Gold Road (ASX: GOR)

Announced a positive PFS for their Gilmour gold project, with a low capex, and a mining start date of late 2026.

The project pre-tax free cash flow estimated at A$377 million at a flat A$3,500 per ounce and A$569 million at a flat A$4,300 per ounce gold price assumption.

.

.

.

|

Gold Road |

ASX : GOR |

|

Stage |

Production (50% JV) |

|

Metals |

Gold |

|

Market cap |

A$2.62 Billion @ A$2.41 |

|

Location |

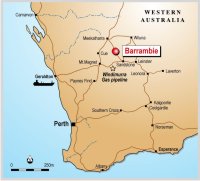

Laverton, Western Australia |

|

Website |

www.goldroad.com.au |

.

GOLD ROAD ANNOUNCE A POSITIVE GILMOUR GOLD PROJECT PRE-FEASIBILITY STUDY & MAIDEN ORE RESERVE

.

Gold Road Resources (ASX: GOR) Announced a positive PFS for their Gilmore gold project, with a low capex, and a mining start date of late 2026.

The project pre-tax free cash flow estimated at A$377 million at a flat A$3,500 per ounce and A$569 million at a flat A$4,300 per ounce gold price assumption.

.

.

HIGHLIGHTS

The Gilmour pre-feasibility study (PFS)1 presents an after-tax net present value (NPV5%) of A$231 million at a flat gold price of A$3,500 per ounce and A$354 million at a flat gold price of A$4,300 per ounce.

*

Project pre-tax free cash flow estimated at A$377 million at a flat A$3,500 per ounce and A$569 million at a flat A$4,300 per ounce gold price assumption.*

PFS mine life of 5 years averaging 50,300 ounces per annum at an average AISC of A$2,004 per ounce, producing a life of mine total production of 0.25 million ounces at 3.9 g/t Au from underground and open pit.

* Orebody remains open at depth with drilling planned for 2025.

High-grade underground mine producing 0.20 million ounces over 4-year underground mine life.

*

Comprising a high-grade component of 0.10 million ounces at 9.34 g/t Au and lower

grade component of 0.10 million ounces at 3.89 g/t Au.*

Establishment capital is estimated at $36 million which includes site infrastructure and haul roads. Ore is modelled as being hauled to the Gruyere process plant, 60 kilometres by road.

No additional growth capital outside of AISC and the initial establishment capital.

*

Project remains on schedule to be shovel ready from late 2026, with the timing of initial production to be optimised in line with the future Gruyere Joint Venture ore processing schedule.

As at 31 December 2024, the maiden Gilmour Ore Reserve totals 1.5 million tonnes at 4.10 g/t Au for 0.19 million ounces.

*

The Ore Reserve is derived from open pit and underground designs at a gold

price of A$2,250 per ounce and includes:

High-grade underground Ore Reserves of 0.6 million tonnes at 6.6 g/t Au for 0.13 million ounces* , and

Open Pit Ore Reserve of 0.8 million tonnes at 2.2 g/t Au for 0.06 million ounces*

.

.

.

Cautionary Statement

The Pre-feasibility Study (PFS) life of mine total production (and derived forecast financial information) referred to in this announcement is under pinned by Indicated Mineral Resources of approximately 72% and Inferred Mineral Resources of approximately 28% over the evaluation period.

Ore Reserves are based solely on Indicated resources.

There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target

will be realised.

The Company believes it has a reasonable basis to disclose a production target that includes some Inferred Mineral Resources as the Inferred Resources are not a determining factor in the viability of the Gilmour Project.

Importantly, the feasibility of the development scenario outlined in the PFS does not hinge on the current Inferred Mineral Resources.

* See cautionary statement and forward-looking statement on pages 1, 2 and 10 of this announcement respectively 1 The PFS Life-of-Mine plan assumes 0.18 million ounces classified as Indicated, 0.07 million ounces classified as Inferred.

Duncan Gibbs, Managing Director and CEO said:

“This is a significant outcome for shareholders and a pleasing return on our ongoing exploration efforts at our 100% owned Yamarna Project.

“Gold Road has a history of delivering value to shareholders and we remain focused on making further discoveries across our Australian portfolio.”

.

To read the full news release, please click HERE

.

The live gold price can be found HERE

City Investors Circle is based in the financial district in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness, and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Disclosure

At the time of writing the author holds shares in Gold Road Resources

.