Lefroy’s Lucky Strike Gold Deposit advances towards operations

Lefroy Exploration (ASX: LEX)

Reported on exploration activities across the Lefroy Project, including progress on key milestones for the Lucky Strike Gold Deposit and a planned drilling program at the Burns Central Gold Project.

The Lucky Strike Gold Deposit contains an MRE of 1.27Mt @ 1.95 g/t Au for 79,600 ounces (Indicated 0.70Mt @ 1.93 g/t Au for 43,400 oz. Inferred 0.57Mt @ 1.97 g/t Au for 36,200 oz).

.

Lefroy Exploration – Burns RC drilling – Courtesy of Lefroy Exploration

.

| Lefroy Exploration | ASX: LEX | |

| Stage | Exploration | |

| Metal | Gold | |

| Market cap | A$37 m @ 15 cents | |

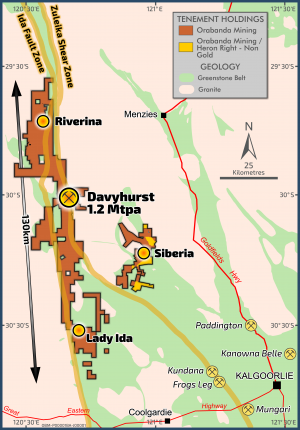

| Location | Kalgoorlie, Western Australia | |

| Website | www.lefroyex.com |

.

Lefroy Exploration’s Lucky Strike Gold Deposit advances towards operations

Advanced drill planning targeting High-Grade Gold at Burns

Lefroy Exploration Limited (“Lefroy” or “the Company”) (ASX: LEX) is pleased to report on exploration activities across the Lefroy Project, including progress on key milestones for the Lucky Strike Gold Deposit and a planned drilling program at the Burns Central Gold Project.

The Lucky Strike Gold Deposit contains an MRE of 1.27Mt @ 1.95 g/t Au for 79,600 ounces (Indicated 0.70Mt @ 1.93 g/t Au for 43,400 oz. Inferred 0.57Mt @ 1.97 g/t Au for 36,200 oz).

.

HIGHLIGHTS

• Major Project Milestones achieved for Lucky Strike Gold Project, including

heritage surveys completed across the entire Mining project area, with all

planned work areas cleared.

• Finalised pit shell optimisation designs for Lucky Strike, with production

schedules and budgets set for finalisation in September

• Clearing permit application assessment over the Lucky Strike mining Lease

M25/366 in the final stages of review, on target for early December quarter

completion.

• Lucky Strike Gold Project on target to commence earthworks and pre-strip

within the first half of the December Quarter.

• Planning underway to progress the recently reviewed Burns Central Deposit

high-grade zone, where significant upside has been identified.

• Burns Central resource extension and metallurgical confirmation drilling

program to commence in October.

• LEX is fully funded, with multiple growth pathways identified as the Company

embarks on an ambitious, self-funded growth strategy throughout FY26.

.

LEFROY CEO, GRAEME GRIBBIN, COMMENTED:

“As we diligently complete our last approvals and permitting prior to gold operations commencing at the Lucky Strike Project in the December quarter, we enter a new phase for the Company, whereby profit from Lucky Strike enables the Company to pursue a self-funded growth strategy.

.

“With heritage clearance now received, environmental approval well advanced and final pit shell designs imminent, the Company remains focused on advancing its strategic goals of unlocking value for shareholders, with Lucky Strike providing the Company with that first pathway.

“We seek to realise further value for shareholders through generating cashflow from Lucky Strike and establishing a strong sustained cash balance, to allow the Company to unlock further value from its portfolio of advanced high-grade shallow gold resources projects (Burns and Mt Martin) and its highly prospective exploration targets”.

.

To read the full news release, please click HERE

——-

.

To View Lefroy Exploration’s historical news, please click here

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Lefroy Exploration

.