Minera Alamos Closes Cerro de Oro Funding Package

Minera Alamos (TSX.V: MAI)

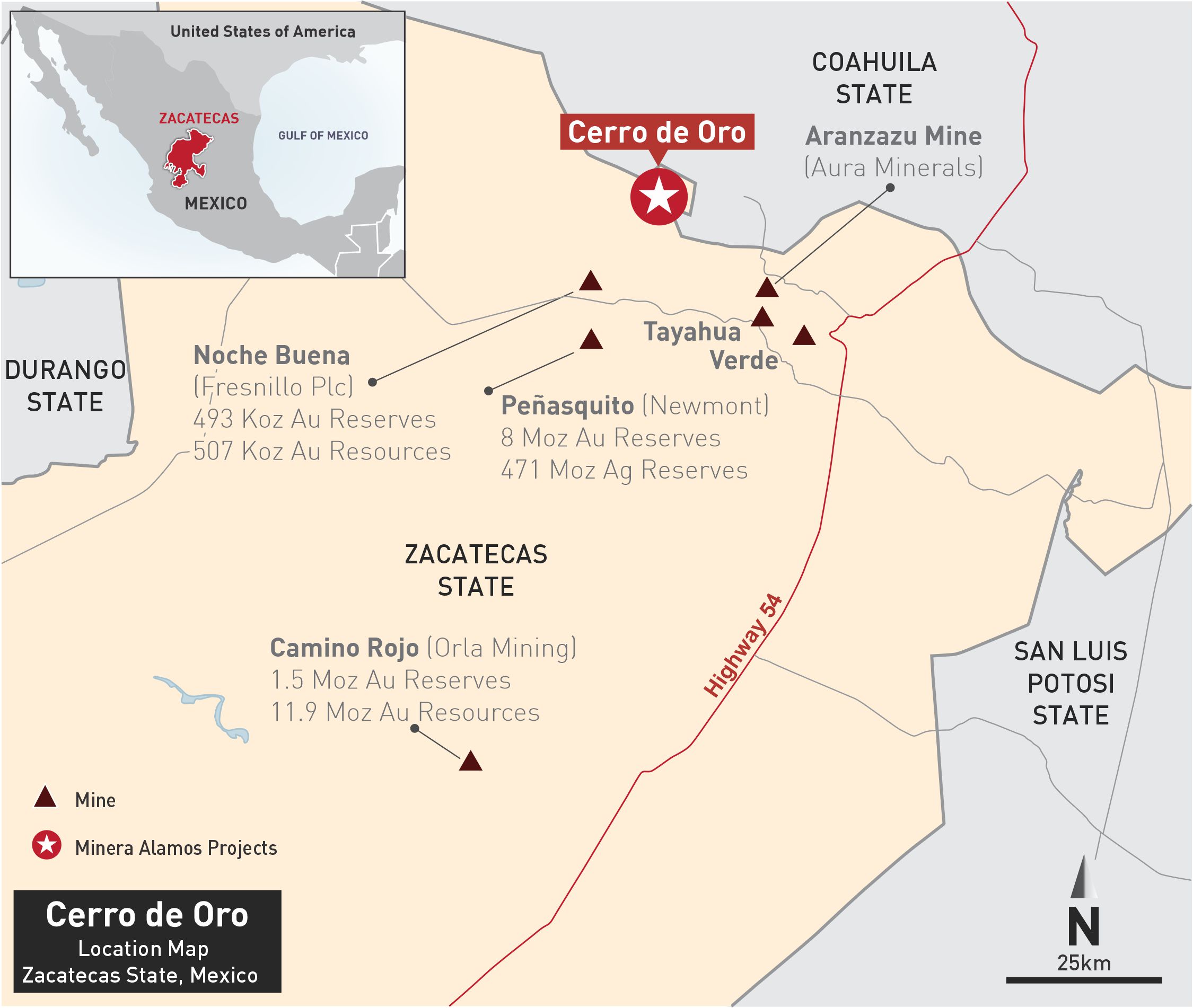

Announced that it has executed the definitive documentation for the previously announced Cerro de Oro funding package associated with the planned construction of the Cerro de Oro gold mine that is currently anticipated to begin next year.

.

Minera Alamos three projects in Mexico

Minera Alamos Signs Definitive Documentation for Cerro De Oro Construction Financing Package of up to US$25 million and Completes Initial Drawdown

Toronto, Ontario – (Newsfile – October 30th, 2023) Minera Alamos Inc. (the “Company” or “Minera Alamos”) (TSX.V: MAI) is pleased to announce that it has executed the definitive documentation (the “Cerro de Oro Financing Documents”) for the previously announced Cerro de Oro funding package associated with the planned construction of the Cerro de Oro gold mine that is currently anticipated to begin next year.

The Company entered into the Cerro de Oro Financing Documents with Auramet International Inc. (“Auramet”) and Auramet Capital Partners LP (“Auramet Capital”) which is comprised of a loan facility for up to US$15 million and a US$10 million royalty (see news release dated May 31, 2023, for a more detailed summary of the terms).

Upon execution of the Cerro de Oro Financing Documents, the Company also completed a drawdown of an initial US$5 million under the loan facility (the “Interim Amount”) to advance certain pre-construction work related to the Cerro de Oro project.

.

Doug Ramshaw, President, Minera Alamos Stated

“We are delighted to have executed these financing documents with Auramet, which provides a fully funded and single source solution to the modest capital expenditure requirements of the planned gold mine at Cerro de Oro.

“Our team has had an excellent working relationship with Auramet in recent years in regard to gold sales from prior operations as well as our Santana gold mine.

“This has provided us great insight into how supportive a partner Auramet can be, and we are happy to have executed a funding facility which will allow us to grow the relationship with the Auramet team.”

.

According to the funding facility, the Company may deliver a drawdown notice to Auramet for the remaining US$10 million under the loan facility (the “Remaining Amount”) upon the satisfactory completion of certain conditions, including, among other things, (i) the final earn-in commitments of the Cerro de Oro project and property; and (ii) receipt of permits required for construction of the Cerro de Oro project.

In the event that the Company does not meet the above closing conditions or should it elect not to deliver a drawdown notice for the Remaining Amount by the earlier to occur of (i) October 27, 2024; and (ii) the date that is 31 days after all closing conditions have been satisfied, the outstanding balance of the Interim Amount (including all interest accrued thereon) shall mature and be payable in equal instalments over the subsequent 10 month period and all obligations of Auramet to advance any part of the Remaining Amount will immediately be canceled and terminated.

Closing and funding of the US$10 million under the royalty facility is conditional upon meeting the same conditions as are required to draw down on the remaining loan facility and is also conditional upon the actual drawdown of the remaining amount under the loan facility and to the extent this does not occur, any obligations under the royalty facility will also terminate.

.

To read the full news release, please click HERE

.

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Minera Alamos.

.