Mining Review 27th April 2025

Mining Review 27th April 2025

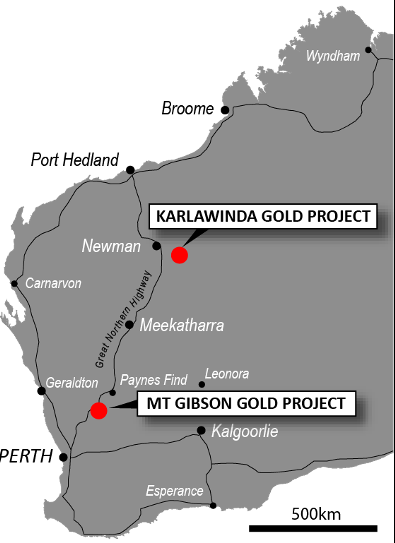

Capricorn Metals dominated the news this week, first by announing the CEO has stood down whilst he contests a case of assault, and then the company announced a new land acquisition near Mt. Gibson.

Gold trod water, as did most metals as Trump started to backtrack on his tariffs.

.

Bullabing Gold Project – Courtesy of Minerals 360

City Investors Circle Mining Review 27th April 2025

.

Mining Review 27th April 2025

Capricorn Metals dominated the news this week, first by announing the CEO has stood down whilst he contests a case of assault, and then the company announced a new land acquisition near Mt. Gibson.

The stock was punished severely for the CEO assault announcement, despite him saying he is going to contest the case. This was a great shame as the sock had built up wuite a bot of momentum, and this surprise announcement has stopped the rise for now.

We iniated coverage of Minerals 260 in our tier 2 watchlist.

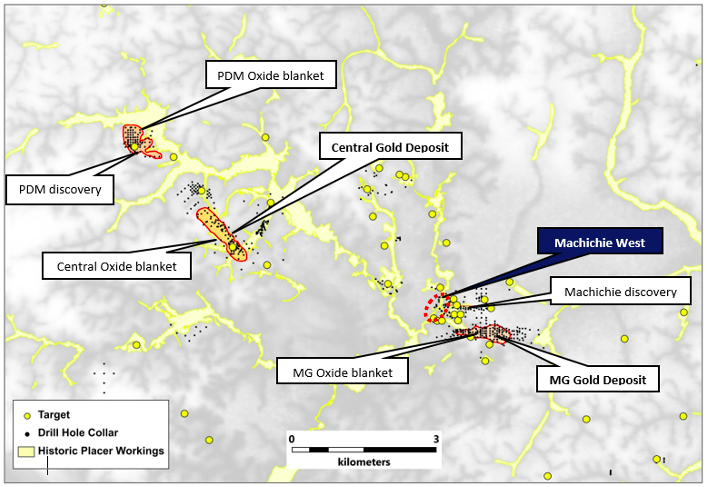

BPM Minerals published a disappointing drill result near Capricorn’s Mt. Gibson project, and is now searching for new targets in the area.

——-

Archives

Capricorn Metals Acquired the Ninghan Gold Project to Extend Mt. Gibson

Equinox Gold Capitulates and Offers Calibre Shareholders a Premium

Capricorn Metals CEO Stands Down During Assault Investigation

Impact Minerals – Continuation of Suspension from Quotation

Initiating Coverage – Minerals 260

Other news items from companies on all our watchlists are below

Stifel Nicholas sets a target of C$19 for Orla Mining

——-

.

Market Data

Weekly Price Changes

(US$ unless stated).

| Metal Prices | Price | Weekly % change |

| Gold price in UK £ | 2498 | -0.48% |

| Gold in AUD$ | 5216 | -0.08% |

| Gold | 3320 | -0.36% |

| Silver | 33.13 | 1.04% |

| Palladium | 925 | -4.34% |

| Platinum | 940 | -3.39% |

| Rhodium | 4625 | 0.00% |

| Copper | 4.89 | 2.09% |

| Nickel | 6.55 | -6.70% |

| Zinc | 1.26 | -1.56% |

| Tin | 16.29 | 0.00% |

| Cobalt | 15.76 | -1.75% |

| Lithium | 9258 | -2.10% |

| Uranium | 66.06 | 1.47% |

| Iron Ore | 100.2 | 0.70% |

| Coking Coal | 185 | 1.65% |

| Thermal coal | 94 | -4.08% |

#

.

.=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non-deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Declaration

At the time of writing the author may hold positions in any of the stocks mentioned.

.