Horizon Minerals Drilling Underway at Burbanks

Horizon Minerals (ASX: HRZ)

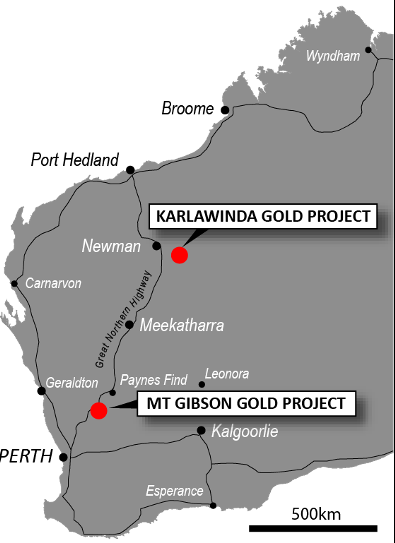

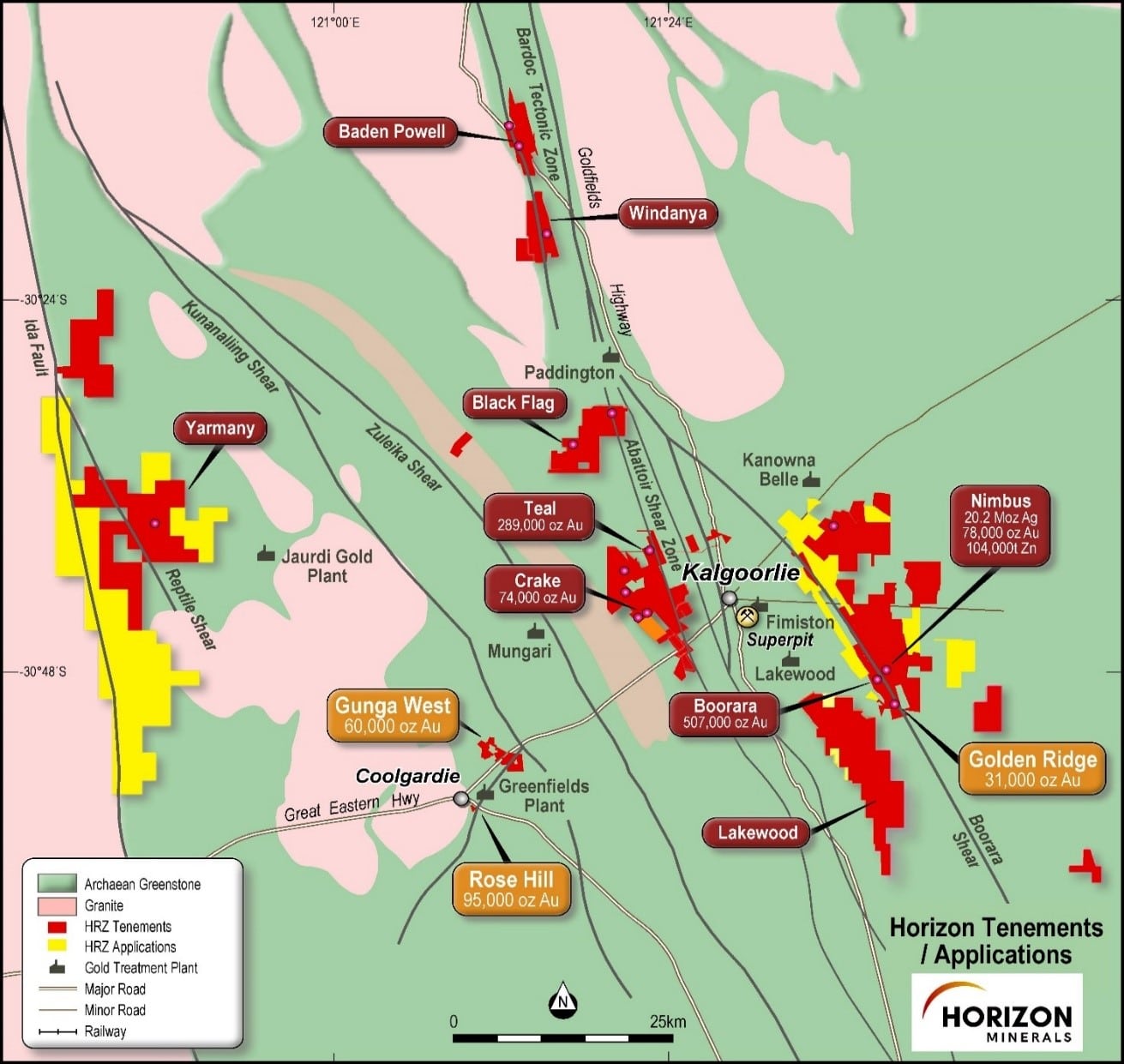

Announced the commencement of drilling at the high grade Burbanks project, located approximately 9km to the south of Coolgardie in the heart of the Western Australian Goldfields.

.

,

.

| Horizon Minerals | ASX: HRZ | |

| Stage | Development, Production | |

| Metals | Gold,Nickel, Cobalt | |

| Market cap | A$103 million @ A$0.47 | |

| Location | Kalgoorlie, Western Australia | |

| Website | www.horizonminerals.com.au/ |

.

Horizon Minerals Drilling Underway at Burbanks

.

Horizon Minerals Limited (ASX: HRZ) (“Horizon” or the “Company”) is pleased to announce the commencement of drilling at the high grade Burbanks project, located approximately 9km to the south of Coolgardie in the heart of the Western Australian Goldfields.

.

HIGHLIGHTS

• Extensional and infill drilling has commenced at the high-grade Burbanks gold project, 9km south of Coolgardie in the Western Australian Goldfields

• Two phase RC and diamond drill programs for 30,000m planned:

o Phase 1 comprises ~15,000m of infill drilling to enhance resource continuity and

confidence with results expected in the September 2025 quarter

o Phase 2 comprises ~15,000m of extensional drilling, targeting along strike and down

dip of known high grade lodes

• Underground mining at Burbanks historically produced 324koz @ 22.7g/t Au

• The historical production is in addition to the existing JORC (2012) Mineral Resource of:

o 6.1Mt grading 2.4g/t Au for 466koz 1

