Perpetua Resources Price Falling on Bad News

Perpetua Resources (TSX: PPTA)

The share price is falling following the News Release on Febrary 13th 2025, and now the lawyers are lining up to sue the company on behalf of investors.

A director has just announced a sale due to “tax reasons”. This is turning sour very quickly,

.

.

.

Comment.

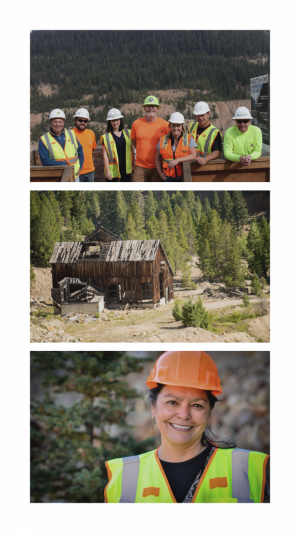

A month ago Perpetua Resources looked a solid hold. The company had received permits for its Stribnite gold / antimony mine in Idaho, USA, despite local opposition from enviromentalists.

On the 13th February the company published a press release wich mentioned increased capex costs and AISC compared to the 2020 Feasibility Study.

This has caused the share price to go into a steep decline and has now fallen around 33% from the recent peak, including over 9% on Friday 21st February.

.

Perpetua Resources Price Falling on Bad News, Lawyers Lining Up

Investigation Details

On February 13, 2025, Perpetua disclosed in a filing with the U.S. Securities and Exchange Commission that the Company had “released an updated cash flow model for the Stibnite Gold Project (the ‘Project’), which is based, in part, on basic engineering work completed by Ausenco Engineering USA South Inc. (‘Ausenco’) in January 2025 (the ‘Financial Update’).”

Perpetua said that the “Financial Update also applies fourth quarter 2024 cost estimates for construction and operations, consistent with the Basic Engineering analysis, as well as current and consensus commodity pricing for sales” and that “the Financial Model reflects an increase in initial and total capital expenditures and LOM AISC compared to the base model included in the 2020 Feasibility Study” for the Project.

On this news, Perpetua’s stock price fell $2.68 per share, or 22.39%, to close at $9.29 per share on February 14, 2025.

What’s Next?

If you are aware of any facts relating to this investigation or purchased Perpetua securities, you can assist this investigation by visiting the firm’s site: bgandg.com/PPTA. You can also contact Peretz Bronstein or his client relations manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC: 332-239-2660

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

——-

.

.