Karora Resources (TSX: KRR)

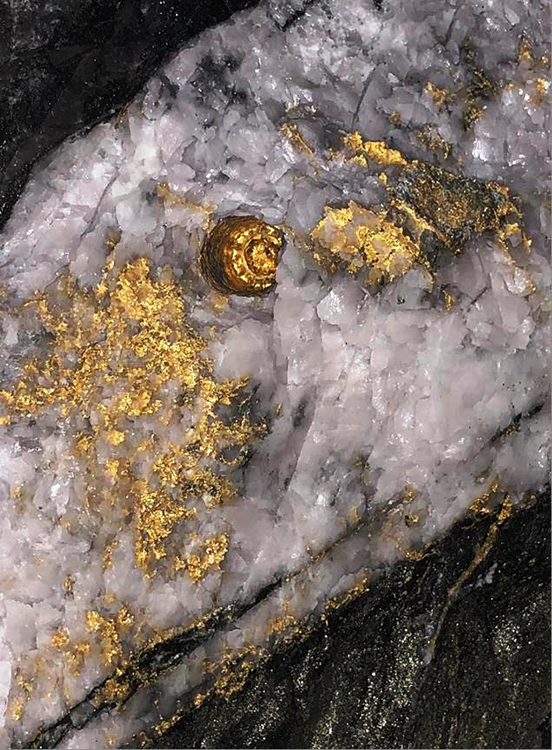

Announced new exploration drilling results from the Beta Hunt Mine, located near Kalgoorlie, WA.

The new drilling results include the discovery of high grade gold mineralization approximately 50 metres below the interpreted extension of the 50C nickel trough in the Gamma Block.

.

| Karora Resources |

TSX: KRR |

| Stage |

Production + Development + Exploration |

| Metals |

Gold + Nickel |

| Market cap |

c$626 m @ C$4.1 |

| Location |

Kalgoorlie, Western Australia |

.