• Infill and extension drilling in late 2023 intercepted significant mineralisation immediately down dip of historical high-grade intercepts with results including: 2

o 0.3m @ 45.40g/t Au from 428.1m (BBRC437D)

o 7.0m @ 5.51g/t Au from 130.0m (BBRC437D)

o 1.55m @ 20.43g/t Au from 301.0m (BBRC463D)

o 2.0m @ 11.79g/t Au from 425.0m (BBRC463D)

• Burbanks is expected to make a meaningful long-term contribution of high-grade ore feed to a refurbished Black Swan processing plant in the future

• The Black Swan PFS is scheduled for completion in the December quarter 2025

.

Managing Director and CEO Mr Grant Haywood commented,

“Past drilling at Burbanks has demonstrated the growth potential of this high-grade mineralised system both along strike and at depth.

“Our first phase of drilling will focus on transitioning more of the existing resource into the higher confidence JORC Indicated category to enable future conversion to an Ore Reserve and to progress this cornerstone asset towards being development ready.

“The second phase will then seek to deliver on the extensional potential seen in earlier drilling.

“As part of our strategy to become a standalone gold producer, we’re undertaking a Pre-Feasibility Study to generate a five-year life of mine plan to feed our Black Swan processing facility, with Burbanks one of the key sources of high-grade mill feed for the plant.

“Refurbishment studies for Black Swan are being undertaken concurrently with the aim of first gold pour by the end of 2026.”

.

——-

To read the full news release please click HERE

..

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Horizon Minerals.

.