Banyan Gold Corp. (TSX.V: BYN)

Present the complete set of results from the diamond drill exploration campaign on the Aurex Hill zone at the Company’s rapidly developing AurMac Property, Yukon.

These results demonstrate this zone has the potential to host widespread, consistent and near-surface gold mineralization over meaningful extents.

.

| Banyan Gold |

TSX.V: BYN |

| Stage |

Exploration |

| Metal |

Gold |

| Market cap |

C$68m @ 30c |

| Location |

Yukon, Canada |

.

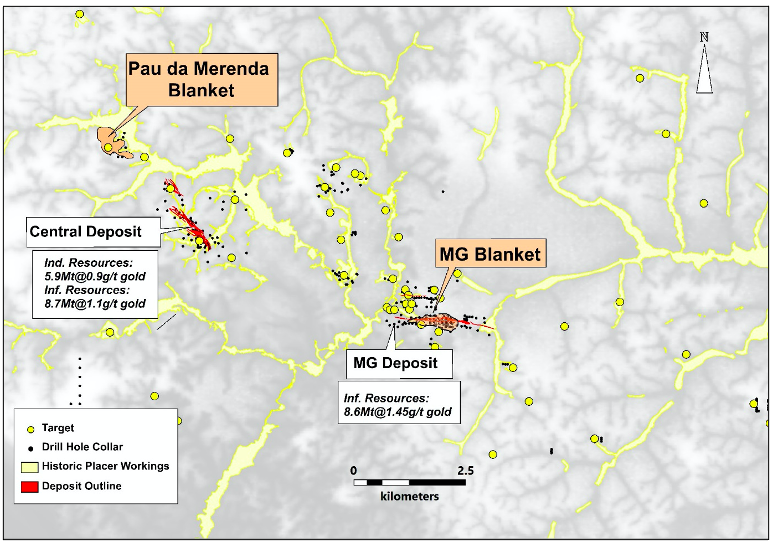

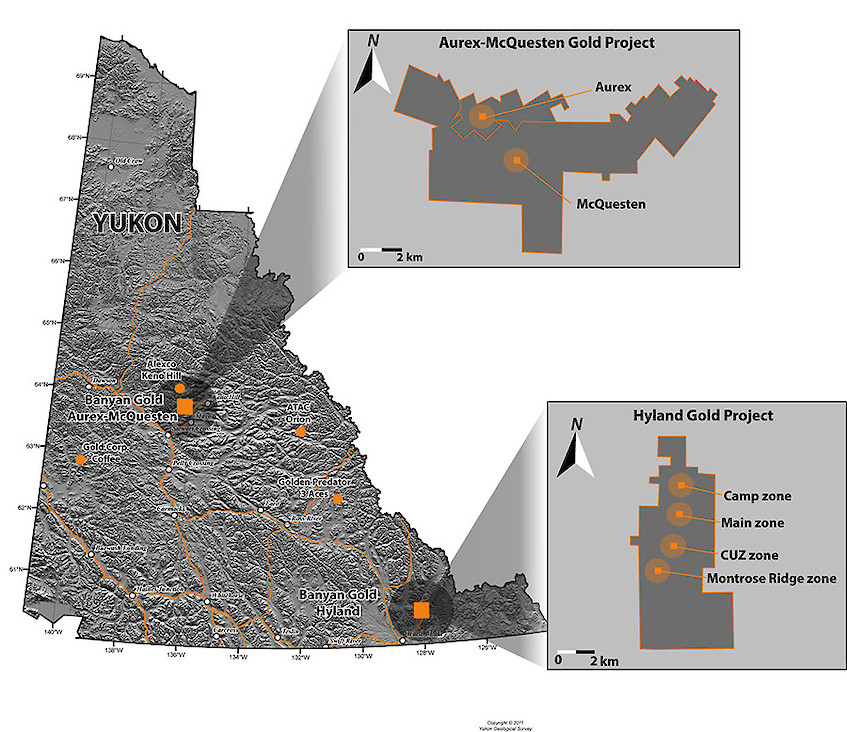

Banyan Gold project map, Yukon Territory, Canada

.

