Mining Review 12th October 2025

Mining Review 12th October 2025

Orla Mining announced a potential significant discovery at Musselwhite.

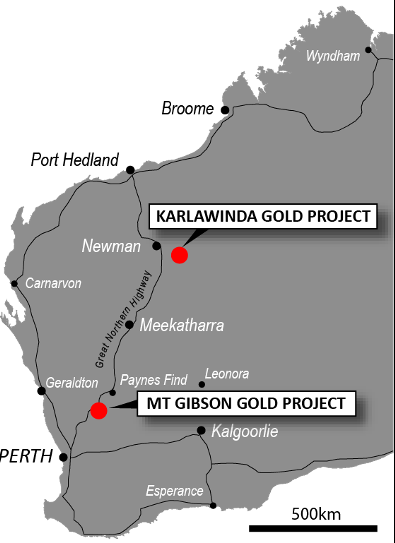

Capricorn Metals and Erdene Resource Development both announced updated resources.

.

G Mining Oko West project panoramic view – Courtesy of Reunion Gold

City Investors Circle Mining Review 12th October 2025

Mining Review 12th October 2025

Orla Mining announced a potential significant discovery at Musselwhite.

Capricorn Metals and Erdene Resource Development both announced updated resources in a generally positive week for mining stocks.

——-

The price of gold holding above $4,000 and silver reaching an all time high kept the price of most producing precious metal mining companies near their recent highs. Some Australian companies lost around 5% in Friday trading due to a fall in the gold price, only for that to reverse later in the day, benefitting TSX listed stocks.

The price of copper remains around recent highs, and tungsten is still strong due to its military applications.

——-

My portfolio suffered a bit of pain this past week as some mining stocks, even gold producers, fell away badly after the gold price appeared to top out and fall back.

The late rally past $4,000 will, hopefully, mean a strong day on the ASX on Monday, and that may restore some of the Friday losses on that market. My portfolio was at an all-time high just before the pullback.

I met management from Stallion Uranium and made a small investment afterwards as the company are well funded, have prospective ground in the Athabasca Basin, and have a drill program scheduled to commence in January.

——-

A list of all the significant news releases from our watchlist companies last week is below, please click on the link to be taken to the full story.

Pacgold Raises Funds to Acquire The White Dam Gold Mine

G Mining Ventures Secured Financing to Construct Oko West

Capricorn Metals Confirmed 4 m Ounces of Gold Reserves

Orla Mining Discovered Potential 2 KM Extension at Musselwhite

Pacgold Announced A Transformational Acquisition

Erdene Resource Development Zuun MRE Update

Mining Review 5th October 2025

Market Data

Weekly Price Changes

(US$ unless stated)

| Metal Prices | Price | Weekly % change |

| Gold price in UK £ | 3014 | 4.44% |

| Gold in AUD$ | 6068 | 3.07% |

| Gold | 4032 | 3.70% |

| Silver | 49.89 | 3.74% |

| Palladium | 1385 | 7.70% |

| Platinum | 1592 | 1.02% |

| Rhodium | 7100 | 0.35% |

| Copper | 4.8 | 1.48% |

| Nickel | 6.86 | -0.15% |

| Zinc | 1.4 | 2.94% |

| Tin | 16.52 | 4.82% |

| Cobalt | 15.76 | 0.06% |

| Lithium | 10007 | -0.05% |

| Uranium | 77.7 | -3.96% |

| Iron Ore | 106 | 1.92% |

| Coking Coal | 190 | 0.00% |

| Thermal coal | 107 | 0.00% |

| Metal ETFs | Price | Weekly % change |

| GLD | 370 | 3.35% |

| GDX | 76 | -1.40% |

| GDXJ | 99 | -0.74% |

| Sil | 71 | 0.00% |

| SILJ | 23.37 | 1.61% |

| GOEX (PCX) | 69 | -0.09% |

| URA | 52 | -11.19% |

| COPX | 60 | -3.18% |

| HUI | 613 | -0.74% |

| Gold / Silver ratio | 80.82 | -0.04% |

.=======

.

City Investors Circle is based in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non-deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Declaration

At the time of writing the author may hold positions in any of the stocks mentioned.

.