Calibre Delivers Record Q4 Gold Production of 76,269 Ounces

Calibre Mining Corp. (TSX: CXB)

Announced operating results for Q4 and year ended December 31, 2024, an update on the Valentine Gold Mine, located in Newfoundland & Labrador, Canada and initial 2025 guidance.

Record consolidated Q4 gold production of 76,269 ounces; Nicaragua 66,578 ounces and Nevada 9,691 ounces.

.

.

.

| Calibre Mining | TSX: CXB | |

| Stage | Production, development, exploration | |

| Metals | Gold | |

| Market cap | C$1.98 Billion @ C$2.37 | |

| Location | Canada, Nicaragua, USA | |

| Website | www.calibremining.com |

Calibre Delivers Record Q4 Gold Production of 76,269 Ounces; 2025 Gold Production Expected to Significantly Increase as Valentine Gold Mine, Canada Remains on Track for First Gold During Q2, 2025

VANCOUVER, British Columbia, Jan. 08, 2025 (GLOBE NEWSWIRE) —Calibre Mining Corp.(TSX: CXB; OTCQX: CXBMF) (the “Company” or “Calibre”) is pleased to announce operating results for the three months (“Q4”) and year ended (“Full Year”) December 31, 2024, an update on the Valentine Gold Mine (“Valentine”), located in Newfoundland & Labrador, Canada and initial 2025 guidance. All figures are expressed in U.S. dollars unless otherwise stated.

.

.

Q4 & Full Year 2024 Production Results and Exploration Highlights

- Record consolidated Q4 gold production of 76,269 ounces; Nicaragua 66,578 ounces and Nevada 9,691 ounces;

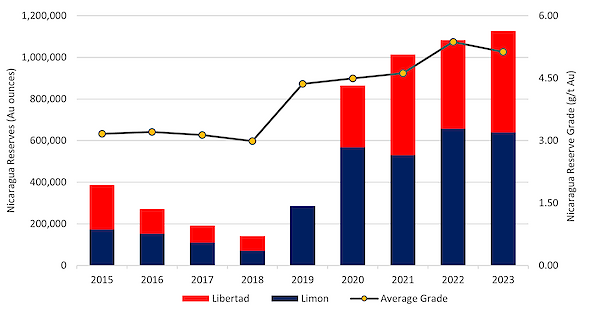

- Consolidated Full Year gold production of 242,487 ounces, exceeding updated 2024 guidance (230,000 – 240,000 ounces); Nicaragua 207,220 ounces and Nevada 35,267 ounces;

- Q4 delivered the strongest production of the year, setting a solid foundation for a promising start to 2025;

- Cash $186.7 million ($131.1 million in cash and $55.6 million in restricted cash);

.

Valentine Remains on Track for Q2, 2025 Gold Production

.

.

Executive Officer of Calibre, stated:

“Calibre achieved total gold production of 242,487 ounces in 2024. After addressing challenges in the third quarter, we delivered an exceptional fourth quarter, producing a record 76,269 ounces.

“Looking ahead, 2025 is shaping up to be a transformational year for Calibre with first gold production from Valentine on schedule for Q2. With Valentine fully operational, Calibre transitions into a robust, multi-asset, diversified mid-tier gold producer.

“Valentine is poised to become a long-life, cornerstone asset in Canada, initially delivering approximately 200,000 ounces of gold annually with significant exploration upside.

“We have made substantial progress on technical studies to increase Valentine’s throughput in a phase two expansion. While the original design envisioned an increase in throughput from the currently planned 2.5 million tonnes per year to 4 million tonnes per year starting in 2029, we are now actively advancing plans to accelerate the timeline for scaling up production to as much as 5.4 million tonnes per year.

“In 2025, we will focus on detailed engineering and schedule with the intent of committing to long lead time items before year end.

“Considering these developments, Valentine has the potential to exceed the production levels outlined in the 2022 feasibility study, especially given the promising results emerging from our ongoing exploration efforts. This positions Calibre for substantial growth and value creation in the coming months and years.

As previously announced, our exploration investment at Valentine has delivered very exciting results. November’s discovery of broad widths of gold mineralization outside mineral resources at the Frank Zone, approximately 1 km south of the Valentine Gold Mine demonstrates the upside potential.

“Results included 2.43 g/t gold over 172.8 metres including 3.84 g/t gold over 90.9 metres, 2.12 g/t gold over 95.4 metres and 2.26 g/t gold over 78.3 metres from the initial discovery.

“Our 2024 drilling program wrapped up in mid December, and we anticipate providing additional results surrounding the Frank Zone discovery as assays become available.

“Exploration is ramping up and as construction activity progresses to completion, we expect to add drills to increase the Valentine exploration activity throughout the year. In 2025, we expect to execute the largest annual exploration drill program in the property’s history.

“The geologic setting at Valentine is similar to the prolific Val d’Or and Timmins camps in the Abitibi gold belt. This, in combination with the significant prospectivity of the 32-kilometre Valentine Lake Shear Zone (“VLSZ”), I am confident that we will continue to deliver strong exploration results, unlocking the potential of this highly prospective region.

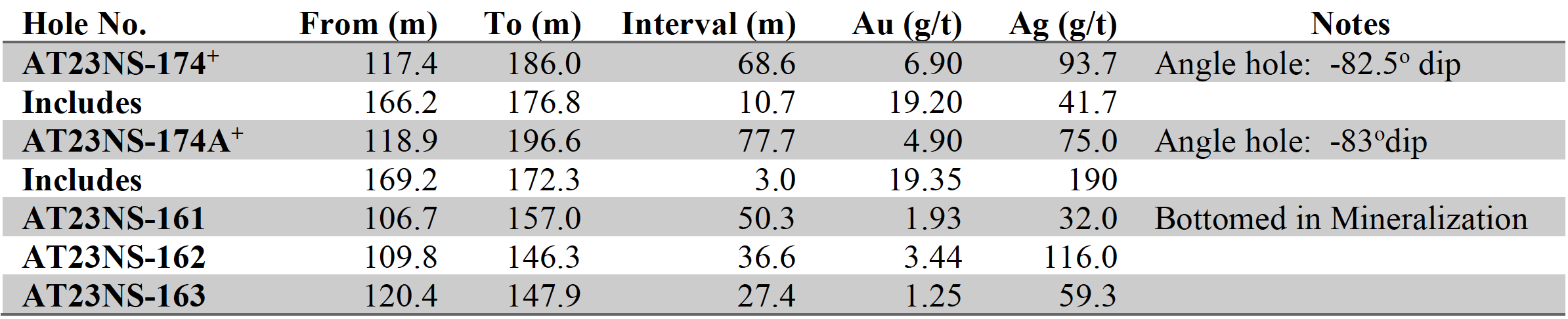

“Additionally, we are very encouraged by the continued exploration success across our assets in Nicaragua. During 2024, we announced numerous high-grade results from the Talavera Gold Zone and the VTEM Gold Corridor within the Limon Mine Complex demonstrating the exceptional potential for rapid resource growth.

“During 2025, I anticipate additional success as we expand our exploration efforts and again advance a multi-rig 100,000 metre drill program.”

.

.To read the full news release please click HERE

.

The live gold price can be found HERE

.

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Calibre Mining

.