BANYAN GOLD REPORTS AUREX HILL ZONE DIAMOND DRILL RESULTS, AURMAC PROPERTY, YUKON

VANCOUVER, B.C., December 7, 2021 – Banyan Gold Corp. (the “Company” or “Banyan“) (TSX-V: BYN) is pleased to present the complete set of results from the diamond drill exploration campaign on the Aurex Hill zone at the Company’s rapidly developing AurMac Property, Yukon (Table 2 and Figure 1 and 2). These results demonstrate this zone has the potential to host widespread, consistent and near-surface gold mineralization over meaningful extents.

Assay highlights from the 2021 Aurex Hill target include:

- 13.7 metres (“m”) of 0.59 g/t Au from surface in DDH AX-21-116

- 17.8 m of 0.81 g/t Au from 121.9 m in DDH AX-21-116

- 71.6 m of 0.36 g/t Au from 196.6 m in DDH AX-21-117

- 43.9 m of 0.52 g/t Au from 118.0 m in DDH AX-21-118

- 13.8 m of 0.66 g/t Au from 9.1 m in DDH AX-21-119

- 89.2 m of 0.35 g/t Au from 164.6 m in DDH AX-21-120

- 34.4 m of 0.53 g/t Au from 37.2 m in DDH AX-21-121

- 46.0 m of 0.41 g/t Au from 62.8 m in DDH AX-21-123

- 24.2 m of 0.57 g/t Au from 195.1 m in DDH AX-21-125

- 41.2 m of 0.54 g/t Au from 187.4 m in DDH AX-21-127

.

Banyan Gold management comments

“Results from the seventeen holes of the 2021 Aurex Hill campaign, combined with historic intercepts, significantly increases the mineralization footprint of Aurex Hill.

“The zone represents a large untested target area with the potential to define additional near-surface, potentially heap leach developable, gold resources.

“The existing infrastructure, recently augmented by Banyan, has positioned AurMac to be advanced quickly; supporting the four drills currently operating.”

Tara Christie, President and CEO Banyan Gold

.

Results from these 17 holes are consistent with previous exploration drilling campaigns at Aurex Hill, all of which have yielded significant intersections of gold mineralization including 1.11 g/t over 17.9 m from surface in AX-20-57, 0.91 g/t over 20.5 m from surface in AX 20-54 (see Company News Release, February 8, 2021)

.

