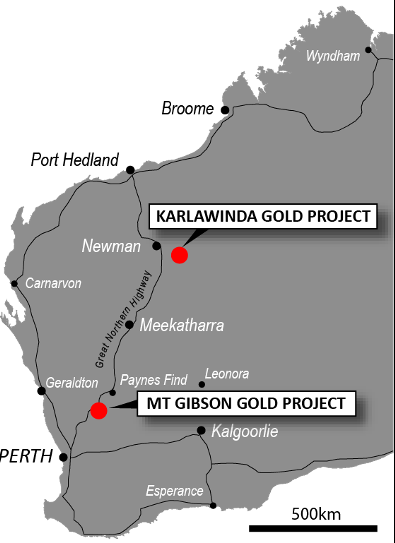

Orla Mining Achieves Record Annual Gold Production

Orla Mining (TSX: OLA; NYSE: ORLA)

Provided an operational update for the fourth quarter and year ended December 31, 2024, as well as preliminary 2025 guidance.

The Company produced 26,531 ounces of gold in Q4, bringing total annual gold production for 2024 to 136,748 ounces. Orla achieved its already improved 2024 production guidance range of 130,000 to 140,000 ounces, representing a 19% beat.

.

Orla Mining heap leach pad, Solution pond, and Merrill-Crowe plant

,

.

| Orla Mining | TSX : OLA | |

| Stage | Development | |

| Metals | Gold | |

| Market cap | C$2.6 billion @ C$8.08 | |

| Location | Mexico + Nevada + Canada + Panama | |

| Website | www.orlamining.com |

Orla Mining Achieves Record Annual Gold Production, Meets Improved 2024 Production Guidance, and Announces Preliminary 2025 Guidance

,

Vancouver, BC – January 16, 2025 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an operational update for the fourth quarter and year ended December 31, 2024, as well as preliminary 2025 guidance.

The Company produced 26,531 ounces of gold in the fourth quarter, bringing total annual gold production for 2024 to 136,748 ounces.

As a result, the Company achieved its improved full-year 2024 production guidance range of 130,000 to 140,000 ounces, representing a 19% beat to the mid-point of its initial production 2024 guidance of 110,000 to 120,000 ounces.

As a result of this increased production the Company anticipates full year 2024 all-in sustaining cost[1] (AISC) to be at the low end of the improved guidance range of $800 to $900 per ounce of gold sold.

Complete financial and operating results for the fourth quarter and full year 2024 are expected to be provided on March 18, 2025.

/

(All amounts expressed in millions of US dollars, as at December 31, 2024 and are unaudited)

Fourth Quarter and Year End 2024 Camino Rojo Oxide Mine Operational Update

Camino Rojo maintained higher mining rates during the fourth quarter as a result of the mine pit redesign to ensure steady production through 2024 and 2025.

The strip ratio was 1.54 for the quarter and 1.12 for the full year. Gold production in the fourth quarter totaled 26,531 ounces, in line with the plan.

An additional 4,100 ounces of gold remained in the refinery inventory as concentrate at year end due to the pour schedule and has been poured and shipped in January. Full year gold production achieved a record 136,748 ounces due to higher than planned tonnes stacked, higher grade processed, and higher recoveries due to finer crusher product size..

Liquidity Position

During the fourth quarter 2024, the Company repaid the entirety of the outstanding balance of $58.4 million under its revolving credit facility, taking the Company to a debt free position. At December 31, 2024, Orla’s cash position was $160.8 million.

2025 Guidance Summary (Preliminary)

This preliminary guidance does not reflect the benefits of the Company’s acquisition of the Musselwhite Mine from Newmont Corporation, announced on November 18, 2024, which is anticipated to close in the first quarter of 2025.

Updated 2025 guidance, including the Musselwhite Mine and corporate G&A will be provided following the transaction’s closing. this news release for additional information.

.

Camino Rojo (Mexico)

In 2025, Camino Rojo expects to mine approximately 20 million tonnes, placing about 7 million tonnes of ore on the heap leach pad, stockpiling just over 1 million tonnes of low-grade ore.

In the first half of 2025, stacking will primarily consist of oxide ore, resulting in higher gold recovery rates.

The stacked ore blend will shift in the second half of 2025 which will see the stacking of more transition ore resulting in slightly lower gold recovery rates.

Total gross operating costs in 2025 are expected to be in line with 2024 but slightly lower gold production in 2025 is expected to result in higher cash costs and AISC per ounce.

Despite this, Camino Rojo’s first quartile costs are expected to continue to deliver strong cash margins. Sustaining capital in 2025 is mostly related to capitalized waste movement and completion of the live ore stockpile dome.

Exploration efforts in Mexico for 2025 are focused on advancing Zone 22 (Camino Rojo Extension) to an indicated mineral resource classification, as well as testing regional drill targets for new discoveries.

The Company plans to spend $16 million to conduct 22,000 metres of drilling in Mexico during the year.

In addition, the Company is advancing an initial underground resource estimate for the Camino Rojo Sulphides, which is expected to be released in the first half of the year.

Following this, additional studies will be undertaken to support a Preliminary Economic Assessment (PEA) for the Camino Rojo Sulphides.

.

.

South Carlin Complex (Nevada)

In 2025, the Company is focused on advancing permitting and project development on the South Railroad Project, part of the larger South Carlin Complex. The Company intends to allocate $12 million toward project development expenses in 2025 at South Carlin Complex.

.

.

Fourth Quarter 2024 Conference Call

Orla will host a conference call on Wednesday March 19, 2025, at 15:00 UK time, to provide a corporate update following the release of its financial and operating results for the fourth quarter 2024:

Dial-In Numbers / Webcast:

USA / International Toll: +1 (646) 307-1952

Canada – Toll-Free: +1 (888) 672-2415

Conference ID: 6451818

Webcast: https://orlamining.com/investors/

,

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Orla Mining.

.