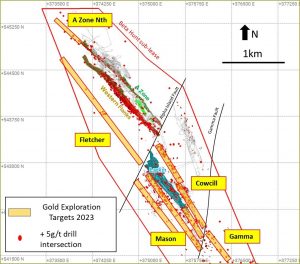

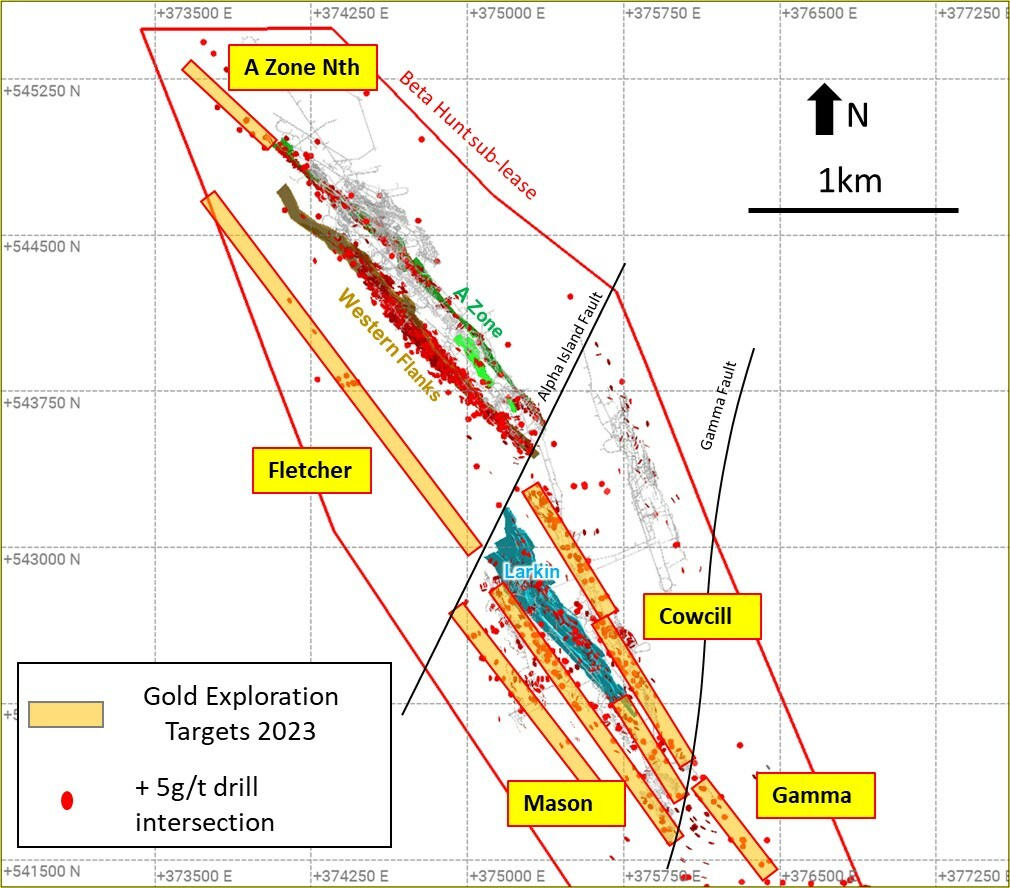

Karora Resources project map, Kalgoorlie, Western Australia

Karora Resources Intersects 40.5 G/T Gold Over 4.0 Metres In New Discovery And Widest Intercept To Date At Beta Hunt Totalling 1.5 G/T Gold Over 90.5 Metres

TORONTO, Nov. 15, 2021 /CNW/ – Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) (“Karora” or the “Corporation”) is pleased to announce new exploration drilling results from the Beta Hunt Mine.

The new drilling results include the discovery of high grade gold mineralization approximately 50 metres below the interpreted extension of the 50C nickel trough in the Gamma Block (see Karora news releases dated April 6, 2021 and October 8, 2021.

.

Highlights:

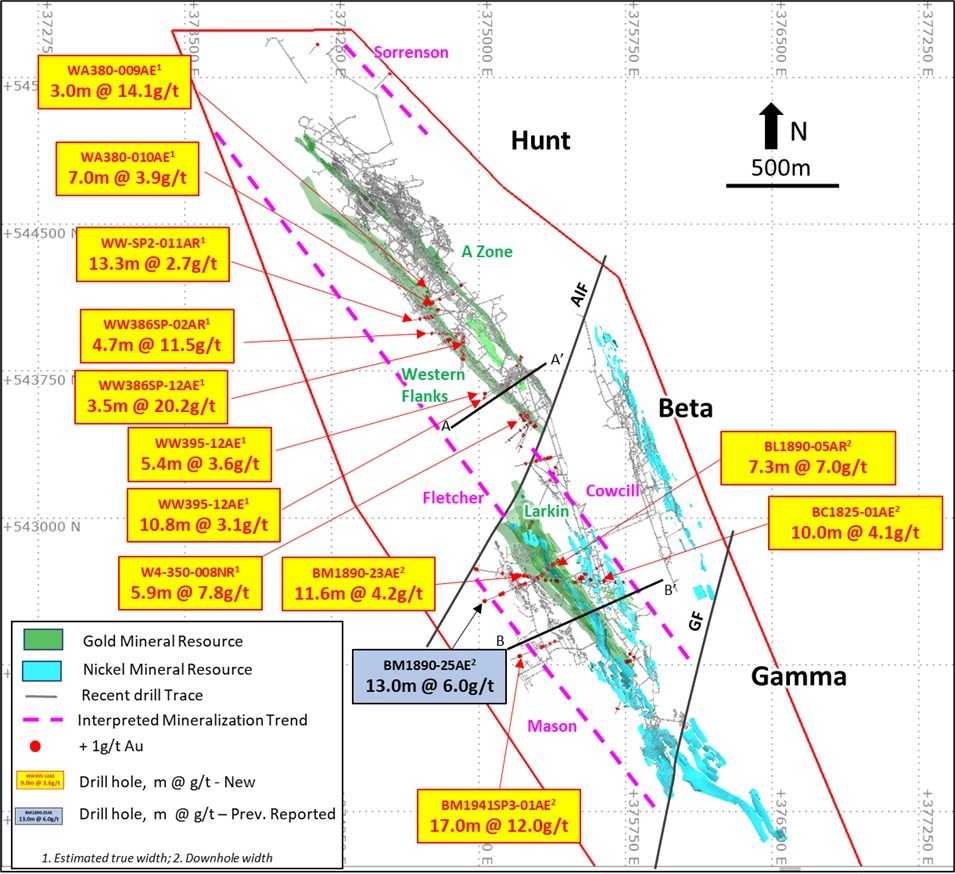

- New mineralized setting intersected beneath the 50C nickel trough has returned an initial diamond drill intersection of 40.5 g/t over 4.0 metres in hole G50-22-007NE1,3. The intersection is associated with a basalt breccia, different to what has previously been observed in the A Zone and Western Flanks Mineral Resources. Interpretation of this new host mineralization is underway.

