Los Cerros Limited (ASX: LCL)

Provided an update on recent infill drilling at Tesorito, an at-surface porphyry discovery that forms part of the 100% owned Quinchia Gold Project, in Risaralda – Colombia.

Quinchia is a cluster of porphyry and epithermal gold targets within a 3km radius, underpinned by established Mineral Resources of 2.6Moz @1g/t Au1

.

| Los Cerros |

ASX: LCL |

| Stage |

Exploration |

| Metals |

Gold, copper |

| Market cap |

A$20 m @ 3.1 c |

| Location |

Risaralda, Colombia |

.

.

Los Cerros report 28m @ 3.34g/t Au in Tesorito Infill Drilling at Tesorito

.

Los Cerros Limited (ASX: LCL) (Los Cerros or the Company) is pleased to provide this update on recent infill drilling at Tesorito, an at-surface porphyry discovery that forms part of the 100% owned Quinchia Gold Project, in Risaralda – Colombia.

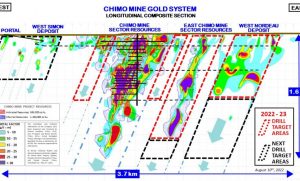

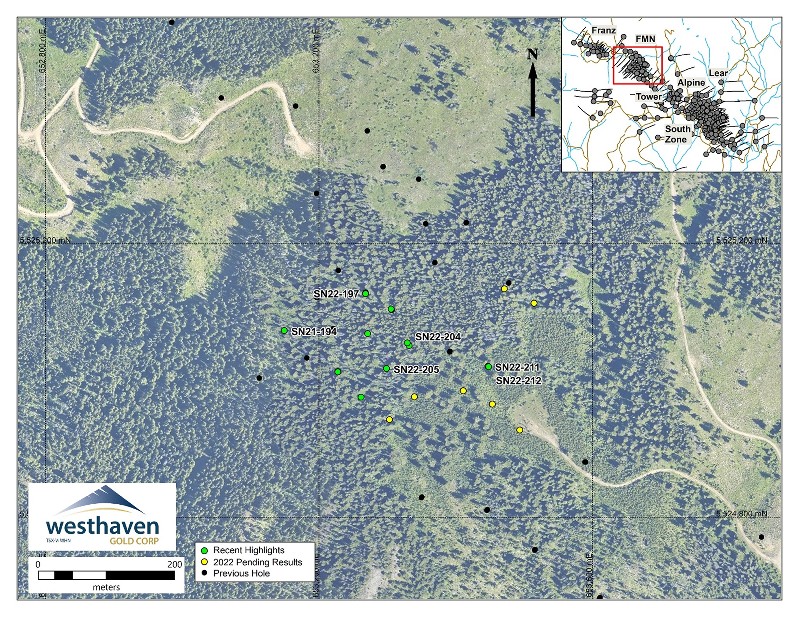

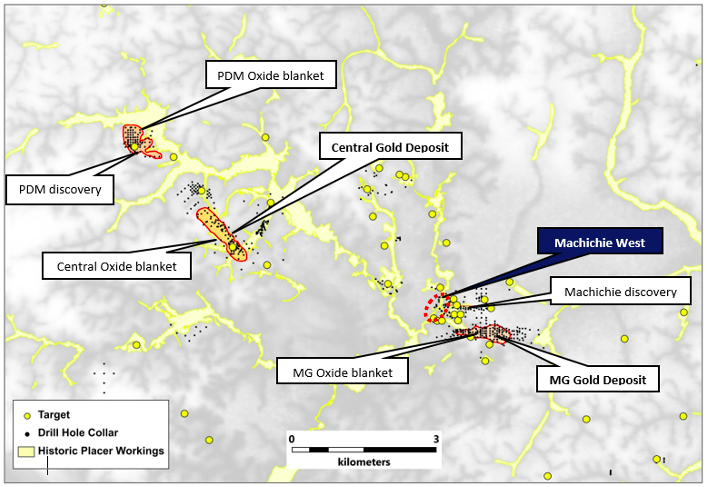

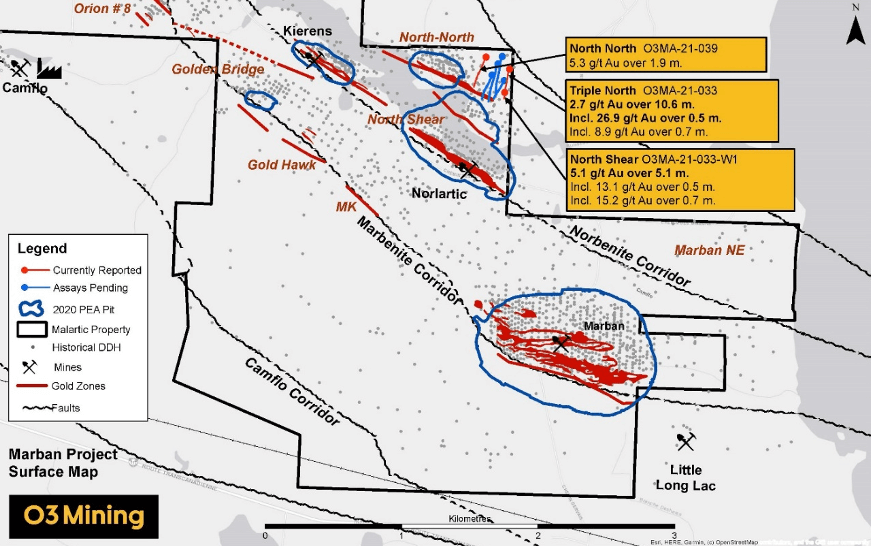

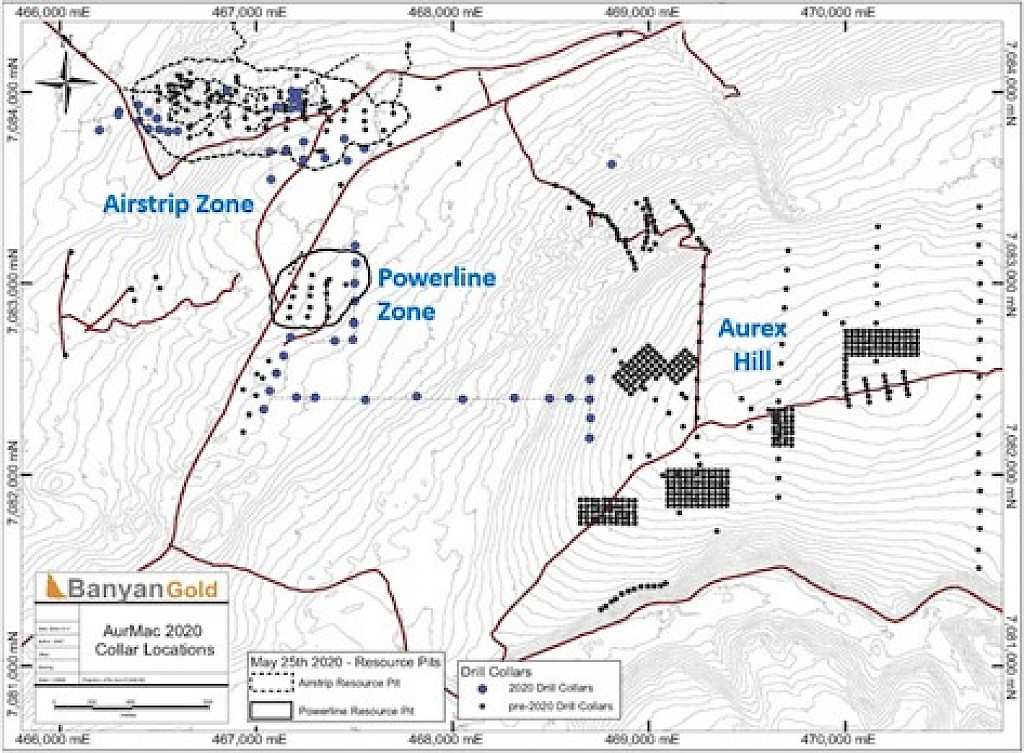

Quinchia is a cluster of porphyry and epithermal gold targets within a 3km radius (Figure 1), underpinned by established Mineral Resources of 2.6Moz @1g/t Au1

.

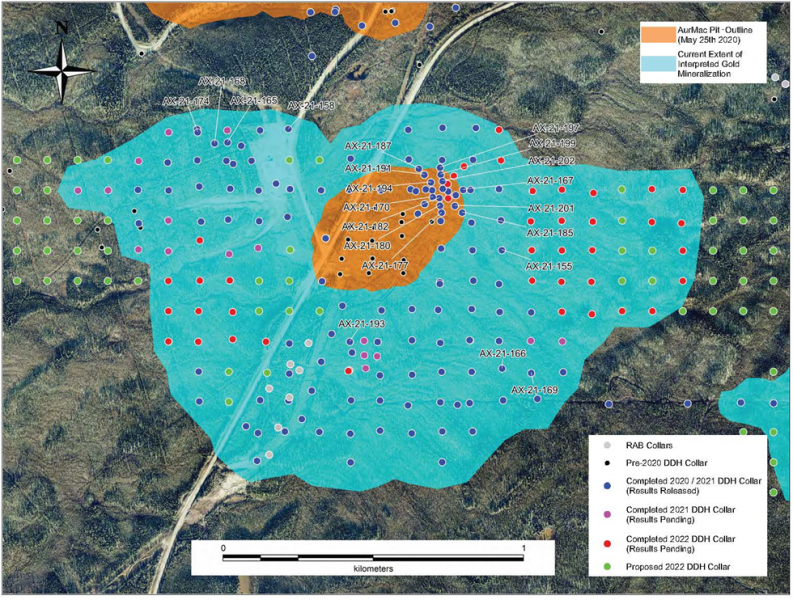

A short Tesorito infill drilling program comprising three drill holes was undertaken to increase drill hole density in the area that defines the high-grade potential starter pit within the 1.3Moz Tesorito Inferred Resource pit shell.

