Cyprium Metals Nifty Financing Cancelled

Cyprium Metals (ASX: CYM)

Provided the following update on the financing of the Nifty Copper Project Restart.

The terms proposed for the USD denominated senior secured bond were revised and deemed not commercially satisfactory to the Company. The shares are suspended at the request of the company.

.

.

.

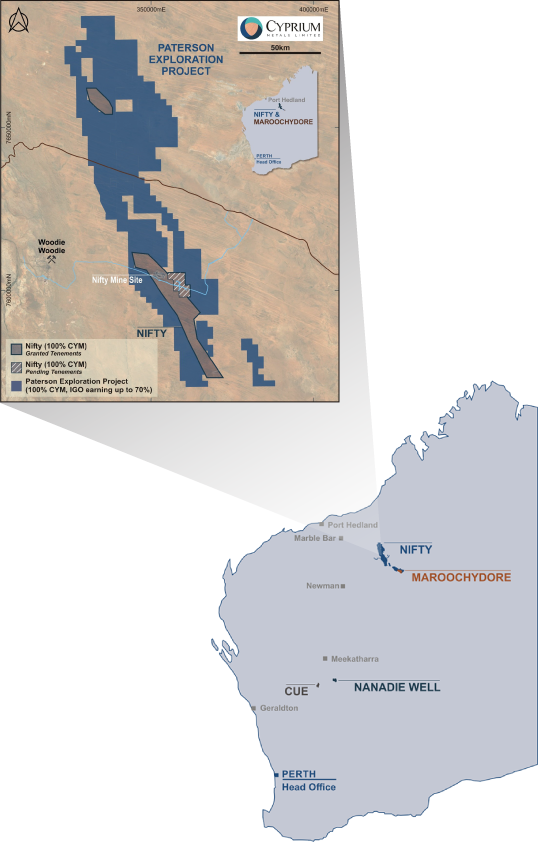

Cyprium Metals – Project locations in Western Australia

.

.

.

| Cyprium Metals | ASX: CYM |

| Stage | Development, Exploration |

| Metals | Copper, Cobalt |

| Market cap | A$70m @ 9.6 c |

| Location | Pilbara, Western Australia |

.

.

.

Comment

This news was not expected, and a bit of a shock to understand they have lost the initial UA$35 million as well. Although it was announced as part of the overall package, I’m not sure it was clearly specified that it would not proceed if the whole package failed.

So back to square one and the company have requested a suspension until they can replace this financing.

Very disappointing is putting it politely.

.

.

Nifty Copper Project Restart Financing Update

/

/

Cyprium Metals Limited (“CYM”, “Cyprium” or “the Company”) provides the following update on the financing of the Nifty Copper Project Restart.

The Company undertook fixed income investor calls with international debt capital market investors for a proposed issue of a USD denominated senior secured bond with a five-year tenor, subject to inter alia market conditions (refer to CYM ASX announcement dated 16 January 2023, “Senior Secured Bond Issue Investor Calls Commencing for Nifty Copper Project Restart” here).

The net proceeds from the contemplated bond issue together with the Offtake Prepayment Facility (refer to CYM ASX announcement dated 22 December 2022 here, “USD35M Secured Offtake Prepayment Facility for Nifty Copper Project Restart”) comprised the targeted AUD240 million to AUD260 million debt funding package to finance the restart of the Nifty Copper Project.

The terms proposed for the USD denominated senior secured bond were revised and deemed not commercially satisfactory to the Company.

The previously announced equity raise (refer to CYM ASX announcement dated 6 February 2023, “AUD35M Placement to Support Nifty Project Restart”) was contingent on the debt funding package being available, and as a result this equity raise will not complete in the current form.

As a consequence, the Company is evaluating possible alternative financing arrangements for the Nifty Copper Project Restart.

Concluding the terms of possible alternative financing arrangements is expected to take

several weeks and the Company will advise of any material developments regarding the

alternative financing process as it is progressed.

The Company intends to remain in voluntary suspension until it is in a position to make a definitive announcement regarding an alternative financing package.

This ASX announcement was approved and authorised by the Board.

.

To read the full news release, please click HERE

.

=======

If you need clarification of any information contained in this note, or have any questions, I will be delighted to assist – Please email andrew@city-investors-circle.com

=======

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

.

Disclosure

At the time of writing the author holds no shares in Cyprium Metals.

.

.

Read more: http://www.city-investors-circle.com/cyprium-metals-signs-offtake-term-sheet/#ixzz7uBrcYtSM