Cyprium shareprice collapses after financing

Cyprium Metals (ASX: CYM)

Advised that CYM issued ordinary shares have been reinstated to official quotation and will resume trading upon market open today following the confirmation from ASX of the satisfaction of certain conditions for reinstatement to quotation.

The shares subsequently collpapsed from 10c to 4c as shareholders dumped their holdings in response to the deeply discounted placing.

.

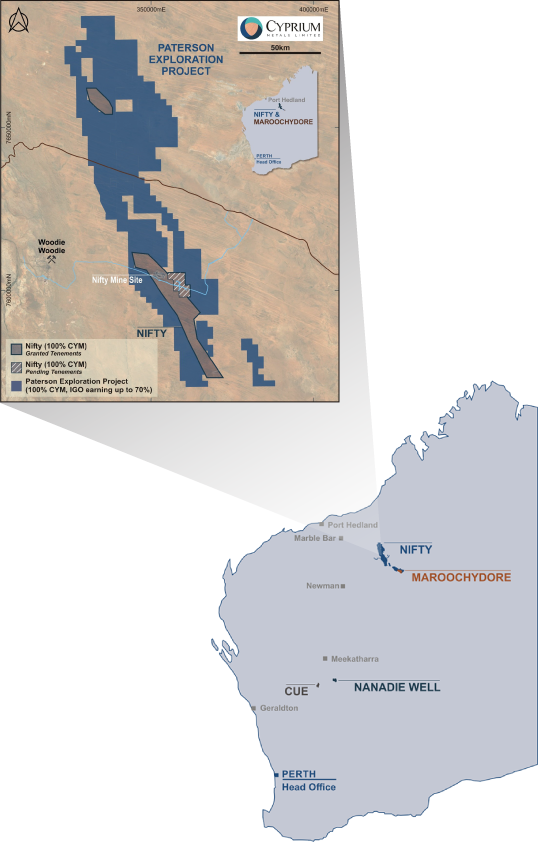

Cyprium Metals – Project locations in Western Australia

.

.

.

| Cyprium Metals | ASX: CYM |

| Stage | Development, Exploration |

| Metals | Copper, Cobalt |

| Market cap | A$49m @ 3.1 c |

| Location | Pilbara, Western Australia |

Comment

This is great news for the new investors in the company, but disasterous news for shareholders holding before the suspension.

This totally wrecks the share structure, and is so disappointing when the company was seemingly so close to prodiction.

We will cease coverage of this company as the investment thesis has changed beyond all recognition.

Cyprium Metals Shareprice bombs after Reinstatement to Official Quotation

.

Cyprium Metals Limited (ASX: CYM), (Cyprium or the Company) is pleased to advise that CYM issued ordinary shares have been reinstated to official quotation and will resume trading upon market open today following the confirmation from ASX of the satisfaction of certain conditions for reinstatement to quotation (refer to CYM ASX announcements on 20 September 2023, “Reinstatement to Quotation”, 19 September 2023, “Statement of Confirmations”, and 14 August 2023, “Prospectus” in Annexure A – Reinstatement Conditions).

.

Clive Donner, Managing Director commented:

“The Board is very pleased that the Company’s securities have resumed trading on the ASX.

“We are appreciative of the strong support we have received from our shareholders, including new institutional investors from the recently completed oversubscribed Equity Raising.

“The $31.6 million Equity Raising and US$14.5 million Bridging Facility provides the Company with the capital to advance the Nifty technical studies and finalise an appropriate development funding package next year.

“This enables the delivery and execution of our strategy to restart the Nifty Project as a larger scale open pit copper operation.”

.

.

=======

.

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in Cyprium Metals.

.

.