Lithology logs and gold assays for all three infill diamond drill holes were consistent with geology model expectations, again demonstrating wide, high grade gold mineralization starting from or near to surface.

Best results include:

• 255.9m @ 0.86g/t Au from surface including

o 121.2m @ 1.25g/t Au from 96m in TS-DH64

• 296.0m @ 0.82g/t Au from 4m including 98.1m @ 1.65g/t Au including

o 16.1m @ 3.11g/t Au from 189.8m in TS-DH65

• 196m @ 1.28g/t Au from surface including 89.3m @ 2.02g/t Au from 46.7m including

o 28.0m @ 3.34g/t Au from 106m in TS-DH66.

▪ Tesorito infill drilling delivers more high grade gold intercepts including:

▪ 255.9m @ 0.86g/t Au from surface including 121.2m @ 1.25g/t Au from 96m in TS-DH64

▪ 296.0m @ 0.82g/t Au from 4m including 98.1m @ 1.65g/t Au from 189.9m including

o 16.1m @ 3.11g/t Au from 189.9m in TS-DH65

▪ 196m @ 1.28g/t Au from surface including 89.3m @ 2.02g/t Au from 46.7m including

o 28.0m @ 3.34g/t Au from 106m in TS-DH66

▪ Infill program has been designed to better define potential high grade starter pit

▪ Strong cash position of over $13 million at end of June ensures Los Cerros is well funded to continue advancing Miraflores and Tesorito deposits within the Quinchia Gold Project.

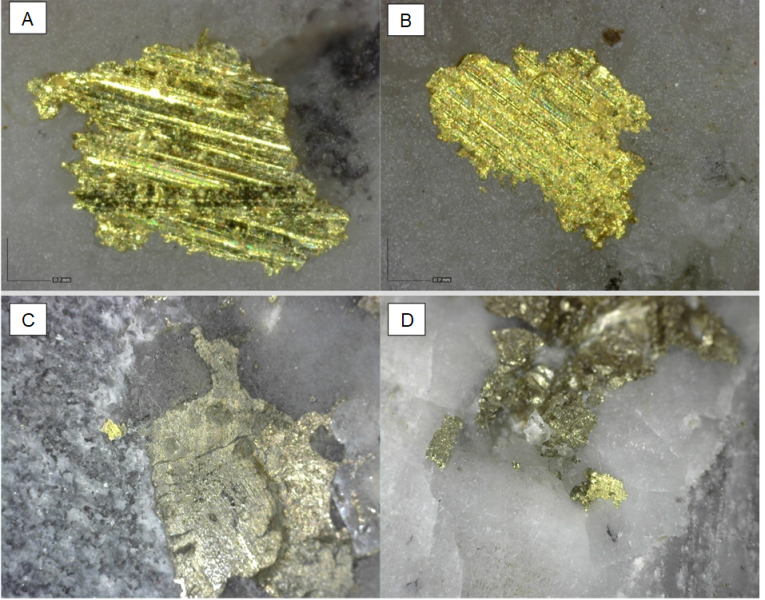

The higher grade material is associated with the porphyry core or breccia that surrounds it. All three drill holes crossed Marmato Fault lithologies and left the porphyry system at predicted depths.

Los Cerros management comments

“With a backdrop of difficult markets and increased risk aversion, the Company is focussed on advancing and de-risking mature prospects within the Quinchia Gold Project.

“Recently announced results of Tesorito metallurgical test work demonstrated Tesorito ore is likely to be amenable to a conventional process flow and to enjoy typical porphyry style recovery performance characteristics, contains a mix of Inferred, Indicated and Measured Resources. Using Tesorito MRE of 1.3Moz @ 0.81 g/t Au.”

Los Cerros Managing Director, Jason Stirbinskis

“The Miraflores Reserve is included in the Miraflores Resource. Refer ASX announcement dated 14 March 2017 (Miraflores Resource) and 27 November 2017

(Miraflores Reserve) and 25 February 2020 (Dosquebradas Resource) and 22 March 2022 (Tesorito Resource).

The Company confirms that it is not aware of any new information or data that materially affects the information included in the market announcements, and that all

material assumptions and technical parameters underpinning the estimates continue to apply.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.Disclosure

The writer holds shares in Los Cerros Resources, bought in the market at the prevailing price on the days of purchase.

.