Market Review October 2025

The highlighted company is Heliostar Metals (TSX.V: HSTR).

After a volatile month for the price of gold, our Tier 1 watchlist companies rose an average of 3% with seven risers and one even out of ten companies. Galiano Gold was the highest riser, and we feature the significant news from companies on our watchlists.

.

Abore Gold Mine – Credits Galiano Gold

.

City Investors Circle Market Review October 2025

City Investors Circle has published the Market Review for October 2025

The highlighted company is Heliostar Metals (TSX.V: HSTR).

After a volatile month for the price of gold, our Tier 1 watchlist companies rose an average of 3% with seven risers and one even out of ten companies. Galiano Gold was the highest riser, and we feature the significant news from companies on our watchlists.

Both Orla Mining and G Mining Ventures reported strong production and revenue during their Q3 reporting period.

Additions to the watchlist Tier 2 are Erdene Resource Development, Silver Storm Mining, and Western Gold Resources.

Aris Mining was moved into the Tier 1 watchlist after performing well and growing production in Colombia.

i-80 Gold was deleted from the watchlists after not performing as I had hoped. Minera Alamos is under review for deletion for the same reason.

——-

Almost all metal prices increased during October, despite the volatility. Gold and silver rose 6%, 8% in UK pounds sterling terms, after the pound fell v the US dollar. This is a good reason for having investments quoted in other currencies, given the current lack of faith in the Labour government.

Copper reached an all-time high price of $5.15, and tungsten remains the metal that has increased in price the most in 2025 so far, up 95% year to date.

——-

We feature top slicing or trimming from companies that have performed well but growth has slowed as they mature and investing in newer exciting companies that look to enter an exciting growth phase.

——-

To read the October 2025 Market Review, please click HERE.

To receive future issues of the Market Review and invitations to our free to attend mining presentations, please email andrew@city-investors-circle.com

.

——-

Archive of October’s news releases is listed below, click the link to be taken to the full story.

Meeka Metals Reports Strong Grades in First Underground Ore

Catalyst Metals Intersected 7.4 GPT of Gold at Cinnamon

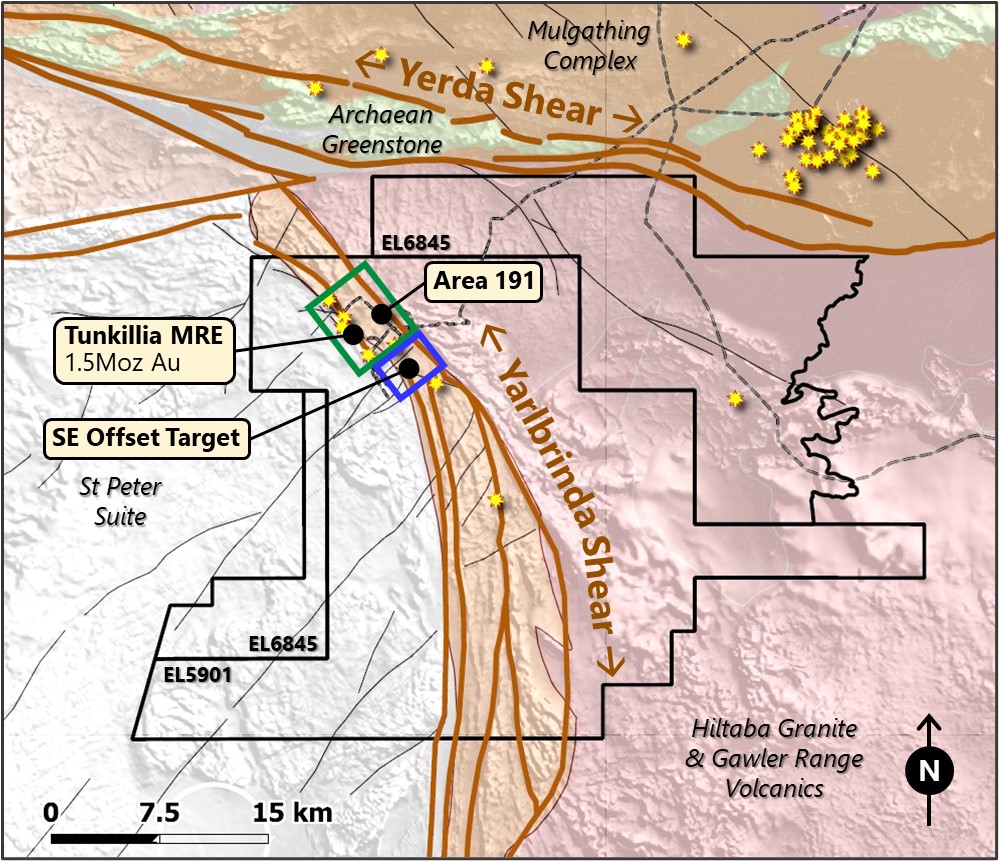

Barton Gold Tunkilia Drilling Ahead Of Schedule

Kaiser Reef Announces High-Grade Gold at Union Hill

Barton Gold Starts Geotechnical Drilling at Central Gawler Mill

Mining Review 26th October 2025

Wesdome Announces Q3 2025 Results and Record Quarterly Production

Kaiser Reef Increase Henty Reserves by 29%

G Mining Ventures Approves Oko West Construction

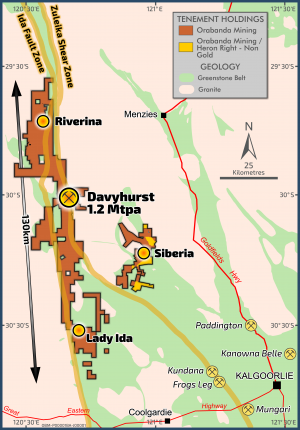

Ora Banda Mining Reports Record Revenue and Production

Horizon Minerals Boosted by Spectacular Gold Grades

Catalyst Advances Four Eagles With Exploration Tunnel Approval

Mining Review 19th October 2025

Capricorn Increases Warriedar Acquisition Consideration

Meeka Reports Thick, High-Grade Gold in First Drill at Turnberry North

Orla Mining Reports Strong Q3 Gold Production from Musselwhite

G Mining Ventures Reports Record Q3 2025 Production

Kaiser Reef Production Update Quarter ending September 2025

Minerals 260 Reports Thick, Shallow high-grade Gold Intercepts

Mining Review 12th October 2025

Pacgold Raises Funds to Acquire The White Dam Gold Mine

Barton Gold Trading Halt

G Mining Ventures Secures Financing to Construct Oko West

Capricorn Metals Confirm 4 m Ounces of Gold Reserves

Orla Mining Discovers Potential 2 KM Extension at Musselwhite

Pacgold Announce Transformational Acquisition

Erdene Resource Development Zuun MRE Update

Mining Review 5th October 2025

Cornish Metals Updates The PEA Of The South Crofty Tin Mine

Pacgold Halted Pending Announcement of a Project Acquisition

G Mining Ventures Receives Approval of SUDAM Tax Incentive

New Murchison Gold Announce a Strong Start at Crown Prince

Market Review September 2025 Published

——-

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author may hold shares in some or all of the companies mentioned

.