Neometals Issue a Barrambie Offtake Update

Neometals Ltd (ASX & AIM: NMT)

Announced that its wholly owned subsidiary Australian Titanium Pty Ltd has been unable to advance from offtake term sheet to binding take or pay offtake agreement with Jiuxing.

Both parties have invested significant time and money evaluating the feasibility of using Barrambie MGC in Jiuxing’s downstream titanium processing facilities.

.

.

| Neometals | ASX / AIM : NMT |

| Stage | Production + development |

| Metals | Titanium + Vanadium + lithium + nickel |

| Market cap | A$199 m @ A$0.31 |

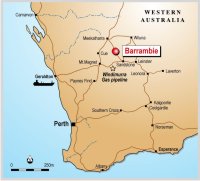

| Location | Western Australia, Germany, Finland, USA |

.

Neometals Issue a Barrambie Offtake Update

Highlights

• Neometals and Jiuxing Titanium Materials Co (“Jiuxing”) have been unable to agree mutually acceptable offtake terms; and

• Discussions with other parties in relation to offtake, equity investment and development financing continue.

Neometals Ltd (ASX: NMT & AIM: NMT) (“Neometals” or “the Company”), announces that its wholly owned subsidiary Australian Titanium Pty Ltd has been unable to advance from offtake term sheet to binding take or pay offtake agreement with Jiuxing.

Both parties have invested significant time and money evaluating the feasibility of using Barrambie MGC in Jiuxing’s downstream titanium processing facilities.

Regrettably, the broader macroeconomic backdrop has required Jiuxing to adjust its production plans and shelve further Barrambie related activities.

The Company is continuing its engagement with other third-party titanium producers and mining services companies in relation to offtake, equity investment and development financing.

The recent completion of the PFS Update continues to highlight the significant inherent value of the Project and the Company remains committed to determine the best pathway to achieve Barrambie value for shareholders.

.

Neometals Managing Director Chris Reed said:

“Despite this disappointing outcome for both Jiuxing and Neometals, strong alternative interest for offtake and investment into the Barrambie remains.

We continue to pursue multiple options with other parties about potential development options for Barrambie.”

To read the full news release, please click HERE

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in Neometals.

/

/