Capricorn Delivers Strong Half Year Results

Capricorn Metals (ASX: CMM)

Delivered strong half year results, aided by the strong gold price.

Underlying profit before tax increased by 10% to a $90.7 million from previous

corresponding period, reflecting strong operating performance.

.

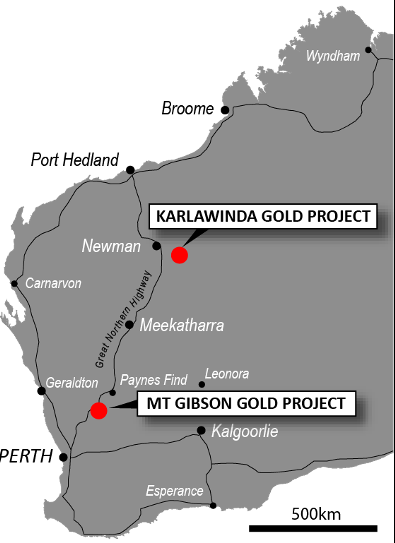

Capricorn Metals projects location map

.

.

| Capricorn Metals | ASX: CMM | |

| Stage | Production, development, exploration | |

| Metals | Gold | |

| Market cap | A$3.26 Billion @A$7.90 | |

| Location | Western Australia | |

| Website | www.capmetals.com.au |

.

CAPRICORN DELIVERS STRONG HALF YEAR RESULTS

Capricorn Metals (ASX: CMM) delivered strong half year results, aided by the strong gold price.

.

Highlights

• Underlying profit before tax increased by 10% to a $90.7 million from previous

corresponding period, reflecting strong operating performance:

o Delivered gold price up 31% to $3,943 per ounce for 54,062 ounces sold

o Strong cost control against back drop of industry wide inflationary pressures

• Lowest quartile Australian gold industry all-in-sustaining-cost (AISC) of $1,564 per

ounce underpins strong EBITDA of $95.1 million and an EBITDA margin of 45%.

• Gross operating profit per ounce sold of $1,700 translating to significant cash build for

the half year of $41.8 million after $20.4 million spent on exploration and feasibility

activities at Mt Gibson and Karlawinda, $10.1 million on development activities at

Mt Gibson, and before the $200 million (before costs) placement proceeds.

• Receipts from gold sales increased by 17% from the sale of 54,062 ounces at an

average delivery price of $3,943 per ounce. A further 1,825 ounces of gold bullion on

hand was subsequently sold in January 2025 for $7.7 million;

• Strong cash flow from operations of $84.8 million further strengthening Capricorn’s

robust balance sheet position:

o Cash and bullion of $363.2 million (30 June 2024: $110.3 million)

o Net cash position of $313.2 million with $50 million bank debt outstanding with

a single bullet repayment in June 2025

• H1 FY25 gold production of 54,261 ounces at AISC of $1,564 per ounce was in line

with expectations and puts Capricorn in a strong position to achieve production

guidance for FY25 of 110,000 – 120,000 ounces at AISC of $1,370 – $1,470 per ounce.

1Underlying profit excludes non-cash adjustments following the adoption of hedge accounting in July 2023.

2 Includes bullion valued at $7.7 million representing the value of the bullion subsequently sold in Jan ’25 and capital proceeds

from a $200 million (before costs) placement completed in Nov ’24.

3Net cash is defined as cash and bullion less corporate bank debt (A$50 million).

________________________________________________________________

.

Capricorn Metals Financial results

A strong six months of operations at the Karlawinda Gold Project (“KGP”) has seen Capricorn Metals Ltd (“Capricorn” or “the Company”) report a statutory profit before tax of $63.1 million for the half year ended 31 December 2024.

Underlying profit before tax of $90.7 million was net of the non-cash adjustments of $27.7 million resulting from the adoption of hedge accounting.

Cash flow from operations of $84.8 million continued the strong financial performance of the KGP.

Capricorn expects to achieve annual production guidance of 110,000 – 120,000 ounces and AISC guidance of $1,370 – $1,470 per ounce.

.

To read the full news release please click HERE

.

The live Spot gold price can be found HERE

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Capricorn Metals

.