G Mining Ventures Announces First Gold Pour at Tocantinzinho

G Mining Ventures (TSX: GMIN)

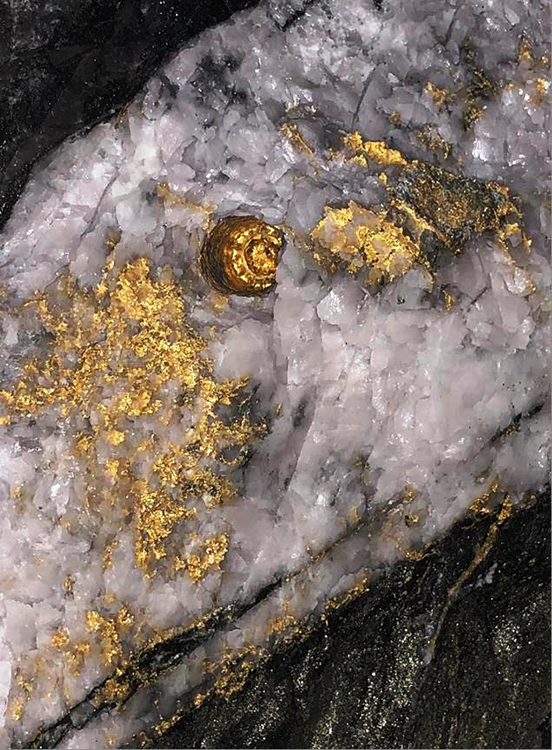

Announced that it has completed its first gold pour at GMIN’s 100%-owned Tocantinzinho Gold Projectin the State of Pará, Brazil.

The first pour yielded approximately 440 ounces of gold.

.

Figure 2 – Vincent-Luc Authier, Construction Manager at TZ with the First Gold Bar Poured at the Mine (CNW Group/G Mining Ventures Corp)

,

.

| G Mining Ventures | TSX: GMIN |

| Stage | Development + Exploration |

| Metals | Gold |

| Market cap | C$1.15 bmillion @ C$2.51 |

| Location | Tapajos, Para State, Brazil |

| Website | www.gminingventures.com |

.

G Mining Ventures Announces First Gold Pour at Tocantinzinho Project

.

BROSSARD, QC, July 9, 2024 – G Mining Ventures Corp. (“GMIN” or the “Corporation”) (TSX: GMIN, OTCQX: GMINF) is pleased to announce that it has completed its first gold pour at GMIN’s 100%-owned Tocantinzinho Gold Project (“TZ” or the “Project”) in the State of Pará, Brazil.

The first pour yielded approximately 440 ounces of gold, and the Project remains on time and budget for commercial production in the second half of 2024.

Once in commercial production, TZ will become Brazil’s third-largest primary

gold mine.

Highlights

o First gold pour at Tocantinzinho achieved on time and budget, only 22 months after the formal construction decision

o Commercial production and subsequent ramp-up to nameplate plant capacity of 4.7 million tonnes per annum expected to be achieved in H2-24

o Over 2.6 Mt of ore, containing over 78,000 gold ounces, mined and stockpiled ahead of the processing plant ramp-up.

.

.

.

Louis-Pierre Gignac, President & Chief Executive Officer, commented:

“I am delighted to announce that TZ has achieved the significant milestone of the first gold pour, less than two years after the formal construction decision.

“The team successfully constructed TZ on time and in line with the original budget while maintaining an outstanding safety record. This milestone is a testament to the strength of our self-perform approach and demonstrates our competitive advantage.

“I sincerely thank our employees and contractors for their remarkable efforts in achieving this milestone. I look forward to ramping up the operation to commercial production in the second half of 2024.

“We are excited about TZ’s future and its significant role in Brazil’s gold mining industry.”

.

.

To View G Mining Ventures’ historical news, please click here

.

——-

.

To read the full news release, please click HERE

.

Live spot metal prices can be found HERE

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in G Mining Ventures.

.