Orla Mining (TSX: OLA)

Provided an interim operational update for Q4 ended December 31, 2023.

This news release also includes the Company’s 2024 annual guidance which contains the outlook for production, operating and capital costs, and exploration spending across the Company’s portfolio.

.

.

| Orla Mining |

TSX : OLA |

| Stage |

Development |

| Metals |

Gold |

| Market cap |

C$1.28 billion @ C$4.07 |

| Location |

Zacatecas, Mexico + Nevada + Panama |

.

.

.

Orla Mining Beats Increased 2023 Production Guidance and Provides 2024 Production and Cost Guidance

The Company Repays Nearly $60 million in Debt in 2023

.

Vancouver, BC – January 16, 2024 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an interim operational update for the fourth quarter ended December 31, 2023.

This news release also includes the Company’s 2024 annual guidance which contains the outlook for production, operating and capital costs, and exploration spending across the Company’s portfolio.

(All amounts expressed in million U.S. dollars, unaudited as at December 31, 2023 unless otherwise stated)

.

Fourth Quarter 2023 Camino Rojo Oxide Mine Operational Update

The Camino Rojo Oxide Mine produced a record 34,484 ounces of gold during the fourth quarter and 121,877 ounces of gold for the full year 2023, exceeding the increased gold production guidance range of 110,000 to 120,000 ounces.

Gold sold was 31,300 ounces during the fourth quarter and 118,993 ounces for the full year.

——-

During the fourth quarter, Orla repaid $25.0 million towards its revolving credit facility reducing the balance outstanding under its credit facility to $88.4 million.

The Company also paid the final installment of $22.8 million to Fresnillo plc as part of the Layback Agreement. In 2023, the Company repaid $58.9 million towards its debt outstanding.

At December 31, 2023, Orla had a cash position of $96.6 million and total debt position of $88.4 million, resulting in a net cash position of $8.2 million1.

The Company has $61.7 million undrawn on its revolving credit facility which supports total liquidity of $158.3 million at year end1. Current unaudited liquidity position shown below. Financial and operating results for the fourth quarter and year end 2023 will be provided on March 19, 2024.

Liquidity Position

| Cash position |

$96.6 |

| Long-term debt2 |

$88.4 |

| Net cash 1,2 |

$8.2 |

| Undrawn debt available |

$61.7 |

| Total available liquidity1 |

$158.2 |

1. Net cash and liquidity are non-GAAP measures. See the “Non-GAAP Measures” section of this news release for additional information.

2. Long-term debt and undrawn debt may not tie due to rounding

.

.

Production and Cost Outlook 2024

Gold production from the Camino Rojo Oxide Mine is expected to be 110,000 to 120,000 ounces in 2024.

The Company is planning to mine approximately 8.3 million tonnes of ore and 9.9 million tonnes of waste for a total of 18.2 million tonnes resulting in a strip ratio of 1.2. The increased strip ratio in 2024 is a result of increased waste mining planned for the east-west pit expansion following the receipt of applicable permits.

Camino Rojo’s 2024 total cash cost is expected to be in a range of $625 to $725 per ounce of gold sold, including royalties and net of changes in inventory, while sustaining capital expenditures are expected to total $18.0 million, of which $12.5 million is for the planned heap leach pad expansion (phase 2) which is scheduled for the first half of 2024 and $0.5 million is for capitalized exploration on the Camino Rojo oxide layback.

All-in sustaining costs for 2024 is expected to be in the range of $875 to $975 per ounce of gold sold. The higher AISC guidance range in 2024 versus 2023 is predominantly a result of increased waste stripping at Camino Rojo (~$85/oz) and sustaining capital related to the heap leach pad expansion (~$110/oz).

The only exploration expenses that are expected to impact the Company’s AISC are capitalized exploration (sustaining) on the Camino Rojo layback area totalling $0.5 million. All other exploration is either capitalized as non-sustaining or expensed (regional exploration).

.

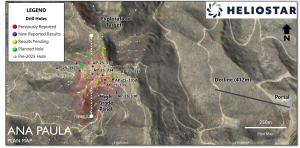

Orla focused on multiple exploration projects throughout 2023. Near the Camino Rojo Oxide Mine, a 6,500-metre drilling campaign defined additional oxide mineralization, targeting the layback and oxide extensions. The layback drilling validated historical drill results, confirming the continuity of oxide gold mineralization and extending into the Fresnillo property. Oxide extension drilling revealed significant mineralization with plans for 2024 follow-up.

.

Orla also executed a successful 34,000-metre drill program into the Camino Rojo Sulphides deposit, enhancing understanding of the Camino Rojo Sulphides and testing for sulphide mineralization extension below the limits of current resources. The south-oriented drill holes substantially improved understanding and strengthened the continuity of higher-grade mineralization, with the objective of upgrading existing resources and exploring for new sulphide mineralization beyond current resources.

.

At South Railroad in Nevada, Orla remains dedicated to evaluating the project upside potential, producing positive drill results that enhance the continuity of oxide gold mineralization over the southeast extension of the Pinion Deposit, and uncover high-grade oxide at Dark Star.

Drilling at the North Bullion deposit is aimed at enhancing the resource classification. The 2023 drill program tests across the South Railroad property contributed to an improvement of the geological understanding and led to the identification of new target areas.

Additional exploration details related to 2023 results and 2024 plans, including specific exploration programs, will be provided through separate press releases in the first quarter 2024.

.

.

Fourth Quarter 2023 Conference Call

Orla will host a conference call on Wednesday March 20, 2024, at 10:00 AM, Eastern Time, to provide a corporate update following the release of its financial and operating results for the fourth quarter 2023:

Dial-In Numbers / Webcast:

Conference ID: 5844017

Toll: 1 (646) 960-0685

Webcast: https://orlamining.com/investors/presentations-and-events/

.

To read the full news release, please click HERE

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds shares in Orla Mining.

.