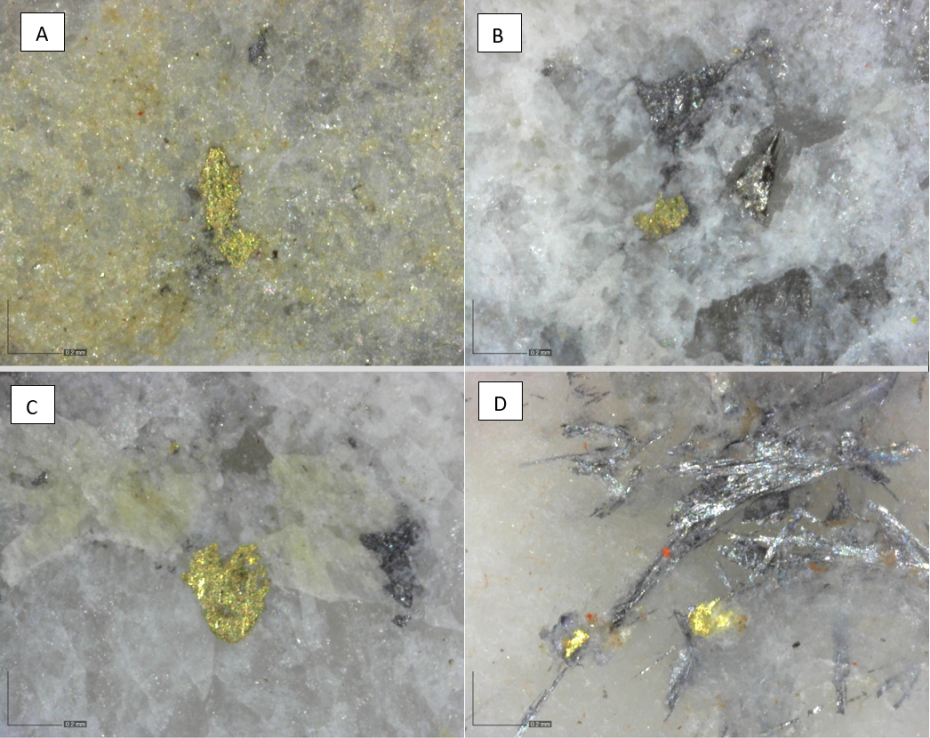

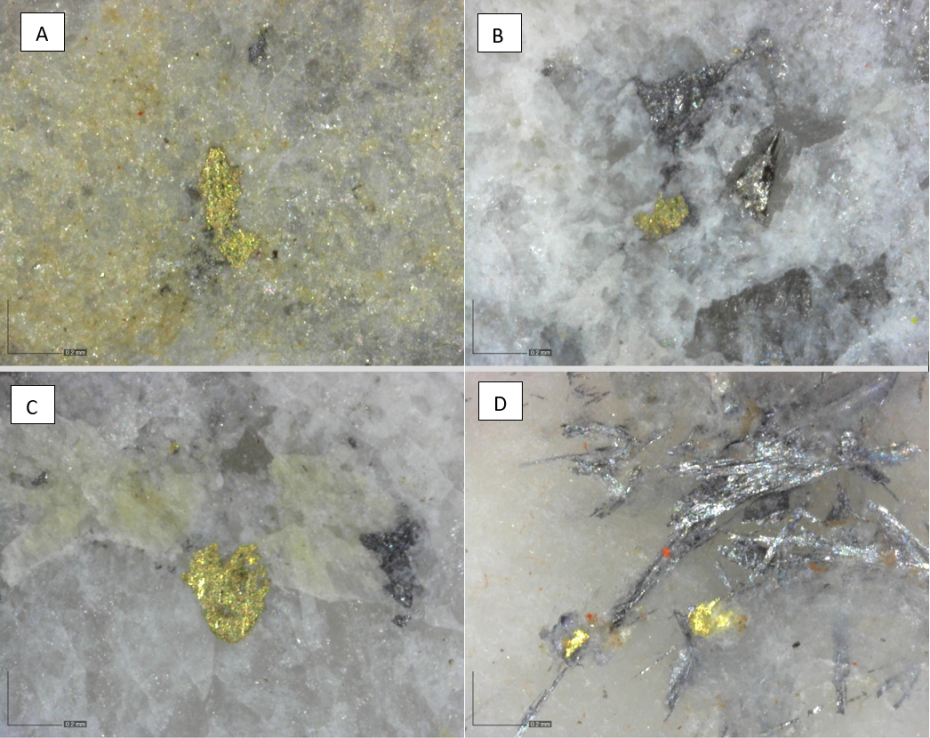

Image 1: Photographs of visible gold from AX-21-116 128.0 m to 129.5 m which assayed 1.64 g/t over 1.5 m images A, B, & C and image D from AX-21-131 155.5 m to 157.0 m which assayed 0.22g/t over 1.6 m.

.

