Orla Mining Provides Update on Pit Wall Event at Camino Rojo

Orla Mining (TSX: OLA; NYSE: ORLA)

Provided a status update on the recent pit wall event that occurred at its Camino Rojo Oxide Mine in Zacatecas, Mexico.

Camino Rojo experienced an uncontrolled material movement on the north wall on July 23rd resulting in no injuries or equipment damage.

.

Orla Mining project panoramic view and location map – Zacatecas State, Mexico – Credits Orla Mining Ltd.

.

.

| Orla Mining | TSX : OLA | |

| Stage | Development | |

| Metals | Gold | |

| Market cap | C$4.4 billion @ C$13.35 | |

| Location | Mexico + Nevada + Canada | |

| Website | www.orlamining.com |

.

Comment

Well I have to admit I’m happy and relieved with today’s news release and the small fall in share price.

It could have been worse, and to be honest I thought it might be.

The company have approached this in the right way, and been open and transprent with shareholders, which is the correct and professional way to handle such a situation.

Management deserve credit for their conduct throughout a tough few days in my opinion.

Action plan in place to resume in-pit access, annual guidance updated

Summary Detail

- Pit wall event: Camino Rojo experienced an uncontrolled material movement on the north wall on July 23rd resulting in no injuries or equipment damage.

- Assessment: A geotechnical assessment, supported by third party consultants, has been ongoing which has informed an action plan and safe restart of mining.

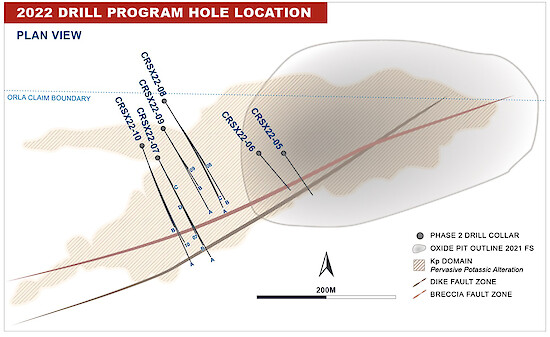

- North wall stabilization: A 50–80 metre pushback of the north wall is planned, with a redesigned slope and continuous monitoring to ensure safe operating conditions. Approximately 9.0 Mt of predominantly oxidized material (1:0.9 strip ratio, 0.74 g/t au) is expected to be removed and then crushed and stacked on the heap leach from the north wall.

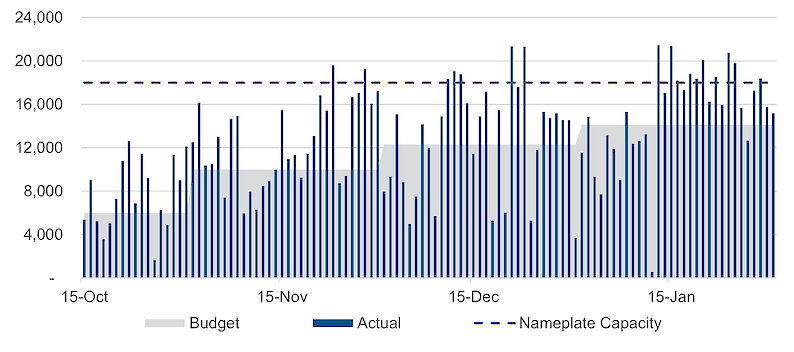

- No material was lost or sterilized in the pit wall event but rather the update to 2025 guidance is attributed to a deferral of production at Camino Rojo due to grade and recovery mix.

.

Jason Simpson, President and Chief Executive Officer of Orla stated;

“While the north wall event at Camino Rojo was a temporary setback, it has reinforced the importance of our pit wall monitoring, technical planning, risk management, and operational discipline.

“The team onsite acted quickly before the event to ensure safety.

“Following the event, our broader team, supported by expert consultants, rapidly implemented a comprehensive action plan that prioritizes safety, reinforces slope stability, and allows for continued operations in Mexico, important for all stakeholders.”

.

To read the full news release please click HERE

.

——-

,

Pit Wall Event Context

.

As reported on July 23, 2025, and updated on July 24, 2025, Camino Rojo experienced an uncontrolled material movement along the temporary north wall of the open pit. Importantly, there were no injuries, equipment damage, or environmental impacts resulting from the event.

Ramp access to the pit remained intact; however, open pit mining operations were temporarily suspended while the Company undertook a geotechnical assessment to support a safe action plan and restart of in-pit mining activities.

.

To read the full news release please click HERE

.

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Orla Mining.

.