first two years of Plutonic ownership concluded at 1 July 2025 – the

beginning of this reporting period. These first two years were focussed on

stabilising operations, building a team, growing mine lives, readying projects for

their development and clarifying the path to ±200koz pa

• The six months commencing 1 July 2025 was a period of capital investment to

commence the path to 200koz pa and as such Catalyst secured its financial position

in May 2025 by raising A$250m of capital

• As a consequence, cash at bank has remained stable with operating cashflows reinvested into the following activities:

• Completion and ramp-up of Plutonic East;

• Advancing K2’s underground development;

• Development of the Trident open-pit;

• Exploration drilling to double Reserves on the Plutonic Belt to 1.5Moz1,2 of gold;

and

• De-risking future operations at Plutonic Main by improving the dewatering and

electrical infrastructure.

.

.

To read the full report please click HERE

+++++++

To view the latest share price and chart, please click HERE

To View Catalyst Metal’s historical news, please click here

.

+++++++

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Catalyst Metals

.

To read our full terms and conditions, please click HERE