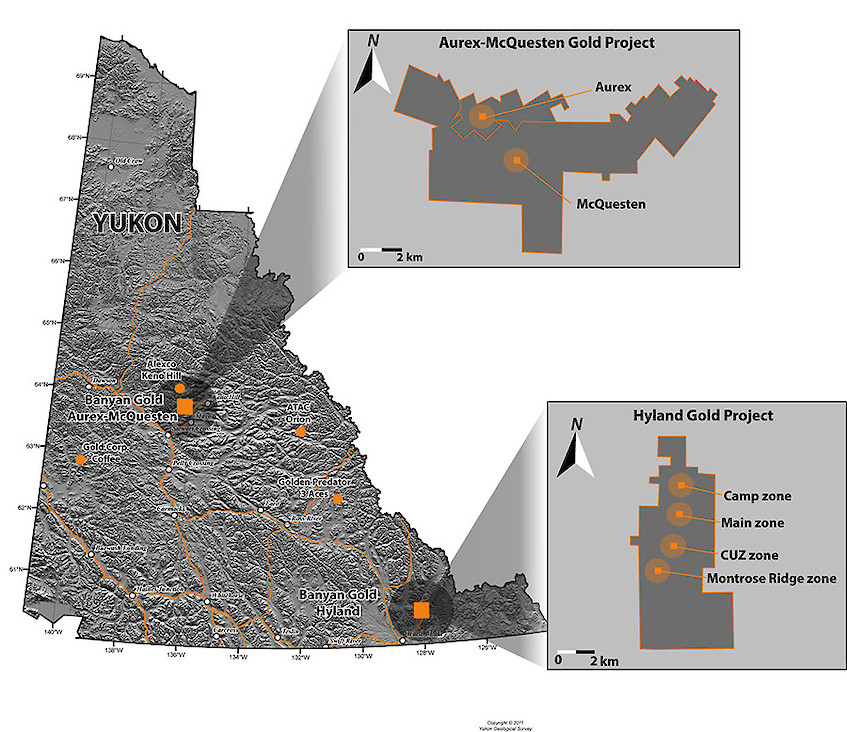

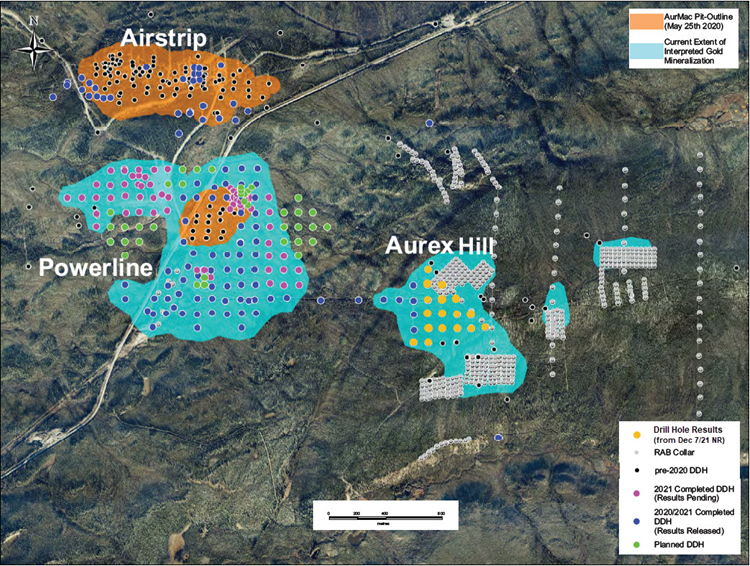

Diamond drilling at the Aurex Hill Zone comprised of seventeen (17) diamond drill holes designed on a nominal 100 m step-out grid focused on definition and expansion from historic rotary air blast (“RAB”) and Banyan diamond drill results from 2017 and 2020 reconnaissance drill programs which highlighted the mineralization connection potential between the Powerline and Aurex Hill zones (See Company News Releases dated January 11, 2021 & February 8, 2021).

The location of the drill grid was selected to make use of existing roads for access and previous drill results before constructing new access into other target areas of Aurex Hill.

.

