Colonial Coal – Warren Irwin Interview

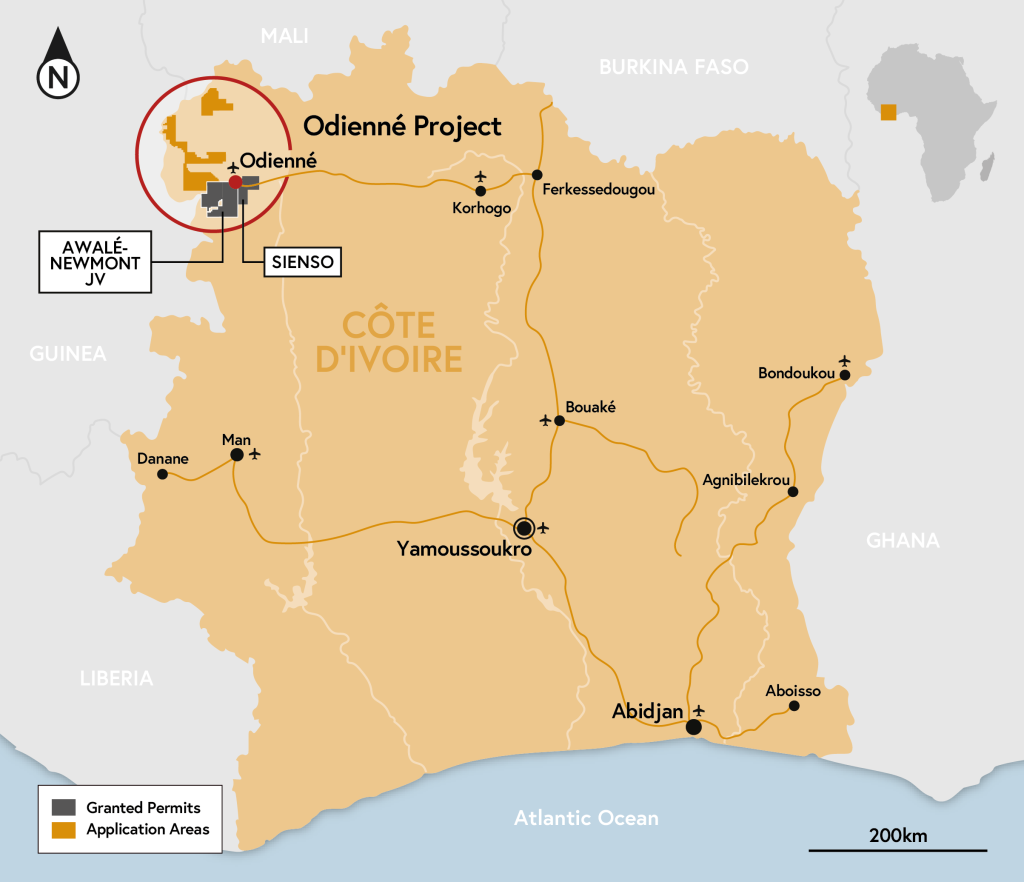

Colonial Coal (TSX.V: CAD)

Top Canadian Fund manager Warren Irwin, of Rosseau Asset Manager is interviewed about his opinion of Colonial Coal.

This is a rare opportunity to hear the thoughts of a successful fund manager talking about a single stock he knows intimately.

.

