Catalyst Metals A$150m placement to institutional investors

Catalyst Metals (ASX: CYL)

Announced it has received firm commitments for an institutional placement to raise A$150 million at an issue price of $6.00 per share.

The Placement was strongly supported by existing institutional shareholders and new high quality Australian and international institutional investors.

.

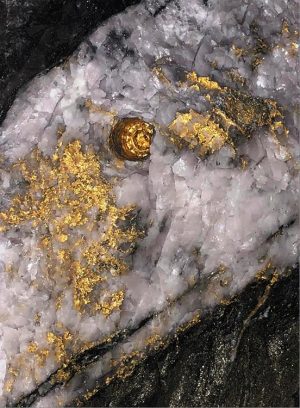

Catalyst Metals Mining, courtesy of Catalyst Metals

.

.

| Catalyst Metals | ASX : CYL | |

| Stage | Exploration / development | |

| Metals | Copper / Gold | |

| Market cap | A$1.44 Billion @ A6.35 | |

| Location | Murchison, Western Australia | |

| Website | www.catalystmetals.com.au |

.

Comment

This placing disappoints me to be honest.

The excuse ” we wanted to bring in some institutional investors” (at a 9.6% discount!) wears thin, why should they be brought in at the expense of loyal exisitng shareholders?

Why not ask them to pay the full market price if they want to come in so badly? Where were they when the company was growing and supported by existing shareholders?

Existing shareholders took the risks, and now the company has a stable path, they bring in institutions at a 9.6% discount!

It wouldn’t have been so bad had they offered existing shareholders the same discount, but we don’t get the chance, and have to suffer the loss of shareholder value as the price has dropped, and dilution to our holdings, which effects future earings per share.

This is an all too familiar tactic in the mining sector, sadly.

Catalyst completes A$150m placement to institutional investors

.

Catalyst Metals Limited (Catalyst or the Company) (ASX:CYL) is pleased to announce it has received firm commitments for an institutional placement (Placement) to raise A$150 million at an issue price of $6.00 per share.

The Placement was strongly supported by existing institutional shareholders and new high quality Australian and international institutional investors.

Funding underwrites Catalyst’s organic growth strategy and strengthens balance sheet

• Catalyst has successfully raised $150m via a placement to leading domestic and offshore institutional investors

• The proceeds, together with existing cash reserves allow Catalyst to execute its growth plans, and pursue growth initiatives without placing pressure on its balance sheet.

Catalyst’s MD and CEO, James Champion de Crespigny, commented:

“Over the past two years, Catalyst has steadily worked toward de-risking and simplifying its business.

.

“We felt the timing was right to bring further institutional support to our register.

.

“With almost $250m in cash, Catalyst is well funded to grow production at Plutonic, continue to explore the belt and pursue other growth initiatives.”

/

Placement Details

The Company has received firm commitments from sophisticated and professional investors under the Placement to raise $150.0 million (before costs) through the issue of 25 million shares at an issue price of $6.00 per new share.

The issue price of $6.00 per new share represents a 9.6% discount to Catalyst’s last traded price of $6.64 on 20 May 2025, and a 7.2% discount to Catalyst’s 10-day VWAP of $6.46.

.

——-

To read the full news release please click HERE

.

=======

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Catalyst Metals.

.