Cabral Gold Drills 3m @ 15.9 g/t gold at Machichie

Cabral Gold (TSX.V: CBR)

Announced results from eleven additional reverse circulation drill holes and two trenches at the Machichie Main gold deposit within the Cuiú Cuiú Gold District, Brazil.

Highlights include Drill hole RC0515 which returned 10m @ 2.2 g/t gold from surface.

.

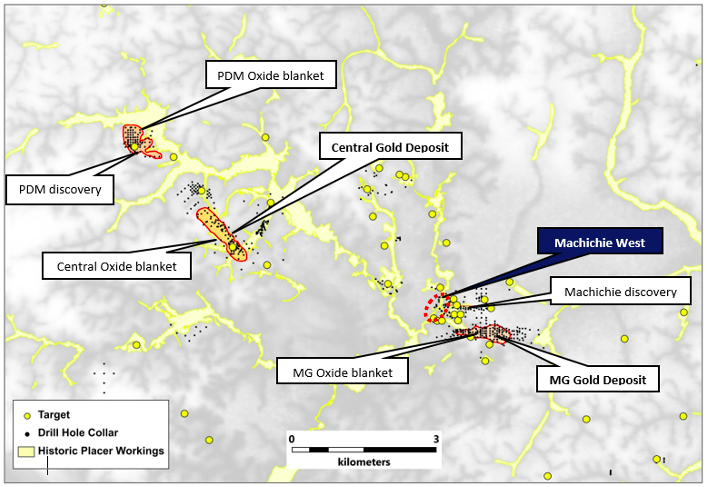

Cabral Gold map (Courtesy of Cabral Gold)

.

.

| Cabral Gold | TSX.V : CBR | |

| Stage | Exploration | |

| Metals | Gold | |

| Market cap | C$69 m @ 32.5c | |

| Location | Tapajos, Para State, Brazil | |

| Website | www.cabralgold.com |

.

Cabral Gold Drills 3m @ 15.9 g/t gold and Discovers New Mineralized Zone at the Machichie Main Gold Deposit, Cuiú Cuiú Gold District, Brazil

Vancouver, British Columbia–(Newsfile Corp. – March 26, 2025) – Cabral Gold Inc. (TSXV: CBR) (OTC Pink: CBGZF) (“Cabral” or the “Company“) is pleased to announce results from eleven additional reverse circulation (“RC”) drill holes and two trenches at the Machichie Main gold deposit within the Cuiú Cuiú Gold District, Brazil.

.

Highlights

- Drill hole RC0515 returned 10m @ 2.2 g/t gold from surface and 3m @ 15.9 g/t gold from 16m depth within weathered gold-in-oxide material (saprolite). The hole also intersected 11m @ 0.9 g/t gold in fresh rock from 31m depth

- Drill hole RC0504 drilled at the Machichie Main gold deposit at Cuiú Cuiú returned 12m @ 3.1 g/t gold including3m @ 11.2 g/t gold in weathered gold-in-oxide material at surface

- The drill result from RC504 indicates the presence of a new previously unrecognized mineralized zone located 40m north of the main mineralized structure at Machichie Main. The new zone is open to the east and west and will require further drilling

- Additional drill results from Machichie Main include 7m @ 2.8 g/t gold including 2m @ 7.5 g/t gold in RC502, and15m @ 1.5 g/t gold in RC506. Other notable results included 6m @ 0.9 g/t gold from RC508,5m @ 1.2 g/t gold from RC511, and 2m @ 6.6 g/t gold from RC519

- Trench CT054 also returned 13m @ 2.3 g/t gold in saprolite material on surface including 5m @ 5.8 g/t gold

.

Alan Carter, Cabral’s President and CEO commented,

“The identification of a new and previously unrecognised parallel zone of mineralization at Machichie Main is a very positive development.

“Together with the other new drill and trench results released today, this underlines the potential of the Machichie Main deposit to make a meaningful contribution to the near-term development plans for the gold-in-oxide material at Cuiú Cuiú, as well as the global resource base within the district.

“The trench results are again significant because they confirm the presence of excellent grades within gold-in-oxide material at surface.

“This bodes very well for our efforts to upgrade the Inferred resources at Machichie Main and significantly updating the PFS study released in October 2024.”

.

——-

.

To read the full news release, please click HERE

To View Cabral Gold’s historical news, please click here

.

——-

..

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in Cabral Gold.

.

.