West Red Lake Gold Intersects 25.12 g/t Au over 5.5m

West Red Lake Gold Mines (TSXV: WRLG)

Reported drill results from its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

Hole MM24D-12-4640-012 Intersected 5.5m @ 25.12 g/t Au, from 24.0m to 29.5m, Including 1.0m @ 134.90 g/t Au, from 25.0m to 26.0m.

.

.

| West Red Lake Gold Mines | TSX.V : WRLG |

| Stage | Exploration / Development |

| Metals | Gold |

| Market cap | C$145 m @ 68 cents |

| Location | Ontario, Canada |

West Red Lake Gold Intersects 25.12 g/t Au over 5.5m, 39.46 g/t Au over 2m and 18.60 g/t Au over 4m at South Austin Zone – Madsen Mine

.

VANCOUVER, British Columbia, March 04, 2024 (GLOBE NEWSWIRE) — West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) is pleased to report drill results from its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

The drill results featured in this news release were focused on the high-grade South Austin Zone, which currently contains an Indicated mineral resource of 474,600 ounces (“oz”) grading 8.7 grams per tonne (“g/t”) gold (“Au”), with an additional Inferred resource of 31,800 oz grading 8.7 g/t Au.

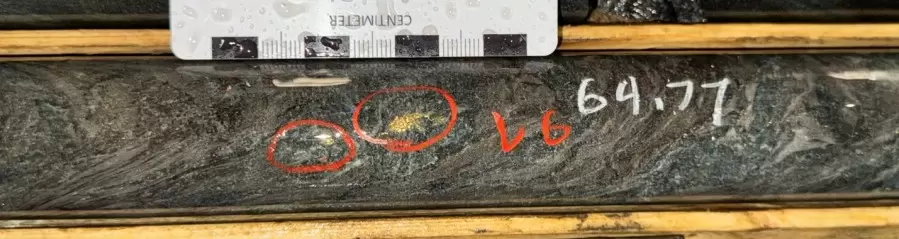

The purpose of this drilling was definition within South Austin to continue building an inventory of high-confidence ounces for eventual restart of the Madsen mill. Notably, visible gold (“VG”) was observed in holes MM24D-12-4640-008 and -012 (Figure 1). Based on these observations, additional holes were added to the drill station to further define these high-grade zones up and down plunge.

,

HIGHLIGHTS:

- Hole MM24D-12-4640-012 Intersected 5.5m @ 25.12 g/t Au, from 24.0m to 29.5m, Including 1.0m @ 134.90 g/t Au, from 25.0m to 26.0m.

- Hole MM24D-12-4640-008 Intersected 3.0m @ 12.58 g/t Au, from 45.0m to 48.0m, Including 1m @ 37.40 g/t Au, from 45.0m to 46.0m; And 2.0m @ 39.46 g/t Au, from 64.0m to 66.0m, Including 1.0m @ 76.18 g/t Au, from 64.0m to 65.0m.

- Hole MM24D-12-4640-018 Intersected 4.0m @ 18.60 g/t Au, from 41.0m to 45.0m, Including 1.0m @ 55.69 g/t Au, from 43.0m to 44.0m.

- Hole MM24D-12-4640-003 Intersected 11.0m @ 6.75 g/t Au, from 47.0m to 58.0m, Including 1.0m @ 17.01 g/t Au, from 47.0m to 48.0m, Also including 1.0m @ 10.52 g/t Au, from 51.0m to 52.0m; Also Including 0.5m @ 18.68 g/t Au, from 54.0m to 54.5m, Also including 0.5m @ 14.37 g/t Au, from 56.5m to 57.0m.

- Hole MM24D-12-4640-021 Intersected 6.45m @ 10.43 g/t Au, from 36.0m to 42.45m, Including 0.75m @ 49.68 g/t Au, from 39.25m to 40.0m.

- Hole MM24D-12-4640-019 Intersected 3.0m @ 7.75 g/t Au, from 35.0m to 38.0m, Including 1.0m @ 17.73 g/t Au, from 35.0m to 36.0m.

,

Shane Williams, President & CEO, stated,

“The team has been making great progress de-risking the Madsen deposit with definition drilling as we continue to build up an inventory of high-grade and high-confidence ounces that will prove invaluable during the initial ramping up of mine production.

“The Mine Operations team is working in tandem with Geology to ensure the underground drills get to the highest priority areas of the deposit.

“The excellent results highlighted in this release are indicative of the upside that still exists at Madsen even within the current life-of-mine resource inventory.”

Since underground drilling resumed in early January 2024 the Company has completed 1,996m of Expansion drilling and 2,716m of Definition drilling. In total, 56 diamond drill holes for 4,367m have been completed so far in 2024 at the Madsen Mine. Fire and metallic screen assays have been returned for 56 out of 56 holes completed, with 1 Expansion hole currently drilling.

.

To read the full news release please click HERE

,

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.Declaration

At the time of writing the author holds shares in West Red Lake Gold

,

.