Galiano Gold Reports Q2 2025 Results

Galiano Gold (TSX: GAU)

Reported its second quarter 2025 operating and financial results.

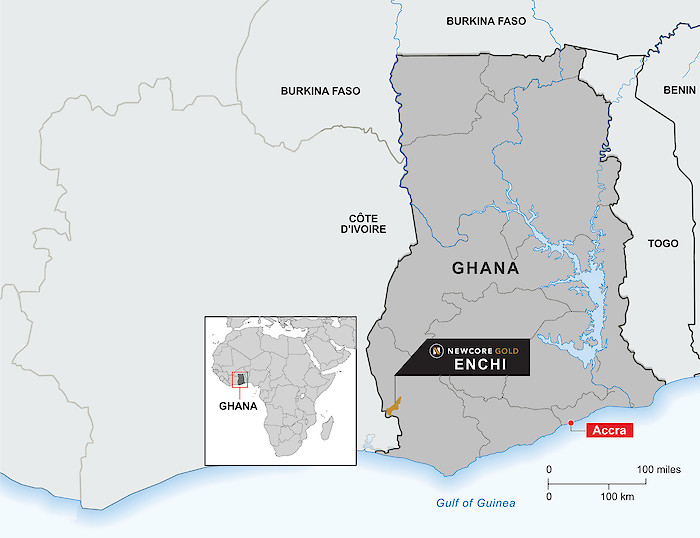

Galiano owns a 90% interest in the Asanko Gold Mine located on the Asankrangwa Gold Belt in the Republic of Ghana, West Africa.

.

Abore Gold Mine – Credits Galiano Gold

.

| Galiano Gold | TSX: GAU | |

| Stage | Production | |

| Metals | Gold | |

| Market cap | C$757 million @ C$2.93 | |

| Location | Ghana | |

| Website | www.galianogold.com |

.

Galiano Gold Reports Second Quarter 2025 Results

VANCOUVER, BC, Aug. 13, 2025 /PRNewswire/ – Galiano Gold Inc. (“Galiano” or the “Company”) (TSX: GAU) (NYSE American: GAU) is pleased to report its second quarter (“Q2”) 2025 operating and financial results. Galiano owns a 90% interest in the Asanko Gold Mine (“AGM”) located on the Asankrangwa Gold Belt in the Republic of Ghana, West Africa.

All financial information contained in this news release is unaudited and reported in United States dollars.

Mining

- Mining activities focused on the Abore and Esaase deposits with 1.4 million tonnes (“Mt”) of ore mined at an average mined grade of 0.8 grams per tonne (“g/t”) gold and a strip ratio of 5.9:1 during Q2 2025.

- Development of Cut 3 at the Nkran deposit continued to ramp up with 1.7 Mt of waste mined during the quarter, a 113% increase compared to Q1 2025.

Processing

- 1.2 Mt of ore was milled at an average feed grade of 0.8 g/t gold, with metallurgical recovery averaging 89% during Q2 2025.

- Secondary crushing circuit was completed on budget and commissioned at the end of July 2025. Processing plant milling capacity is now expected to return to a 5.8 Mt per annum throughput rate.

- Produced 30,350 ounces of gold during the quarter, a 46% increase compared to Q1 2025. 51,084 ounces of gold produced year-to-date.

- Sold 29,287 ounces of gold during the quarter and 56,281 ounces of gold year-to-date at average realized prices of a quarterly record $3,317 per ounce (“/oz”) and $3,084/oz, respectively, excluding the effect of realized losses on gold hedging instruments.

Cost and capital expenditures

- Total cash costs1 of $1,602/oz and all-in sustaining costs1 (“AISC”) of $2,251/oz for the quarter (year-to-date AISC1 of $2,339/oz). AISC1 declined by 10% compared to Q1 2025.

- Sustaining capital expenditures, excluding capitalized stripping costs, of $2.2 million and development capital expenditures (excluding Nkran pre-stripping costs) of $4.9 million during Q2 2025.

- Capitalized development pre-stripping costs at Nkran Cut 3 of $6.9 million during Q2 2025, and $10.1 million year-to-date.

|

1 See section “Non-IFRS Performance Measures” of this news release. |

Financial

- Cash and cash equivalents of $114.7 million at June 30, 2025, and no debt.

- Generated cash flow from operating activities of $35.8 million during Q2 2025.

- Income from mine operations of $37.2 million during Q2 2025.

- Net income of $0.07 per common share and adjusted net income1 of $0.08 per common share during Q2 2025.

- Adjusted EBITDA1 (as defined herein) of $39.9 million during Q2 2025.

Exploration

- A deep step-out drilling program at the Abore deposit, totaling 1,907m across a 1,200m strike length, yielded positive results with mineralization intercepted in all four holes, including 36m at 2.5 g/t gold (refer to news release dated July 14, 2025).

Matt Badylak, Galiano’s President and Chief Executive Officer said,

“We are pleased with the progress made during the period with production, all-in sustaining costs, earnings per share, and cash balances all improving quarter-on-quarter.

“This momentum, in combination with the commissioning of the secondary crusher ahead of schedule in late July, positions us well for a strong second half of the year.

“The results from our Abore deep drilling program confirm the presence of a mineralized system 200 metres below the current Mineral Reserve over a significant 1,200 metre strike length.

“These findings highlight the expansion potential at Abore and provide additional exploration targets to unlock further value beneath our existing reserves.”

.

To read the full news release please click HERE

——-

.

The live Spot gold price can be found HERE

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in Galiano Gold

.