West Red Lake Gold Has New Targets from Surface Sampling

West Red Lake Gold Mines (TSX.V: WRLG)

Announced positive results from the 2024 regional surface mapping and geochemical sampling program across its 100% owned Madsen Property located in the Red Lake Gold District of Northwestern Ontario, Canada.

.

.

.

.

.

| West Red Lake Gold | TSX.V : WRLG | |

| Stage | Exploration / Development | |

| Metals | Gold | |

| Market cap | C$197 m @ 62 cents | |

| Location | Ontario, Canada | |

| Website | www.westredlakegold.com |

.

.

.

West Red Lake Gold Highlights New Targets from Surface Sampling at Madsen

.

.

West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSX.V: WRLG) (OTCQB: WRLGF) is pleased to announce positive results from the 2024 regional surface mapping and geochemical sampling program (the “Program”) across its 100% owned Madsen Property located in the Red Lake Gold District of Northwestern Ontario, Canada.

.

HIGHLIGHTS:

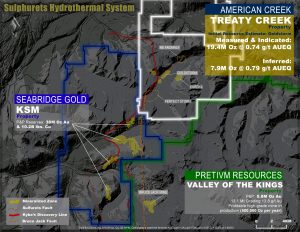

- The Program at Madsen was focused on the Confederation Assemblage of rocks, which has remained mostly unexplored until WRLG completed this first phase of work. The Confederation rocks are known to host significant gold mineralization in the Red Lake district, including Kinross Gold’s Great Bear Project, located approximately 24km southeast of Madsen.

- The Program consisted of 1,460 till samples and 42 channel samples, as well as 69 representative lithologic samples collected to support the geological mapping program.

- Six (6) anomalous areas were defined with a geochemical signature of Au-W-As-Ag-Bi (Figure 1), which is analogous to the geochemical signature of Madsen-style alteration and mineralization. The most compelling of these targets is the North Shore anomaly which has already demonstrated high prospectivity from limited drilling completed in 2024, as well as its spatial association to the Russet Lake Ultramafic (“RLUMAF”). The area beneath the strongest part of the anomaly has never been drilled and will be a top target for 2025.

- Geologic resolution and understanding within the Confederation Assemblage was greatly enhanced through the detailed mapping program and will be a valuable dataset for advancing targets within this package of rocks.

.

.

.

Will Robinson, Vice President of Exploration, stated,

“We are quite pleased with the results of our first ever regional surface exploration program across the Madsen property.

“The program was focused on the underexplored Confederation Assemblage and was successful in delineating a number of high-caliber geochemical anomalies that will warrant follow-up exploration work and possibly drilling in 2025.

“The grade and tenor of the surface anomalies defined within the Confederation rocks and their spatial association with the underlying geology is very encouraging and further reinforces our thesis that this mostly overlooked part of the property still presents excellent potential for discovery.

“Additionally, the till anomaly defined at the North Shore target within Balmer Assemblage rocks along the eastern margin of the Russet Lake Ultramafic fits our exploration model for this highly prospective corridor resulting in an exciting drill-ready target for 2025.”

.

.

To read the full news release please click HERE

.

The live Spot gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in West Red Lake Gold Mines.

.