Nevada King Announces Spin-out of Non-Atlanta Claims

Nevada King Gold (TSX.V: NKG)

Announced that the Company’s Board of Directors has approved plans for a strategic reorganization of its business pursuant to which all of the Company’s concessions and properties with the exception of the Atlanta Gold Mine Project will be spun out to Nevada King shareholders through a newly incorporated company, “Spinco.”

.

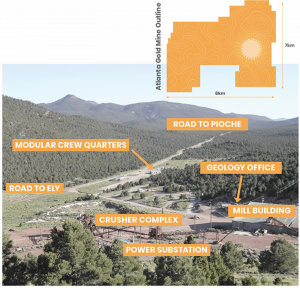

Nevada King Atlanta Gold Mine

NEVADA KING ANNOUNCES SPIN-OUT OF NON-ATLANTA CLAIMS PORTFOLIO AND FULLY ALLOCATED $9.75-MILLION NON-BROKERED PRIVATE PLACEMENT

VANCOUVER, BC, February 12, 2024 – Nevada King Gold Corp. (TSX.V: NKG)(“Nevada King” or the “Company”) is pleased to announce that the Company’s Board of Directors has unanimously approved plans for a strategic reorganization of its business pursuant to which all of the Company’s concessions and properties with the exception of the Atlanta Gold Mine Project (“Atlanta”) will be spun out to Nevada King shareholders (the “Spin-Out”) through a newly incorporated company (“SpinCo”).

In connection with the Spin-Out, Nevada King proposes to also grant to SpinCo a 3.0% royalty on all production from certain portions of Atlanta including the Atlanta resource area and non-core claims surrounding the Atlanta Gold Mine Project.

The Company is also proceeding with a non-brokered private placement financing (the “Non-Brokered Private Placement”) of 27,857,143 common shares of the Company (“Common Shares”) at a price of $0.35 per Common Share for aggregate gross proceeds of $9.75-million.

The Non-Brokered Private Placement is fully allocated to insiders, existing shareholders, and a new strategic shareholder of the Company.

Proceeds of the Non-Brokered Private Placement will be used to advance the Atlanta Gold Mine Project and for working capital purposes of Nevada King.

.

Highlights:

- The Spin-Out will provide investors with an ownership stake in two separate specialized companies. Nevada King will continue to focus exclusively on the advancement of the Atlanta Gold Mine Project, while the newly created SpinCo will focus on advancing its foothold as the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. SpinCo will control over 193,000 acres (9,682 claims) along the Battle Mountain Trend with key project areas hosting significant historical exploration work and possessing untested discovery potential. These project areas include Iron Point, Buffalo Valley, Lewis, Horse Mountain-Mill Creek, Hilltop South, Carico Lake, Kobeh Valley, and Pancake South.

- Company Founder & Chief Executive Officer Collin Kettell is subscribing for $2,000,000 of the Non-Brokered Private Placement, while other members of management and the board of directors are also participating.

- Two significant shareholders of the Company are subscribing for $4,200,000 and $1,345,000 of the Non-Brokered Private Placement, respectively. A new strategic shareholder to the Company is subscribing for $2,000,000. Between participation of the new strategic shareholder, as well as management and significant shareholders, the Non-Brokered Private Placement is fully allocated.

.

Collin Kettell, CEO of Nevada King stated

“We are pleased to announce these two exciting opportunities for the Company.

“Creating a standalone focused company holding Nevada King’s large portfolio of claims along the Battle Mountain trend will create an exciting growth-focused story with a dominant land position along one of the world’s most prolific gold mining trends.

“This project portfolio is nestled amongst some of North America’s most prominent current and former producing mines and has the potential to provide exceptional exploration upside and optionality from multiple properties.

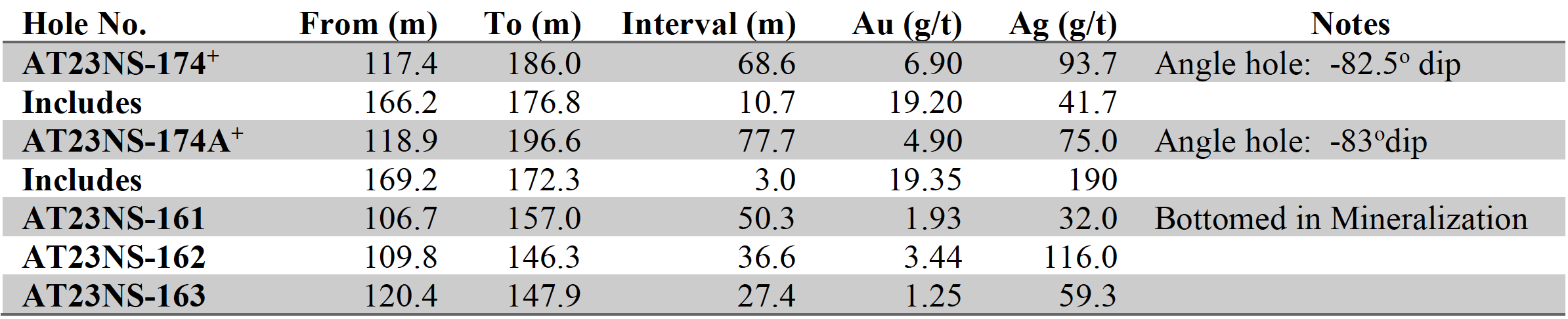

“At the same time, the fully allocated Non-Brokered Private Placement, which is priced at market and without a warrant, will allow Nevada King to fast track drilling at Atlanta, where we have continually intersected high-grade oxide results over significant thicknesses.

“We will be creating value for shareholders on two fronts now, with SpinCo providing exposure to significant exploration potential while Nevada King continues to develop its flagship Atlanta Gold Mine Project.

“Finally, I would like to provide a special thank you to our dedicated and growing group of significant shareholders whose support and long-term vision for Nevada King has allowed us to accelerate the advancement of Atlanta despite difficult equity conditions for the gold exploration sector.”

.

Spin-Out

The Spin-Out will be completed as part of a strategic reorganization to unlock value in Nevada King’s large portfolio of mineral claims in the State of Nevada.

The target areas along the Battle Mountain trend to be held by SpinCo include the Company’s Lewis, Horse Mountain-Mill Creek, and Iron Point projects.

Nevada King will also grant SpinCo a net smelter return (“NSR”) royalty in the amount of 3.0% from all production from certain non-core Atlanta claims surrounding Atlanta, as well as a 3.0% NSR royalty on the core “Bobcat” claims that cover the existing resource zone.

The 3.0% NSR royalty on the Bobcat claims will take effect upon fulfilling the existing royalty on the Bobcat claims which is a 3.0% royalty capped at the first 4,000 ounces of gold equivalent production.

.

To read the full news release, please click HERE

.

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds no shares in Nevada King.

.

.