Orla Mining Files Request for Arbitration Against Panama

Orla Mining (TSX: OLA / NYSE: ORLA)

Announced that, further to its April 10, 2024, news release, the Company has filed a Request for Arbitration against the Government of Panama under the Canada-Panama Free Trade Agreement.

.

Orla Mining Cerro Quema project panoramic view

.

.

| Orla Mining | TSX : OLA |

| Stage | Development |

| Metals | Gold |

| Market cap | C$1.84 billion @ C$5.95 |

| Location | Zacatecas, Mexico + Nevada + Panama |

| Website | www.orlamining.com |

,

Vancouver, BC – July 3, 2024 – Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the “Company”) announces that, further to its April 10, 2024, news release, the Company has filed a Request for Arbitration against the Government of Panama under the Canada-Panama Free Trade Agreement (the “FTA”).

The Request for Arbitration asserts that measures taken by Panama in respect of the Cerro Quema Project constitute violations of Panama’s legal obligations under the FTA and customary international law.

A Notice of Intent to Arbitrate was filed with the Government of Panama under the FTA on March 28, 2024, which was intended to facilitate a 30-day consultation period to reach an amicable resolution to the Company’s claim. As no resolution was reached, the Company has proceeded with filing the Request to Arbitrate.

The arbitration will be facilitated and administered by the International Centre for Settlement of Investment Disputes (ICSID) in Washington, DC, under its Arbitration Rules. As part of the FTA requirements, the Company has submitted an initial and preliminary estimate of damages claimed of no less than US$400 million, plus pre-award and post-award interest.

Although the Company intends to vigorously pursue these legal remedies, the Company’s preference is a constructive resolution with the Government of Panama that results in a positive outcome for all stakeholders.

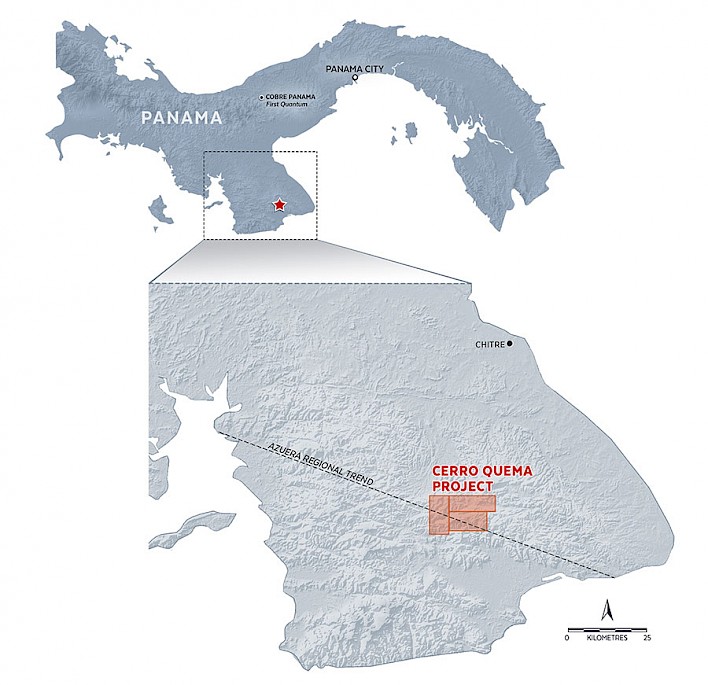

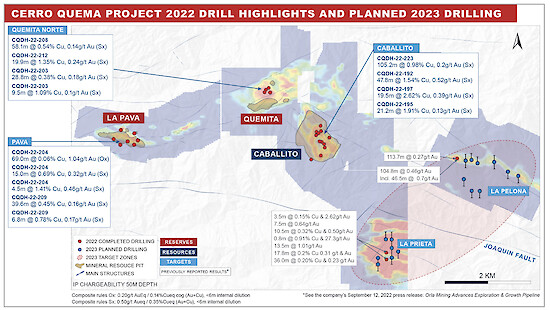

The Cerro Quema Project is located on the Azuero Peninsula in the Los Santos Province of Southwestern Panama, about 45 km southwest of the city of Chitre. The project includes a pre-feasibility-stage, open-pit, heap leach gold project, a copper-gold sulphide resource, and various exploration targets.

The Company believes that the Cerro Quema Project could be an important social and economic contributor to Panama, creating employment and skills development opportunities and contributing tax, royalty, and other fiscal benefits to the host communities and governments. The Company also maintains a strong commitment to operating in an environmentally responsible manner.

,

——-

To View Orla Mining’s historical news, please click here

.

.To read the full news release, please click HERE

.

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Orla Mining.

.