Cabral Gold Drills New Mineralized Structure at Cuiú Cuiú

Cabral Gold Inc. (TSX.V: CBR)

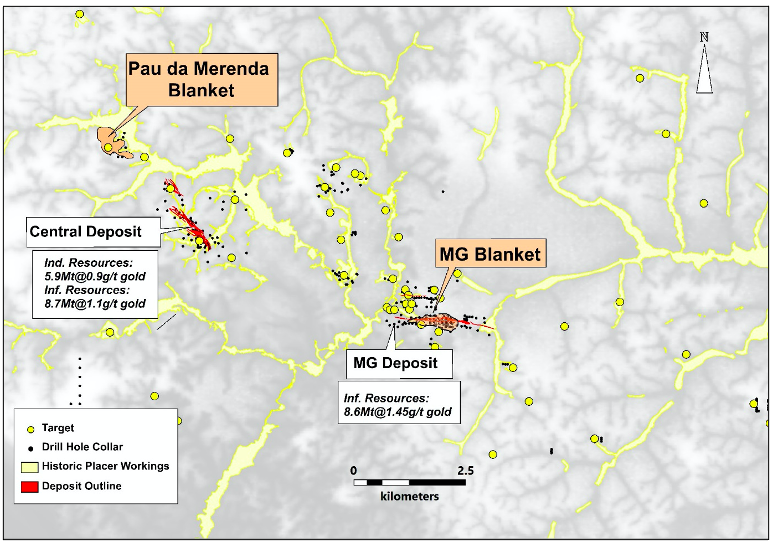

Announced drill results from 17 shallow reconnaissance RC drill holes at the previously untested Mutum target located 1300 metres NW of the Central Gold deposit and 500 metres SE of the PDM gold discovery within the Cuiú Cuiú district.

.

Cabral Gold – MG Deposit, Para state, Brazil – Credits Cabral Gold

.

| Cabral Gold | TSX.V : CBR | |

| Stage | Exploration | |

| Metals | Gold | |

| Market cap | C$196 m @ 71c | |

| Location | Tapajos, Para State, Brazil | |

| Website | www.cabralgold.com |

Cabral Gold Drills New Mineralized Structure Connecting PDM and Central Gold Deposits, Cuiú Cuiú Gold District, Brazil

Vancouver, British Columbia–(Newsfile Corp. – December 4, 2025) – Cabral Gold Inc. (TSXV: CBR) (OTCQB: CBGZF) (“Cabral” or the “Company“) is pleased to announce drill results from 17 shallow reconnaissance RC drill holes at the previously untested Mutum target located 1300 metres NW of the Central Gold deposit and 500 metres (“m”) SE of the PDM gold discovery within the Cuiú Cuiú district.

.

Highlights

- The Company has identified a new and previously unrecognized mineralized structure which appears to extend for 1.8 kilometres (“km”) in a NW-SE direction and connects the Central gold deposit with the PDM gold discovery further to the north

- Reconnaissance drill intercepts from the Mutum target, which is located 1.3km NW of the Central gold deposit and 500m SE of the PDM gold discovery, include 8m@ 1.32 grams per tonne(“g/t”) gold from 43m depth in RC0602,13m @ 0.83 g/t gold from 11m depth in RC0604, and multiple mineralized intervals including4m @ 0.76 g/t gold from 29m depth and4m @ 1.06 g/t gold from 41m depth in RC0603

- The mineralized structure at Mutum was identified on the basis of a recent airborne drone magnetic survey over the area followed by follow up reconnaissance drilling. This survey revealed a clear NW-trending structural corridor that was not visible in earlier airborne data

- The Company has subsequently purchased its own in-house drone magnetic system and intends to fly the entire Cuiú Cuiú district as quickly as possible in advance of additional reconnaissance drilling, particularly along the new NW trending structure linking PDM with Central

.

Alan Carter, Cabral’s President and CEO commented,

“The significance of the results from several of the shallow reconnaissance drill holes recently completed at the previously untested Mutum target at Cuiú Cuiúcannot be overstated.

“These drill results are from a previously untested area located 1.3km NW of the Central gold deposit and 500m SE of the PDM gold discovery, and indicate that a NW-trending mineralized structure extending for 1.8km connects the two deposits.

“This opens up a very large area of prospective ground between Central and PDM for follow up drilling.

“The drone magnetic test survey that we recently completed has generated a lot of high-resolution magnetic data that are much more effective at mapping mineralized structures than the existing fixed wing airborne data.

“This will generate important advances in our understanding of the structural controls on gold mineralization at other deposits and targets within the Cuiú Cuiú district.”

.

To read the full news release, please click HERE

——-

.

To view the latest share price and stock chart, please click HERE

To View Cabral Gold’s historical news, please click here

.

——-

..

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in Cabral Gold.

.

.