GoldMining Inc. Options Almaden to NevGold

GoldMining Inc. (TSX: GOLD; NYSE: GLDG)

Announced that it has entered into an option agreement with NevGold Corp. and its subsidiary (TSXV:NAU) whereby NevGold’s subsidiary may acquire a 100% interest in the Company’s Almaden Project, located in Idaho, U.S.A.

The Agreement provides for total cash and/or share consideration to the Company from NevGold of up to C$16.5 million. [..]

.

| GoldMining Inc. | TSX : GOLD |

| Stage | Exploration |

| Metals | Gold |

| Market cap | C$220 m @ C$1.43 |

| Location | USA and various Latin American countries |

.

Almaden Gold Project – GoldMining Inc

/

GoldMining Options The Almaden Property to NevGold for Total Consideration of $16.5 Million and Makes Strategic Investment in NevGold

.

This news release constitutes a “designated news release” for the purposes of the Company’s prospectus supplement dated December 10, 2021 to its short form base shelf prospectus dated October 27, 2021.

.

Vancouver, British Columbia – June 14, 2022 – GoldMining Inc. (the “Company” or “GoldMining”) (TSX: GOLD; NYSE American: GLDG) is pleased to announce that it has entered into an option agreement (the ” Option Agreement”) with NevGold Corp. and its subsidiary (“NevGold“; TSXV:NAU) whereby NevGold’s subsidiary may acquire a 100% interest in the Company’s Almaden Project, located in Idaho, U.S.A.

The Agreement provides for total cash and/or share consideration to the Company from NevGold of up to C$16.5 million, which is comprised of initial consideration of C$3 million, additional payments of C$6.0 million to exercise the Option and further contingent payments of up to C$7.5 million tied to success-based project milestones.

.

Key Option Agreement Highlights

- On closing, NevGold will issue 4,444,444 common shares of NevGold (the “NevGold Shares“) to GoldMining representing C$3 million of value at a price equal to C$0.675 per share, representing approximately 10.6% of the outstanding NevGold Shares as of the date hereof;

- GoldMining will subscribe for an additional $1 million of NevGold Shares at $0.675/share for 1,481,481 common shares on closing of the Option Agreement, and commits to a further lead order in a future financing by NevGold completed by November 30, 2022 in an amount to the lesser of C$1.25 million and 40% of the total gross proceeds raised by NevGold in the Financing;

- In order to exercise the option, NevGold must make the following additional payments to GoldMining’s subsidiary in cash and/or NevGold Shares (based on a 30 day VWAP):

- January 1, 2023: C$1.5 million

- July 1, 2023: C$1.5 million

- January 1, 2024: C$3.0 million

- To exercise the Option, NevGold must also make qualifying expenditures on the Project totalling C$2.25 million:

- $1.5 million on or before June 1, 2023

- $0.75 million on or before December 31, 2023

- Upon satisfying the total C$9.0 million in cash and/or share payments and completing C$2.25 million in qualifying expenditures by January 1, 2024, NevGold would own 100% of the Project

- Additionally, NevGold is required to make success-based contingent payments totalling up to C$7.5 million to GoldMining, payable in cash or shares at the election of NevGold:

- C$0.5 million on completion of a positive Preliminary Economic Assessment

- C$2.5 million on completion of a positive Preliminary Feasibility Study

- C$4.5 million on completion of a positive Feasibility Study

.

GoldMining Inc. management comments

“In March 2020 with gold near $1,620/oz, we acquired the Almaden project for C$1.15 million, and currently Almaden represents only 3% of our current overall resource base.

“Today’s transaction with NevGold for total consideration of C$16.5 million, represents a significant return for our shareholders and demonstrates the substantial value embedded in our large resource portfolio which was acquired for the most part when gold was less than $1,350/oz and copper near $2/lb.

“The structure of this deal with NevGold presents a ‘win-win’, providing us with exposure to the future success and upside potential of the Almaden Project and providing NevGold with a new strategic investment.

“Furthermore, through our strategic investment and NevGold Share consideration, we have additional exposure to work conducted by NevGold to advance its portfolio of assets in the region, including its active exploration drilling at Limousine Butte in Nevada.”

Alastair Still, CEO of GoldMining Inc.

.

The Option Agreement

Pursuant to the Option Agreement, on closing of the transaction, GoldMining will grant a subsidiary of NevGold an option to acquire a 100% interest in the project for initial consideration for such grant of C$3.0 million, which will be satisfied through the issuance of 4,444,444 NevGold Shares.

Pursuant to the option, in order to acquire the project, NevGold must: (i) make additional payments of C$6 million to the Company, payable in cash and/or NevGold Shares, at the election of NevGold; and (ii) complete qualifying expenditures of C$2.25 million at the project during an exercise period ending January 1, 2024.

The Option Agreement provides for additional contingent payments of up to C$7.5 million by NevGold, payable in cash and/or NevGold Shares, at the election of NevGold.

In the event that any of the foregoing payments are satisfied through the issuance of additional NevGold Shares, the number of such shares will be based upon the volume-weighted average price of the NevGold Shares for the applicable 30-trading day period.

.