- A second new gold discovery hole intersected the widest ever mineralized interval drilled by Karora at Beta Hunt. The intersection of 1.5 g/t over 90 metres1,3 includes 50.9 g/t over 0.4 metres and occurs approximately 250 metres west of the Larkin Zone. Results of the two holes drilled to date west of the Larkin Zone include1,3:

- EL-EA2-004AE: 1.5 g/t over 90.5 metres including 3.2 g/t over 13.1 metres (includes 50.9 g/t over 0.4 metres) and 2.7 g/t over 6.0 metres

- EL-EA2-005AR: 1.2 g/t over 30.3 metres, including 2.2g/t over 4.3 metres

- Recent infill drilling of the Larkin Zone continues to support continuity of the gold mineralization defined to date. Highlights include2,3:

- EL-EA2-004AE: 4.7 g/t over 5.0 metres

- BL-19-17AR: 7.6 g/t over 2.1 metres

- BL-19-20AR: 74.0 g/t over 1.0 metre

|

1.

|

Interval lengths are downhole widths. True estimated widths cannot be determined with available information.

|

|

2.

|

Interval lengths are estimated true widths

|

|

|

Underground exploration drilling has returned an initial intersection of 40.5 g/t over 4.0 metres in diamond drill hole G50-22-007NE. The new discovery is associated with a basalt breccia. This association of gold mineralization with brecciation is not generally observed in current gold Mineral Resources at Beta Hunt.

Exploration drilling to the west of the Larkin Zone has also intersected what appears to be a parallel zone of gold mineralization. The discovery hole of 90 metres grading 1.5 g/t is approximately 250 metres west of the Larkin Zone and returned individual grades as high as 50.9 g/t over 0.4 metres.

Karora Resources management comments

“I am excited by the new exploration drill results which continue to demonstrate the tremendous growth potential at the Beta Hunt Mine.

“Our first drill hole south of the 50C nickel discovery in the Gamma Block area intersected 40.5 g/t gold over 4.0 metres (hole G50-22-007NE) as part of the drill program targeting the southern extent of the nickel trough and highlights the further potential of this area to host significant gold mineralization.

“We also drilled Karora’s widest ever +1 g/t intersection at Beta Hunt. In the Beta Block, a campaign is underway to upgrade the 30C nickel trough and underlying Larkin Gold Zone.

“As part of this campaign an exploration drill hole was extended 250 metres past the Larkin Zone and returned a very wide gold mineralized intercept of 1.5 g/t over 90.5 metres, including 3.2 g/t over 13.1 metres and 2.7 g/t over 6.0 metres (hole EL-EA2-004AE). Infill drilling below the 30C nickel trough intersected gold mineralization supporting our Larkin Zone interpretation of three steep dipping zones ranging between 3 to 12 metres in width. The new drilling results from this area include 4.7 g/t over 5.0 metres (hole EL-EA2-004AE), 7.6 g/t over 2.1 metres (hole BL19-17AR) and 74.0 g/t over 1.0 metre (hole BL19-20AR).

“It is important to understand that Beta Hunt’s current gold Mineral Resources are entirely contained within the northern Hunt Block, with both the Beta and Gamma Blocks remaining at very early stages of gold exploration.

“As Karora continues to develop the mine toward the south, opportunities to add to the current resource from these southern blocks is very encouraging as highlighted by the recent drill intersections from our exploration program.”

Paul Huet, Chairman and CEO of Karora Resources

.

Recent Drilling Update

The description below covers new gold results for the drill period between August 1 to October 31, 2021 for drill holes in the Beta and Gamma Blocks. Drilling within these areas totalled 27 holes for 3,333 metres over the period. The Beta Block is defined as the area between the Alpha Island Fault and the Gamma Island Fault. The Gamma Block is defined by that area south of the Gamma Island Fault. The area north of the Alpha Island fault is defined as the Hunt Block (see Figure 1).

Turn-around times on assay results continue to be slow, up to 6 to 8 weeks for exploration samples, for reasons previously reported (see Karora news release dated September 8, 2021). As restrictions ease, this situation is expected to improve going forward.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Karora Resources, bought in the market at the prevailing price on the day of purchase.

.