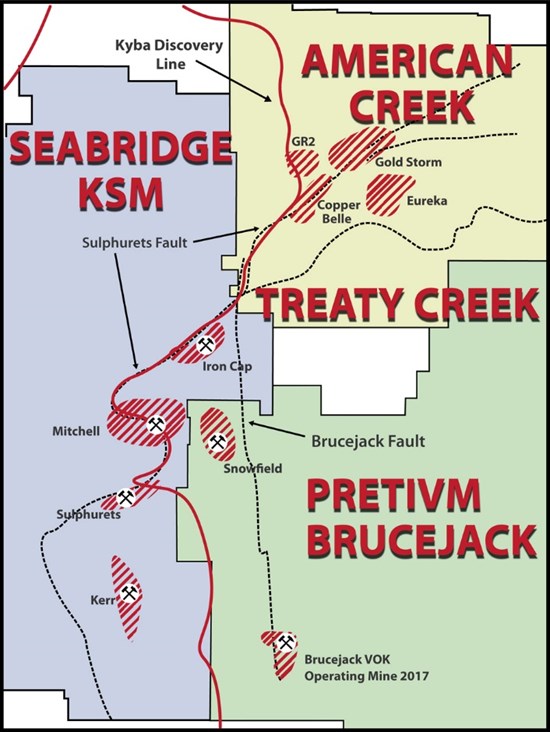

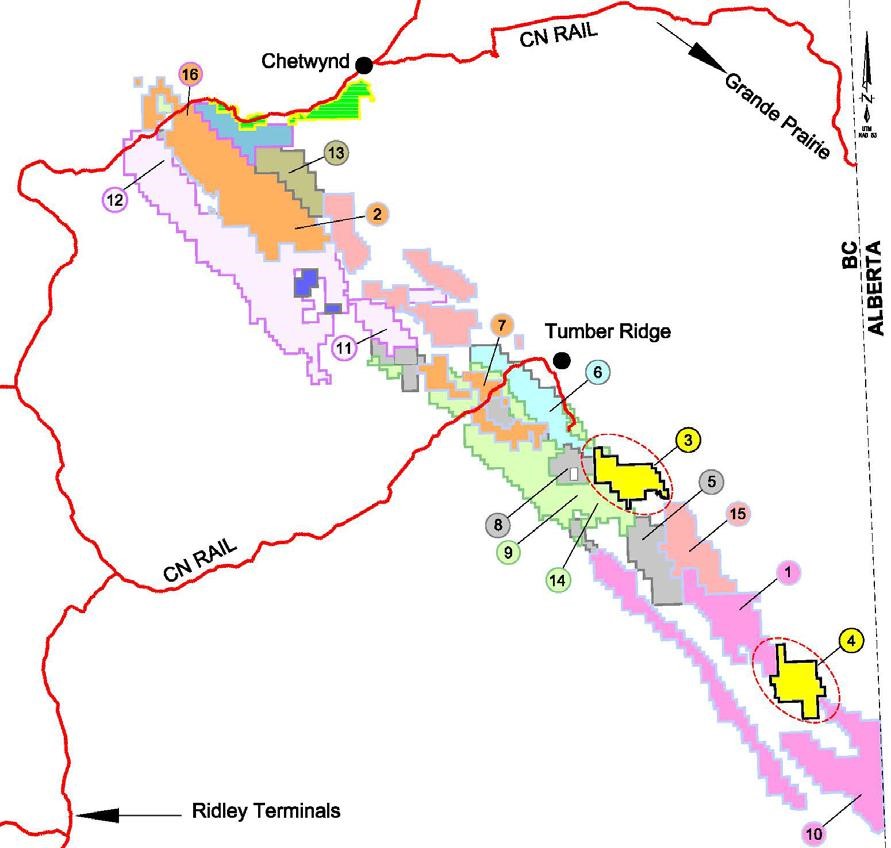

Map of the Peace River Coalfield, Colonail Coal’s Flatbed is licence 3, and Huegenot licence 4

.

.

| Colonial Coal | TSX.v : CAD | |

| Stage | Exploration | |

| Metals | Metallurgical coal | |

| Market cap | C$294m @ C$1.62 | |

| Location | British Columbia, Canada | |

| Website | www.ccoal.ca |

/

Colonial Coal – Warren Irwin Interview

Colonial Coal (TSX.V: CAD)

Top Canadian Fund manager Warren Irwin, of Rosseau Asset Manager is interviewed about his opinion of Colonial Coal.

This is a rare opportunity to hear the thoughts of a successful fund manager talking about a single stock he knows intimately.

Warren expands at some length about the company and his thoughts for future monitization.

As a shareholder myself I thought it well worth listening to the whole interview, which lasts around 40 minutes.

To listen to the interview, which is hosted on Youtube, please click here.

With deals being done in the Peace River region, as well as in other countries around the world such as Australia, Colonial’s large tonnage assets are starting to stand out as one of the few major deposits still in the hands of a junior.

I do feel that with other deals now completed it’s only a matter of time before the first bid arrives for one of the few remaining large deposits of quality coking coal available in a tier one jurisdiction.

CEO David Austin has founded two coking coal companies in this region of Canada that went on to be taken out by majors, with Western Canadian Coal going for $3.2 billion to Walter Energy.

Colonial is taking longer to conclude a deal, and there have been some mitigating circumstances such as covid, and Canada’s relations with India and China being volatile in recent times. These relations have become warmer and more stable in recent times.

I am a long-term holder of Colonial Coal shares, and plan to hold until the company is acquired or participates in a corporate deal.

.

.

live metal prices can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Colonial Coal.

.