Orla Mining Achieves Record Quarterly Production of Gold

Orla Mining (TSX: OLA; NYSE: ORLA)

Provided an operational update for the fourth quarter and year ended December 31, 2025, as well as 2026 guidance.

Orla exceeded its revised annual consolidated production guidance of 265,000 to 285,000 ounces of gold producing 300,620 oz in 2025.

.

.

| Orla Mining | TSX : OLA | |

| Stage | Development | |

| Metals | Gold | |

| Market cap | C$6.67 billion @ C$22.58 | |

| Location | Mexico + Nevada + Canada | |

| Website | www.orlamining.com |

.

Orla Mining Achieves Record Quarterly Production Propelling Company Above 300,000 Ounces for 2025, setting up a Catalyst-Rich 2026

Vancouver, BC – January 20, 2026 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) is pleased to provide an operational update for the fourth quarter and year ended December 31, 2025, as well as 2026 guidance.

Orla exceeded its revised annual consolidated production guidance of 265,000 to 285,000 ounces of gold producing 300,620 oz in 2025.

The Company anticipates full year 2025 all-in sustaining (“AISC”)¹ to be within the revised guidance range of $1,350-$1,550 /oz.

.

(All amounts expressed in millions of US dollars, as at December 31, 2025, and are unaudited)

.

Fourth Quarter and Full Year Operational Update

| Total Gold Production & Sales | Q4 2025 | FY 2025² | FY 2025 Revised Guidance | |

| Total Gold Produced | oz | 95,405 | 300,620 | 265,000 – 285,000 |

| Total Gold Sold | oz | 92,889 | 297,013 | |

| Musselwhite, Canada | ||||

| Ore Milled | tonnes | 361,407 | 1,089,896 | |

| Milled Ore Gold Head Grade | g/t | 6.77 | 6.04 | |

| Gold Produced | oz | 75,818 | 203,8562 | 170,000 – 180,0002 |

| Gold Sold | oz | 73,910 | 198,970 | |

| Camino Rojo, Mexico | ||||

| Ore Stacked | tonnes | 1,862,807 | 8,938,173 | |

| Stacked Ore Gold Grade | g/t | 0.47 | 0.54 | |

| Gold Produced | oz | 19,587 | 96,764 | 95,000 – 105,000 |

| Gold Sold | oz | 18,979 | 98,043 |

– Jason Simpson, President and Chief Executive Officer, Orla Mining;

“Thanks to the effort and dedication of our people across the business, we successfully exceeded our annual production guidance —delivering more than 300,000 ounces for the first time in our history.

“The strength of our diversified portfolio was clearly demonstrated in the second half of 2025, driven by outstanding execution by our operations teams in Mexico and Canada.

“Despite short-term challenges at Camino Rojo, the operation has fully rebounded, and Musselwhite’s exceptional production performance in our first ten months of ownership propelled us to record annual production.

“Our 2026 guidance reflects strong gold production and sustained investment to accelerate growth at Musselwhite, South Carlin, and Camino Rojo.

“Together, these priorities position us to deliver long-term value through disciplined execution of a high-quality pipeline of opportunities.”

.

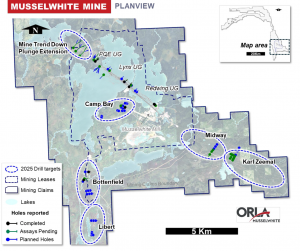

Musselwhite Operations

During the quarter, Musselwhite mined 370,622 tonnes of ore and processed 361,407 tonnes at a mill head grade of 6.77 g/t gold. Gold recovery was 95.65% resulting in gold production of 75,818 ounces.

Camino Rojo Operations

During the quarter, Camino Rojo mined over 1.7 million tonnes of ore and nearly 2.7 million tonnes of waste, for an implied strip ratio of 1.52. A total of 1.86 million tonnes of ore were stacked at an average grade of 0.47 g/t gold equating to an average daily stacking rate of about 20.2 thousand tonnes.

Our Camino Rojo team in Mexico responded rapidly and safely to the July pit wall event, mitigating the impact by processing stockpiled material while the north wall was re-established. With overburden removal now complete and mining returned to the main portion of the deposit, Camino Rojo is well positioned to deliver consistent performance in 2026. Camino Rojo produced 96,764 ounces of gold in 2025, in line with the revised annual guidance.

.

To read the full news release, please click HERE

.=======

To view Orla Mining’s share latest price and chart, please click HERE

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Orla Mining.

.