Cyprium Metals announces deeply discounted placement

Cyprium Metals Limited (ASX: CYM)

Announced a capital raising via a placement and a pro rata non‐renounceable rights issue to raise up to approximately $26 million before costs.

.

The Company has received firm commitments in respect of a placement to issue approximately 139.1 million new shares at 11.5 cents each. […]

.

| Cyprium Metals | ASX: CYM |

| Stage | Development, Exploration |

| Metals | Copper, Cobalt |

| Market cap | A$62m @ 11c |

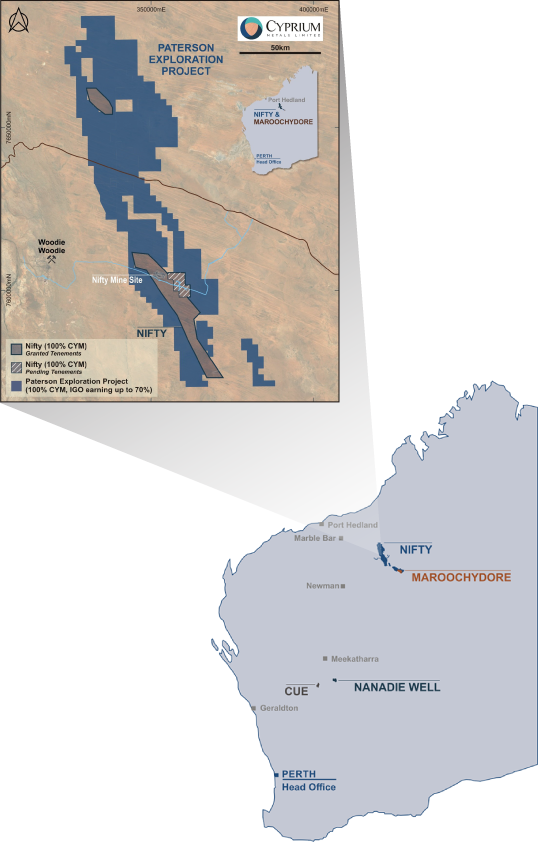

| Location | Pilbara, Western Australia |

.

Cyprium Metals – Project locations in Western Australia

.

.

$16M Placement and $10M Entitlement Issue to Support Nifty Copper Project Development

.

.

Cyprium Metals Limited (ASX: CYM) (“CYM”, “Cyprium” or “the Company”) is pleased to announce a capital raising via a placement and a pro rata non‐renounceable rights issue to raise up to approximately $26 million before costs.

.

The Company has received firm commitments in respect of a placement to issue approximately 139.1 million new shares (Placement Shares) at 11.5 cents each (Offer Price) to raise $16 million (Placement) from sophisticated and institutional investors.

.

The Company is also pleased to announce a non-renounceable pro rata entitlement offer at the Offer Price of one (1) new share for every eight (8) shares currently held by eligible shareholders to raise up to $10 million (Entitlement Offer).

.

The new shares to be issued under the Entitlement Offer will be issued at the same price as the Placement Shares

.

HIGHLIGHTS

• Firm commitments received for a Placement to raise $16M at 11.5 cents per share

• Additional pro rata non-renounceable entitlement offer to raise up to $10M

– 1 new share for every 8 held on the record date at 11.5 cents per share

– Offer will be open to all eligible Cyprium shareholders

• Funds raised will place Cyprium in a strong financial position to continue progressing

the development of the Nifty Copper Project

• Equity raise supports recently announced $50M Offtake Prepayment Facility with

Glencore

• Advanced discussions are continuing with Senior Debt counterparties

.

Cyprium Metals management comments

“The Board is very appreciative of the strong support shown from current shareholders and is pleased to welcome a number of new investors to the register.

“Cyprium has made significant advances in the past 15 months both in terms of increasing the mineral resource estimate but also particularly in the areas of SX/EW and infrastructure refurbishment, government approvals and metallurgical optimisation.

“With the completion of this capital raising, Cyprium will be able to continue to advance the senior debt financing, with the finalisation of the funding package enabling our construction plans and the production of copper metal plate on site in the second half of 2023.”

Cyprium Metals Managing Director Barry Cahill

.

To read the full news release, please click HERE

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Cyprium Metals, bought in the market at the prevailing price on the day of purchase.

.

.