Ascot Delays Mining Resumption Due To Capital Shortfall

Ascot Resources (TSX: AOT)

Provided an update on the progress of the Premier gold project following an initial review conducted by president and chief executive officer Jim Currie and his management team.

.

Comment

Ascot is lurching from one failure to another, and we’re in farce territory now.

From the “ship sinking” news release that delayed the start of production, to a withdrawn financing offer, to an eventual minestart that was halted quickly due to a lack of gold production, to finally this, the halting of the restart due to another lack of money!

Any long term holders still holding must be wringing their hands for staying loyal to a company that has overseen one disaster after another.

I sold at a loss, and am so happy I did, because it would have been a much bigger loss had I held on.

A new CEO has been hired, with significant experience in the industry, so there may be hope yet that Ascot will finally commence commercial production. Once the next financing is done this may well be an investment opportunity, but not before, in my opinion.

.

.

.

| Ascot Resources | TSX : AOT | |

| Stage | Development | |

| Metals | Gold | |

| Market cap | C$136 m @ C$0.14 | |

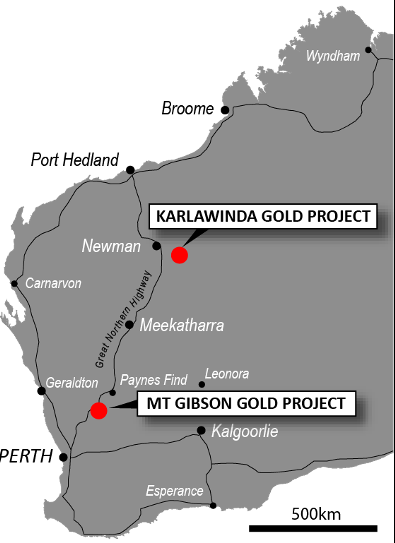

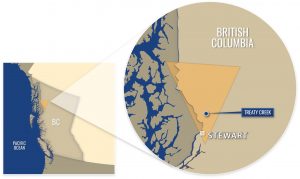

| Location | Golden Triangle, British Columbia | |

| Website | www.ascotgold.com |

.

2025-02-05 14:59 ET – News Release

ASCOT RESOURCES PROVIDES FURTHER UPDATE ON CEO REVIEW

.

Ascot Resources faces delays at Premier

.

Ascot Resources Ltd. (TSX: AOT) has provided an update on the progress of the Premier gold project following an initial review conducted by president and chief executive officer Jim Currie and his management team.

Due to the limited availability of trained labour, underground development has commenced later than expected, with slower advancement than anticipated. As a result, the previously outlined timeline for the restart of mill operations is no longer achievable. The company now projects ore throughput to commence in July, 2025. A revised schedule and budget are currently being finalized to reflect this updated timeline.

.

Mr. Currie commented:

“Following my initial review, the mill and deposit are both expected to perform in line with prior guidance. However, the delay in development will result in a working capital shortfall.

“As such, we are actively engaged in discussions with our major shareholders, debt providers and bankers to address the funding gap. We sincerely appreciate the continued patience and support of our stakeholders as we navigate through this challenging time.”

.

Ascot remains committed to transparent and timely communication with its shareholders, stakeholders and the broader investment community. While the company is in discussions regarding potential financing solutions, there is no certainty that sufficient capital will be raised. The company thanks all stakeholders for their continuing support as the company works toward the successful advancement of the Premier gold Mine.

.

To read the full news release please click HERE

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in Ascot Resources.

.