Strategic Investment

In addition, concurrently with the closing of the option grant, GoldMining will make a strategic investment in NevGold by subscribing for 1,481,481 NevGold Shares at a price of C$0.675 per NevGold Share for total subscription proceeds of C$1 million.

Under the Option Agreement, GoldMining has agreed to purchase additional NevGold equity in an amount to the lesser of C$1.25 million and 40% of the total gross proceeds raised by NevGold in the event NevGold completes a qualifying financing prior to November 30, 2022.

In connection with the transaction, on closing, the parties will enter into an investor rights agreement on customary terms, which provides for, among other things, the grant of certain anti-dilution rights by NevGold to GoldMining and the right to nominate one board member of NevGold, provided the Company maintains an equity interest in NevGold above 4.9%.

Closing of the Option Agreement is expected to occur in June 2022 and is subject to customary regulatory approvals. Upon closing, GoldMining is expected to own approximately 10.6% of the outstanding NevGold Shares based on the number of NevGold Shares issued and outstanding as of the date hereof.

.

To read the full news release, please click HERE

.

About GoldMining Inc.

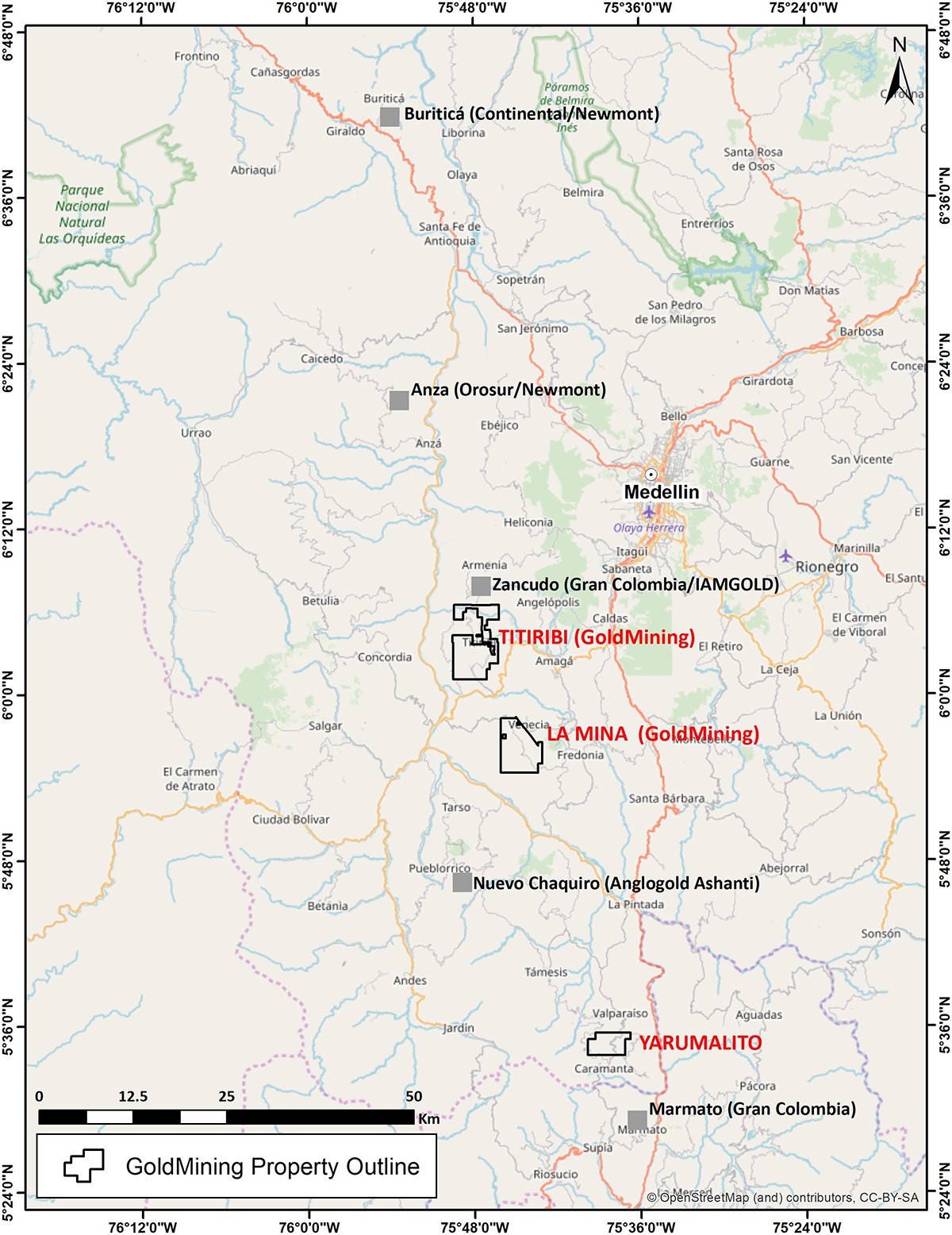

GoldMining Inc. is a public mineral exploration company focused on the acquisition and development of gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, U.S.A., Brazil, Colombia, and Peru. The Company also owns more than 20 million shares of Gold Royalty Corp. (NYSE American: GROY).

.

=======

.If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

.