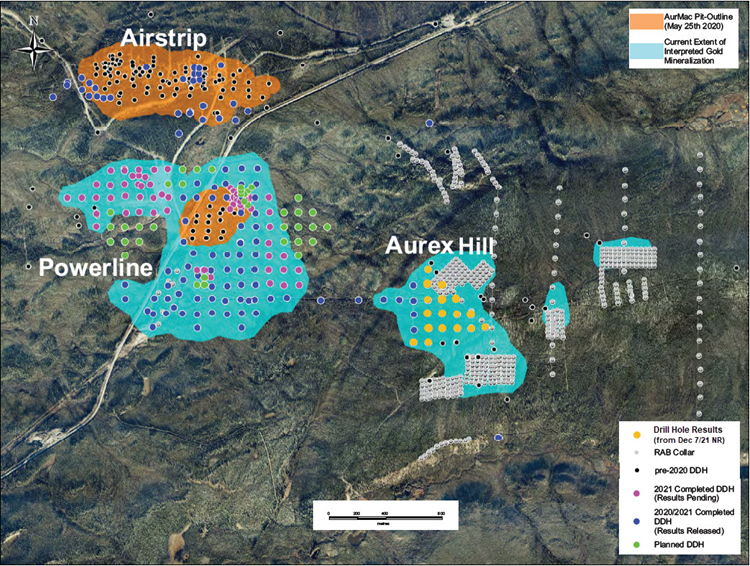

2021 Drill program at Powerline and Aurex Hill, showing historic, completed, and planned diamond drill holes.

.

Detailed maps with drill hole locations and sections, along with additional highlighted results and full database is available on the Banyan’s website

.

Banyan Gold 2021 Drilling Program Update

AurMac drill program has expanded to four (4) drills working onsite and over 30,000 m and over 135 diamond drill holes have been drilled thus far in 2021.

Diamond drilling at AurMac since the Q1 2020 maiden resource announcement is now over 40,000 m to date – which has all targeted resource expansion of the Airstrip Deposit; the Powerline Deposit and the Aurex Hill zone.

About Banyan Gold

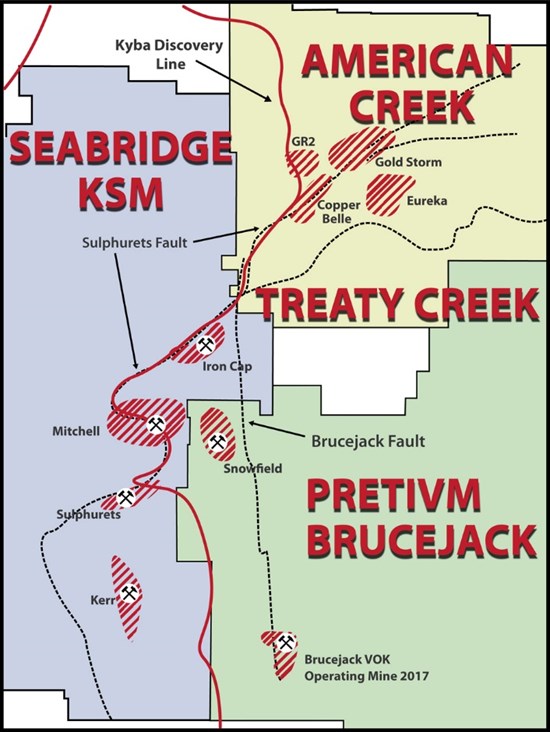

Banyan’s primary asset AurMac is adjacent to Victoria Gold’s Eagle Gold Mine, in Canada’s Yukon Territory, which announced commercial production on July 1, 2020.

The AurMac initial resource of 903,945 oz Au was announced in May 2020.

Major strategic shareholders include Alexco Resource Corp, Franklin Gold and Precious Metals Fund, Osisko Development, and Victoria Gold Corporation.

Banyan is focused on gold exploration projects that have the geological potential, size of land package and proximity to infrastructure that is advantageous for a mineral project to have potential to become a mine. Our Yukon based projects both fit this model and our objective is to gain shareholder value by advancing projects in our pipeline.

The 173 sq km AurMac Property lies 30 km from Victoria Gold’s Eagle Project and adjacent to Alexco’s Keno Hill Silver District and is highly prospective for structurally controlled, intrusion related gold-silver mineralization. The property is located adjacent to the main Yukon highway and just off the main access road to the Victoria Gold open-pit, heap leach Eagle Gold mine. The AurMac Property benefits from a 3-phase powerline, existing Yukon Energy Corp. switching power station and cell phone coverage. Banyan has optioned the properties from Victoria Gold and Alexco respectively with a right to earn up to a 100% subject to royalties.

.

For brevity, this summary has been redacted, to read the full news release, please click HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

Disclosure

At the time of publishing the author holds shares in Banyan Gold, bought in the market at the prevailing price on the day of purchase .