Orla Mining Reaches Major Milestone in Nevada with NOI

Orla Mining (TSX: OLA; NYSE: ORLA)

Announced that the U.S. Department of the Interior Bureau of Land Management (has published the Notice of Intent for the South Railroad Project.

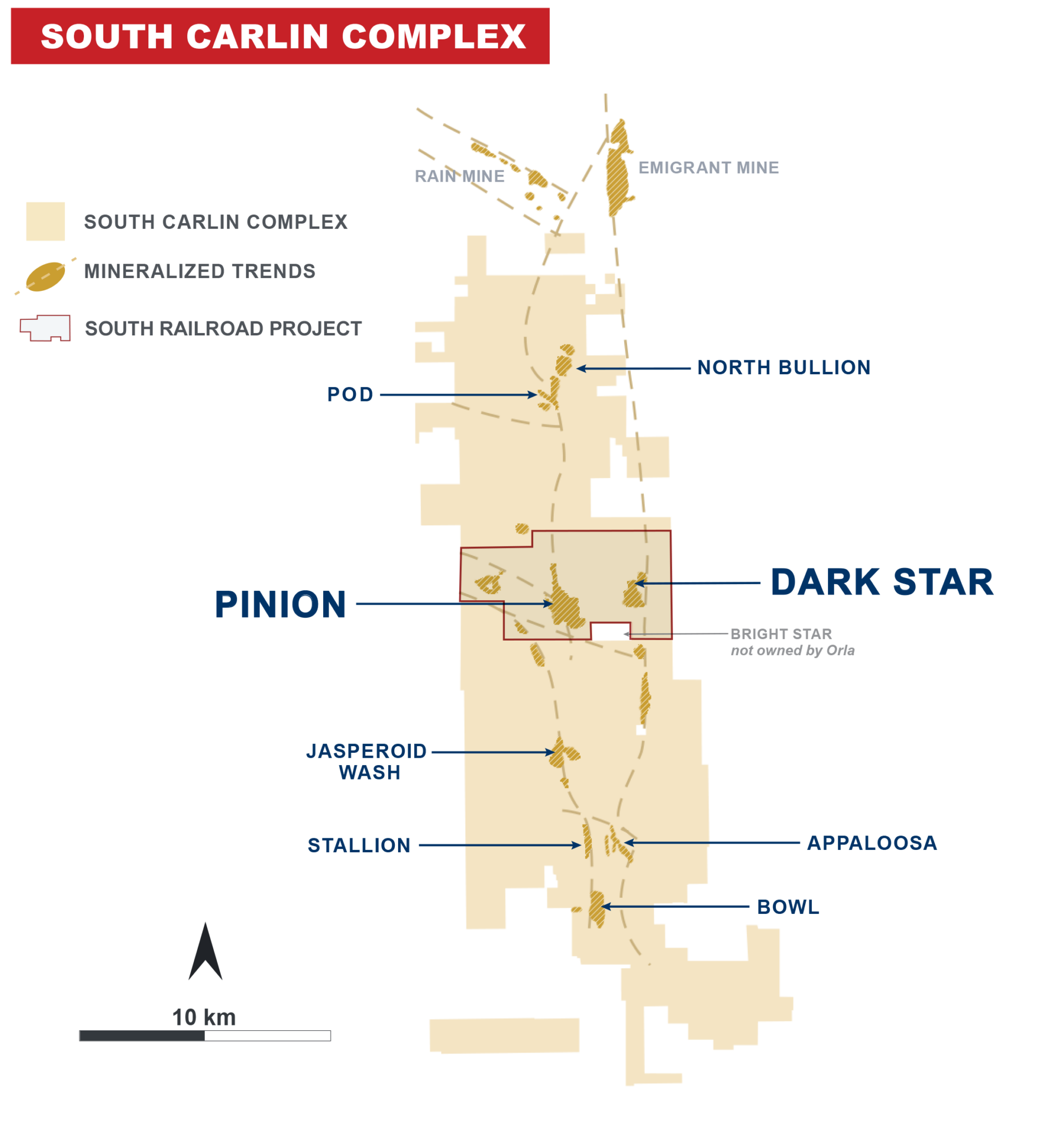

South Railroad is located in Nevada, USA and forms part of the Company’s larger South Carlin Complex land package located on the prolific Carlin Trend.

.

South Carling complex – Courtesy of Orla Mining

.

.

| Orla Mining | TSX : OLA | |

| Stage | Development | |

| Metals | Gold | |

| Market cap | C$4.4 billion @ C$13.35 | |

| Location | Mexico + Nevada + Canada | |

| Website | www.orlamining.com |

.

Company Working with Cooperating Agencies to Fast-Track Timeline to Construction

.

Vancouver, BC – August 13, 2025 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to announce that the U.S. Department of the Interior Bureau of Land Management (“BLM”) has published the Notice of Intent (“NOI”) for the South Railroad Project (“South Railroad” or the “Project”) in the Federal Register.

South Railroad is located in Nevada, USA and forms part of the Company’s larger South Carlin Complex (“South Carlin”) land package located on the prolific Carlin Trend.

The publication of the NOI represents a major milestone in the federal permitting process, as it formally initiates the process to complete the National Environmental Policy Act (“NEPA”) review and preparation of an Environmental Impact Statement by the BLM. Following receipt of all required state and federal permits, anticipated within 12 months, onsite construction can begin. The Company will seek opportunities to accelerate timeline to construction, where possible.

.

–Jason Simpson, President and Chief Executive Officer of Orla

“The publication of the Notice of Intent marks a significant milestone for our South Railroad project, continuing the process towards receipt of final permits.

“South Railroad is the next pillar in Orla’s organic growth strategy toward annual gold production of 500,000 ounces.

“We thank the BLM, the Secretary of the Interior Burgum, and the US Administration for their continued support of American mineral development and production.

“We will work with our cooperating agencies to fast-track the timeline to onsite construction start, and ultimately first gold production.”

.

South Railroad, 100% owned by Orla, is a low-complexity, feasibility-stage heap leach project. Orla plans to provide an update to South Carlin’s mineral resource, mineral reserve estimate, and feasibility study for the Project in the fourth quarter 2025.

The South Carlin Complex is located on a prospective 25,000-hectare land package, on the Carlin Trend, which provides opportunities for resource growth and new discoveries.

The Company has already commenced detailed project engineering and will begin ordering long lead equipment this year to de-risk project development in anticipation of final permits in 2026. The Company has secured sufficient sage grouse credits and has outlined strategies to secure water rights needed for construction, operations, and reclamation.

Additional detail from the Bureau of Land Management available here:

.

To read the full news release, please click HERE

=======

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Orla Mining.

.