Ora Banda Mining Intersect First Ore at Sand King

Ora Banda Mining (ASX: OBM)

Provided an update on its Sand King Underground mine which forms part of the Davyhurst Gold Project.

Sand King has achieved its first major milestone, intersecting multiple ore lodes in the first crosscut on the 315 Level. The mine remains on track to deliver first stoping ore in the March-25 Quarter.

.

Ora Banda Mining – Sand King Decline

.

.

| Ora Banda | ASX: OBM | |||

| Stage | Production + development | |||

| Metals | Gold | |||

| Market cap | A$1.3 Billion @ 70c | |||

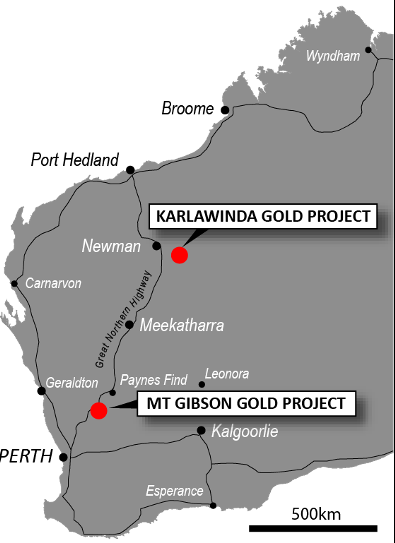

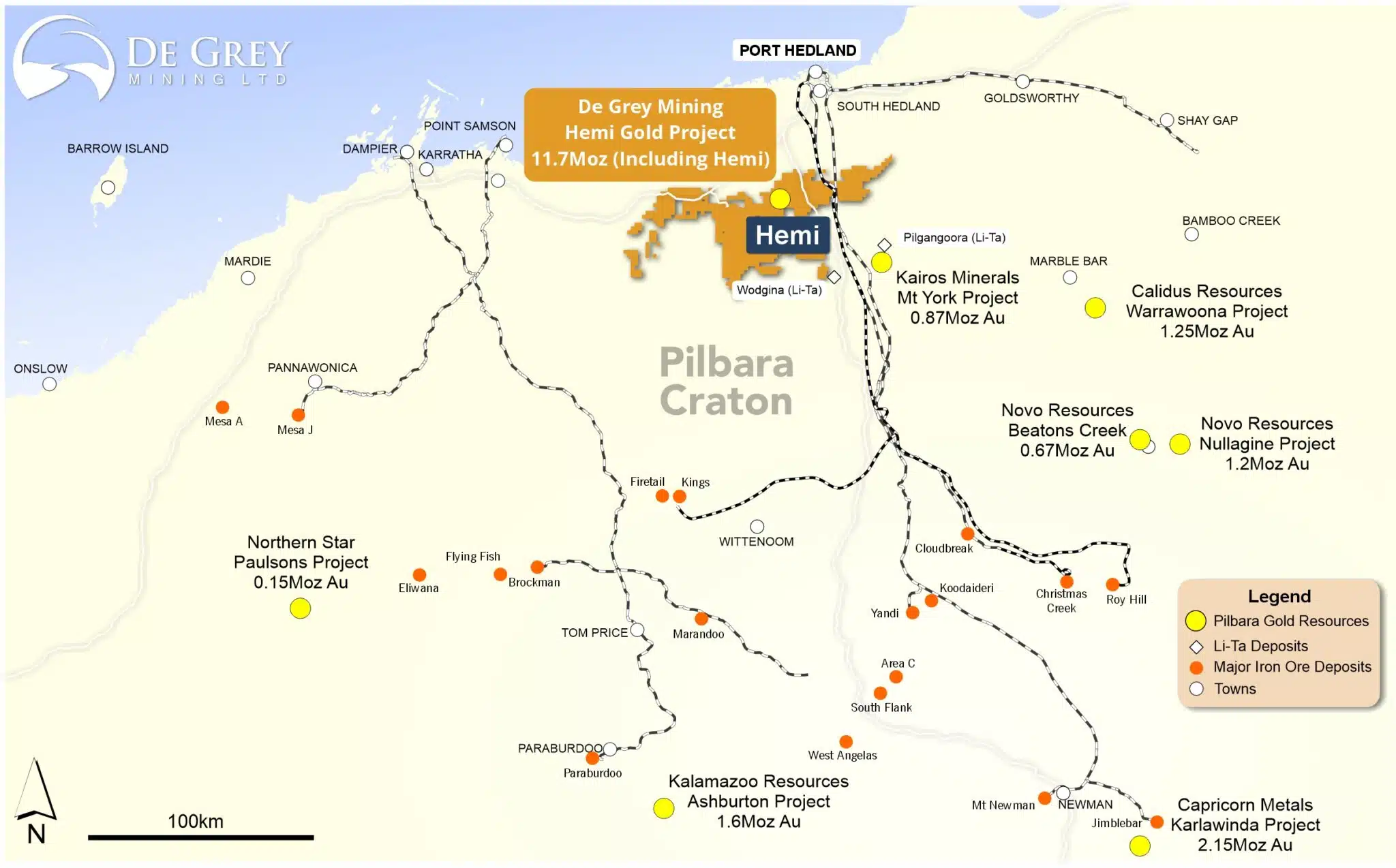

| Location | Western Australia | |||

| Website | www.orabandamining.com.au | |||

…

Ora Banda Announce First Ore Interesected at Sand King

Highlights

• Sand King Underground mine development tracking to plan with first ore intersected just four months after portal establishment

• Initial grade control drilling confirms multiple mineralised lodes per level, including highgrade lodes in addition to bulk tonnage opportunities

• Surface Diamond Drilling extends and enhances 090 lodes in northern Sand King

.

Ora Banda Mining Limited (ASX: OBM) (“Ora Banda”, “Company”) is pleased to provide an update on its Sand King Underground mine which forms part of the Davyhurst Gold Project and together with the Riverina Underground are the centrepiece of the Company’s DRIVE TO 150 Project with an annual production outlook of 140,000oz to 160,000oz in FY26.

Sand King has achieved its first major milestone, intersecting multiple ore lodes in the first crosscut on the 315 Level. This is in line with internal planning and the mine remains on track to deliver first stoping ore in the March-25 Quarter.

Steady state production of ~60kozpa is expected to commence in the June-25 Quarter.

——-

Since the establishment of the Sand King portal in late August this year, mine development has advanced on schedule and in good ground conditions with 427 decline metres and a total of 835 development metres achieved to date.

