Mining Review 19th May 2024

Gold recorded its highest ever (nominal) price this week, $2,413! Silver also shot up, outpacing gold in percentage terms, and closed at $31.46.

Cornish Metals’ share price was pummelled, forcing a “we know of no reason” RNS from the company, which hardly helped.

.

Calibre Mining – El Limon Mine, Nicaragua

.

City Investors Circle Mining Review 19th May 2024

Gold recorded its highest ever (nominal) price this week, $2,413! This needs to be compared to the inflation adjusted record price for gold, which is equal to over US$3,300, so we still have a way to go to reach that high point.

Silver also shot up, outpacing gold in percentage terms, and closed at $31.46.

The gold silver ratio fell over 8% during the week.

Base metals are also strongly up with a “copper squeeze” taking place at the NY Comex, forcing traders to desperately look for scarce physical supply for delivery, forcing the price higher.

The disconnect or “gap” between the London LME copper price and the Comex price was over $1,000 earlier this week, and is still around half that, which is without precedent.

The price of manganese is soaring, up around 25% last week, after a rail incident in Gabon temporaily prevented exports from their port, and a cyclone incident in Australia preventing exports at the same time.

——-

Cornish Metals’ share price was pummelled, forcing a “ we know of no reason” RNS from the company which hardly helped in the UK, but did in Canada after the UK closed, trading over 28 million shares, or around C$2.8 million in a single trading day! Normal daily volumes are a fraction of that.

I strongly suspect that there is some bad news lurking somewhere, or the company are trying to raise funds, and the book building has not gone well.

Having announced they know of no reason, management cannot now release bad news straight away of course, but there is clearly a reason why the stock has sold off so dramatically in recent days. I suspect the market will remain spooked until the reason for the fall becomes apparent.

I still wonder about the reason for the sudden resignation of CEO Richard Williams in March?

——-

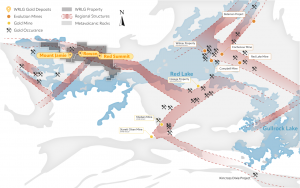

Looking at the news generated from our watchlist this week, it was mainly Q1 reporting, but the main story was that West Red Lake Gold Mines had to clarify they have resources and not reserves at Madsen, a very embarrassing thing to have to admit.

The price, recently over C$1, is now back in the mid 60 cent range, and you wonder how much confidence has been lost in management? I still haven’t bought despite intending to, as I don’t like chasing a share price, and I’m relieved I didn’t now!

This was on the back of the Red Pine scandal where the former CEO has been accused of “manipulating drill results before updating the company database“, see HERE.

This is similar to Bre-X, and I’m shocked this can still occur after all the checks that were supposed to be in place post that scandal. Surely the geologists should also have received the results and scrutinised them at the same time as the CEO?

I’m surprised this has not attracted more media attention, I guess the exchange doesn’t want this destrying confidence in the market and 43-101 process.

All news from our watchlist companies is below, click on the links to read the full story.

Aris Mining Reported Q1 2024 Results, $13.8 M Cash Flow

Cornish Metals’ Response To Share Price Movement

Calibre Mining Reported Strong Progress At Valentine

I-80 Gold Reported Q1 2024 Operating Results

Karora Reported Record Revenue and Strong Cashflow in Q1

West Red Lake Gold Clarified Madsen Has Resources, not Reserves

Mining Review 12th May 2024

.

——-

Market Data

Weekly price changes

(US$ unless stated)

.

| Metal Prices |

Price |

Weekly 5 change |

| Gold price in UK £ |

1902 |

0.79% |

| Gold |

2415 |

2.33% |

| Silver |

31.46 |

11.56% |

| Palladium |

1013 |

1.81% |

| Platinum |

1092 |

10.30% |

| Rhodium |

4700 |

-0.53% |

| Copper |

4.68 |

-0.85% |

| Nickel |

8.77 |

4.40% |

| Zinc |

1.33 |

2.31% |

| Tin |

15.25 |

3.18% |

| Cobalt |

12.45 |

3.75% |

| Manganese |

5.38 |

22.27% |

| Lithium |

14322 |

-3.76% |

| Uranium |

90.7 |

-2.84% |

| Iron Ore |

116.4 |

-0.51% |

| Coking Coal |

326 |

0.00% |

| Thermal coal |

141 |

-1.40% |

|

|

|

| Metal ETFs |

|

|

| GLD |

223.6 |

2.24% |

| GDX |

36.87 |

4.60% |

| GDXJ |

46.35 |

6.70% |

| Sil |

35.23 |

6.82% |

| SILJ |

12.74 |

7.33% |

| GOEX (PCX) |

30.46 |

6.73% |

| URA |

32.65 |

4.58% |

| COPX |

51.67 |

7.69% |

| HUI |

286.85 |

4.93% |

| Gold / Silver ratio |

76.76 |

-8.27% |

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.