Maple Gold Increase Douay Mineral Resources

Maple Gold (TSX.V: MGM)

Reported positive results of an updated Mineral Resource Estimate for the Douay Gold Project in Quebec, Canada, which is held by a 50/50 JV between the Company and Agnico Eagle Mines Limited.

Total contained gold ounces at Douay have increased along with further conversion from Inferred to Indicated Resources categories based on successful exploration and infill drilling. […]

.

| Maple Gold | TSX.V: MGM |

| Stage | Exploration |

| Metals | Gold |

| Market cap | C$124 m @ 34.5c |

| Location | Quebec, Canada |

.

.

Maple Gold Douay Mine, Quebec.

.

.

MAPLE GOLD REPORTS UPDATED DOUAY MINERAL RESOURCE ESTIMATE; INDICATED RESOURCES INCREASE 21% TO 511,000 OZ AU AND INFERRED RESOURCES INCREASE 7% TO 2,525,000 OZ AU ON LIMITED DRILLING

.

.

Vancouver, British Columbia–(Newsfile Corp. – March 17, 2022) – Maple Gold Mines Ltd. (TSXV: MGM) (“Maple Gold” or the “Company”) is pleased to report the positive results of an updated Mineral Resource Estimate (the “2022 MRE”) for the Douay Gold Project (“Douay” or the “Project”) in Quebec, Canada, which is held by a 50/50 joint venture (the “JV”) between the Company and Agnico Eagle Mines Limited.

Total contained gold ounces at Douay have increased along with further conversion from Inferred to Indicated Resources categories based on successful exploration and infill drilling, comprehensive mineralization modeling, and using higher cost and gold price assumptions compared to the RPA 2019 MRE[1].

/

Highlights from the 2022 MRE:

- Pit-constrained Indicated Resources increased 21% compared to the RPA 2019 MRE1 to 511,000 ounces (“oz”) at an average grade of 1.59 grams per tonne gold (“g/t Au”) (from 422,000 oz at an average grade of 1.52 g/t Au)

- Pit-constrained Inferred Resources increased slightly compared to the RPA 2019 MRE1 to 2,065,000 oz at an average grade of 0.94 g/t Au (from 2,045,000 oz at an average grade of 0.97 g/t Au)

- Underground Inferred Resources increased 50% compared to the RPA 2019 MRE1 to 460,000 oz at an average grade of 1.68 g/t Au (from 307,000 oz at an average grade of 1.75 g/t Au)

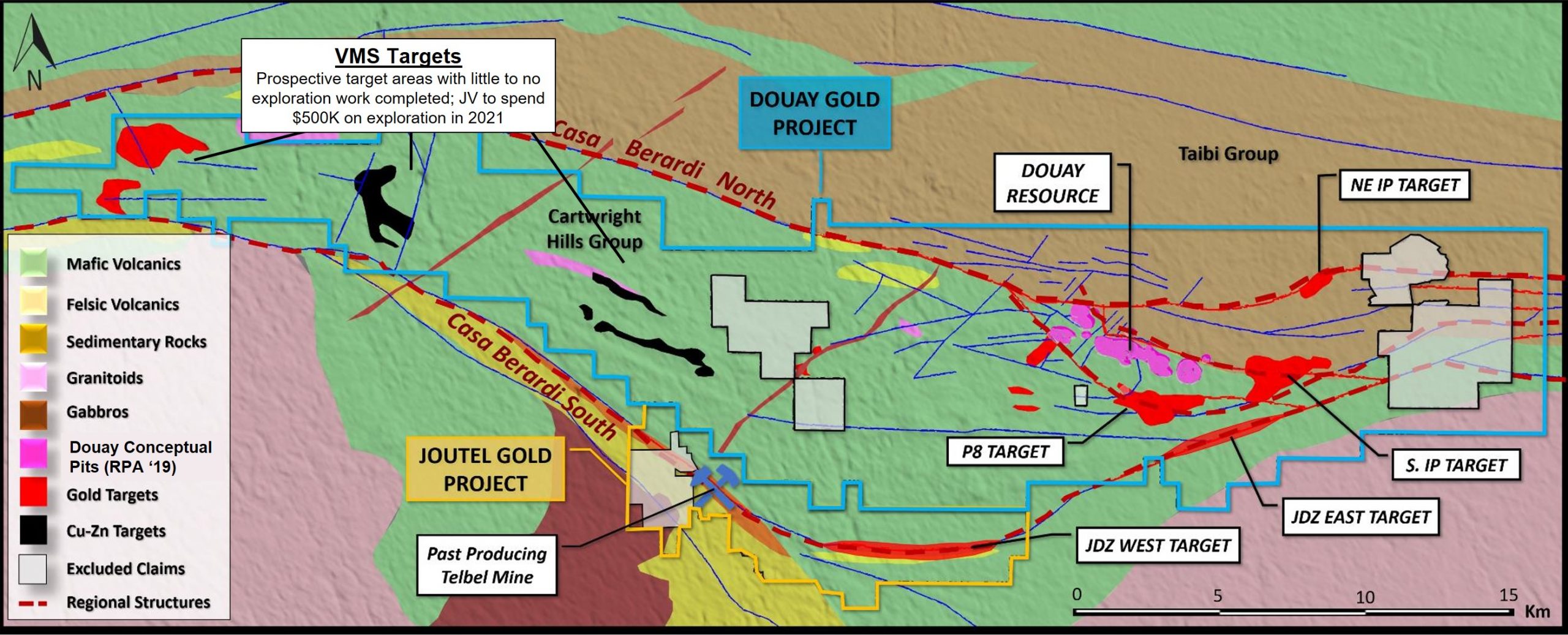

- Initial Indicated Resources in the Nika Zone(30,000 oz at an average grade of 1.13 g/t Au) and the 531 Zone (58,000 oz at an average grade of 2.85 g/t Au), resulting from significant intercepts[2] from the JV’s first drill campaign (see Figure 1 for zone locations)

- Mineralized zones at Douay remain open for expansion and are largely untested below an average vertical drill depth of approximately 350 metres (“m”) (see Figure 2)

- Ongoing drilling at Douay is primarily focused on exploration targets in areas with lateral and depth expansion potential that are not part of the 2022 MRE

.

.

Discovery Costs

Since the RPA 2019 MRE, the Company and the JV have incurred an aggregate of approximately US$6.1 million in direct exploration expenditures. This equates to a discovery cost of approximately US$23/oz Au for the incremental resources defined in the 2022 MRE.

.

Maple Gold management comments

“We completed two modest drill programs in 2020 amid a global pandemic and followed that up with a roughly 10,000-m maiden JV drill campaign in 2021 that, in line with our expectations, successfully converted Inferred to Indicated ounces and ultimately increased the overall gold endowment at Douay,

“Targeted infill drilling demonstrates the potential for future resource conversion within the currently defined mineralized zones and continues to de-risk the deposit; however, the updated model that underpins the 2022 MRE indicates significant room for growth.

“Looking ahead, the Company is targeting larger step-out and deeper drilling along the full extent of the Douay resource area.”

Matthew Hornor, President and CEO of Maple Gold.

.

The 2022 MRE is based on a total Douay drill database of 674 holes (241,626 m) within the resource area, of which 38 holes (15,647 m) were completed by the Company and the JV between 2019-2021. Approximately 6,200 m of drilling has been completed by the JV since the 2022 MRE and roughly 10,000 m has been approved and permitted for future drilling, with additional step-out and deeper holes planned. For further clarity, Fall 2021 and Winter 2022 drilling results at Douay are not included in the 2022 MRE.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

.City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

.