Underground diamond drilling for grade control is also underway at the mine with the rig completing 5,477 metres to date of the planned 45,400 metre program.

This initial program has confirmed multiple discrete high grade lodes and additional bulk tonnage opportunities at Sand King.

.

Significant grade control results to date include:

o 6.0m @ 9.5 g/t Inc. 3.5m @ 13.7 g/t o 1.3m @ 17.6 g/t Inc. 1.0m @ 21.9 g/t

o 2

——-

The Company also recently conducted a small surface exploration drilling program at Sand King North. This 6-hole program targeted high-grade East-West ore structures and successfully infilled and extended the known lodes along strike.

Intercepts included:

o 8.0m @ 5.4 g/t Inc. 2.7m @ 13.6 g/t o 2.4m @ 11.5 g/t Inc. 0.4m @ 48.0 g/t

o 1.0m @ 31.3 g/t Inc. 0.5m @ 61.0 g/t o 2.2m @ 10.9 g/t Inc. 1.9m @ 11.9 g/t

o 13.6m @ 2.3 g/t Inc. 0.4m @ 13.4 g/t o 8.3m @ 2.9 g/t Inc. 0.5m @ 10.7 g/t

——-

.

.

Ora Banda’s Managing Director, Luke Creagh commented on the progress at Sand King

“Reaching first ore at the Sand King Underground mine is exciting, especially considering that this milestone has been achieved less than 4 months after establishing the portal, and 14 months after the first drill hole targeting underground was completed.

“The grade control and surface drilling has confirmed, enhanced and extended known mineralisation and we consider this to be at the early stages of unlocking the full potential of the Sand King mineralised system.

“As the ounce production from Sand King increases month-on-month, we are set up for a strong second half of the financial year. The combination of Riverina and Sand King high-grade ore delivers a step change to our production profile and cashflows, with a production outlook of 140,000oz to 160,000oz in FY26.”

,

To read the full news release, please click HERE

.

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Ora Banda MIning.

.