G Mining Ventures Secures Financing to Construct Oko West

G Mining Ventures (TSX: GMIN)

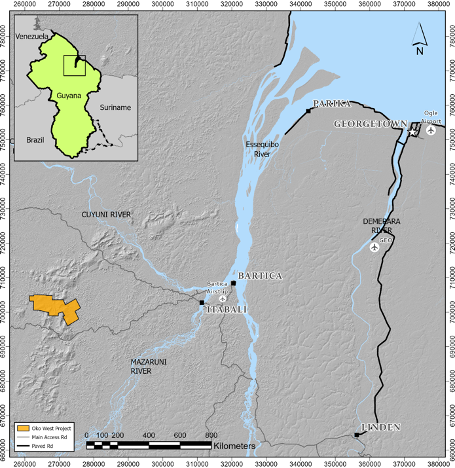

Announced that it has secured commitments for an initial US$387.5 million financing package, with the potential to be increased by an additional US$150M beginning six months after closing, subject to lender approval, for construction of the Oko West gold mine in Guyana.

.

G Mining Oko West project panoramic view – Courtesy of Reunion Gold

.

| G Mining Ventures | TSX: GMIN | |

| Stage | Development + Exploration | |

| Metals | Gold | |

| Market cap | C$7.2 billion @ C$31.95 | |

| Location | Brazil, Guyana | |

| Website | www.gminingventures.com |

G Mining Ventures Secures Financing to Construct Oko West

BROSSARD, QC, Oct. 6, 2025 /CNW/ – G Mining Ventures Corp. (“GMIN” or the “Corporation“) (TSX: GMIN) (OTCQX: GMINF) is pleased to announce that it has secured commitments for an initial US$387.5 million (“M“) financing package, with the potential to be increased by an additional US$150M beginning six months after closing, subject to lender approval.

This financing package, which could total up to US$537.5M, provides the Corporation with the financial flexibility to advance the development and construction of its 100%-owned Oko West Gold Project (“Oko West” or the “Project“) in Guyana.

The financing package is anchored by an agreement (the “Agreement“) with a syndicate of financial institutions (the “Syndicate“) for a revolving credit facility (the “Revolving Credit Facility” or “Facility“) that allows the Corporation to borrow up to US$350M, with an accordion feature for an additional US$150M available post-closing, subject to customary conditions.

The Syndicate is led by National Bank Capital Markets (“National Bank“) and Macquarie Bank Limited (“Macquarie“) as joint bookrunners and co-lead arrangers, with participation from Bank of Montreal, ING Capital LLC, Royal Bank of Canada, Citibank and CIBC.

In addition, Komatsu Finance Chile S.A. (“Komatsu Finance“), a subsidiary of global equipment leader Komatsu Ltd., and GMIN Ventures Guyana Inc., an indirect wholly owned subsidiary of GMIN, are pleased to announce the execution of a Master Loan and Security Agreement (“MLSA“) to finance the procurement of mining and construction equipment for the development of the Project.

Under the terms of the MLSA, Komatsu Finance will provide financing through multiple equipment notes with a total principal amount not to exceed US$37.5M.

.

Julie Lafleur, VP Finance & Chief Financial Officer commented,

“With these financing arrangements in place, together with strong cash flow from the Tocantinzinho Mine, we now have the financial resources required to bring Oko West into production.

“This entirely non-dilutive package increases financial capacity, provides additional flexibility, and reflects the confidence of National Bank, Macquarie, Komatsu Finance and the broader syndicate in our ability to deliver.

“We remain focused on disciplined capital allocation and advancing Oko West responsibly, on schedule, and within budget to generate meaningful value for all stakeholders.”

.

Following the receipt of the Oko West environmental permit from Guyana’s Environmental Protection Agency on September 2, 2025, and with this financing package now in place, GMIN is positioned to make a Final Investment Decision (“FID”) on the Project later this month, which will outline the forecasted initial capital cost, investment incurred to date, and remaining expenditures through to completion.

.

Summary of Revolving Credit Facility Terms:

- Credit Facility: Senior secured revolving facility of US$350M, with an accordion option for an additional US$150M available six months after closing, subject to lender approval.

- Maturity: Initial term of up to 3 years from closing, with annual extension options to reset tenor back to 3 years subject to lender’s consent.

- Use of Proceeds: General corporate purposes, including refinancing existing debt, Oko West Project development and supporting working capital.

- Pricing: SOFR plus a 0.10% credit spread adjustment, and an applicable margin ranging from 2.75% to 3.75%, depending on the net leverage ratio.

.

.

To read the full news release, please click HERE

=======

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in G Mining Ventures.

.