Westgold Doubles Beta Hunt Gold Resource

Westgold (ASX / TSX: WGX)

Announced a maiden Mineral Resource for the Fletcher Zone of 2.3 million ounces of gold.

This doubles the current resource at Beta Hunt, declared in 2024.

.

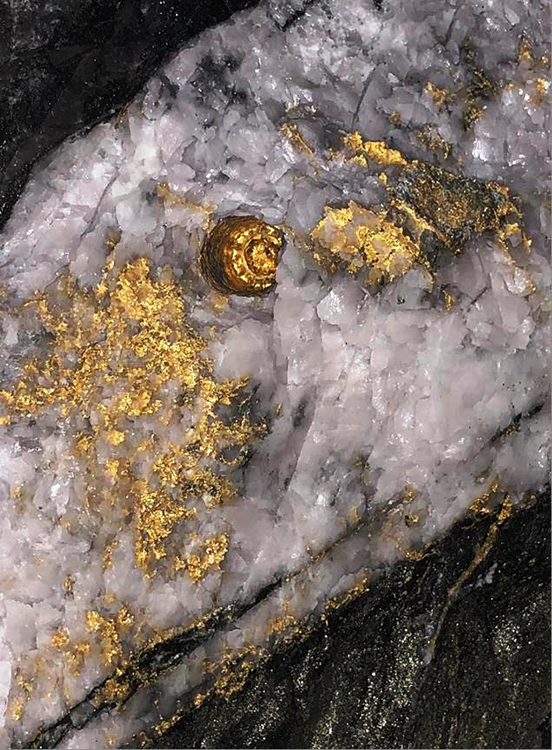

Beta Hunt Mine at night – Credits Westgold

.

.

| Westgold | ASX / TSX: WGX | |

| Stage | Production + development | |

| Metals | Gold | |

| Market cap | A$2.92 Billion @ A$2.74 | |

| Location | Western Australia | |

| Website | www.westgold.com.au |

.

Westgold Announce Fletcher Zone Maiden Mineral Resource of 2.3Moz

Stage 1 Fletcher Resource almost doubles the current Beta Hunt Resource

.

Perth, Western Australia, 23 June 2025: Westgold Resources Limited (ASX | TSX: WGX – Westgold or the Company) is pleased to announce its maiden Mineral Resource Estimate (MRE) for the Fletcher Zone at the Beta Hunt mine in the Southern Goldfields of Western Australia.

Stage 1 drilling only tested 1 kilometre of the 2 kilometres of known strike of the Fletcher Zone, with a Stage 2 programme now being planned to test strike and depth extensions.

.

Highlights

Maiden MRE for Fletcher Zone of 31Mt @ 2.3g/t Au for 2.3Moz Au Inclusion of Stage 1 Fletcher MRE effectively doubles the September 2024 Beta Hunt Mineral Resource.

Stage 1 Fletcher Zone mineralisation extends over a zone up to 500m in width – and 2 km in strike length with a vertical extent in excess of 800m Significant opportunity for resource extensions

MRE drilling tested Stage 1 – the first 1km of the known 2km strike of Fletcher

Stage 1 Mineral Resource remains open at depth

Stage 1 Mineral Resource conversion drilling commenced at Fletcher – targeting a maiden Ore Reserve in FY26

.

.

Westgold Managing Director and CEO Wayne Bramwell commented:

“Westgold is rapidly unlocking the value we identified at Beta Hunt.

“This is a circa 7km long, multi-lode mineralised system that is under-drilled and the Company has delivered a maiden Mineral Resource of 2.3Moz from the Fletcher Zone, from just 1km of Fletcher’s apparent strike.

“This result points to the growth potential of Beta Hunt, and while this is a material milestone for Westgold, it is simply the first step on what is likely to be a multi-decade journey for Fletcher in an expanded Beta Hunt mine plan.

“Critically, mine life at Beta Hunt today exceeds ten years without any contribution from Fletcher.

“Mine outputs are lifting from the existing Western Flanks and A Zone mining areas and this improvement provides scope to evaluate the optimum mining and processing strategy for Fletcher, as it represents a transformational opportunity to further expand the scale of Beta Hunt outputs.

“Our drill teams are not slowing down. They have commenced drilling to upgrade the current Stage 1 Mineral Resource, targeting a maiden Ore Reserve during FY26 and in addition, are preparing to commence testing the northern ~1km extension of Fletcher in the Stage 2 programme.”

.

——-

To read the full news release please click HERE

.To View Westgold’s historical news, please click here

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Westgold.

.