Mining Review 23rd November 2025

Mining Review 23rd November 2025

A week dominated by the first mining conferences of the season in London and Zurich.

Mining stocks took a hammering, but I met a few new companies I like the look of and merit further research.

.

Swiss Mining Conference – Zurich 2025

.

City Investors Circle Mining Review 23rd November 2025

Mining Review 23rd November 2025

A week dominated by the first mining conferences of the season in London and Zurich.

Mining stocks took a hammering, but I met a few new companies I like the look of and I feel merit further research.

——-

The 121 Mining Conference in London seemed well attended but it’s always hard to gauge because most booths have two company representatives, making estimating the number of investors present difficult to assess.

I personally didn’t think it was so vibrant, but that’s probably because of the falling mining stock prices affecting my mood.

I had some interesting meetings though and am currently deciding whether to invest in any of the companies I met.

——-

I then met 55 North at a private luncheon presentation. This company is run by an experienced and successful mining CEO, Bruce Reid if Carlisle fame.

I like this story a lot and have decided to make an initial investment.

——-

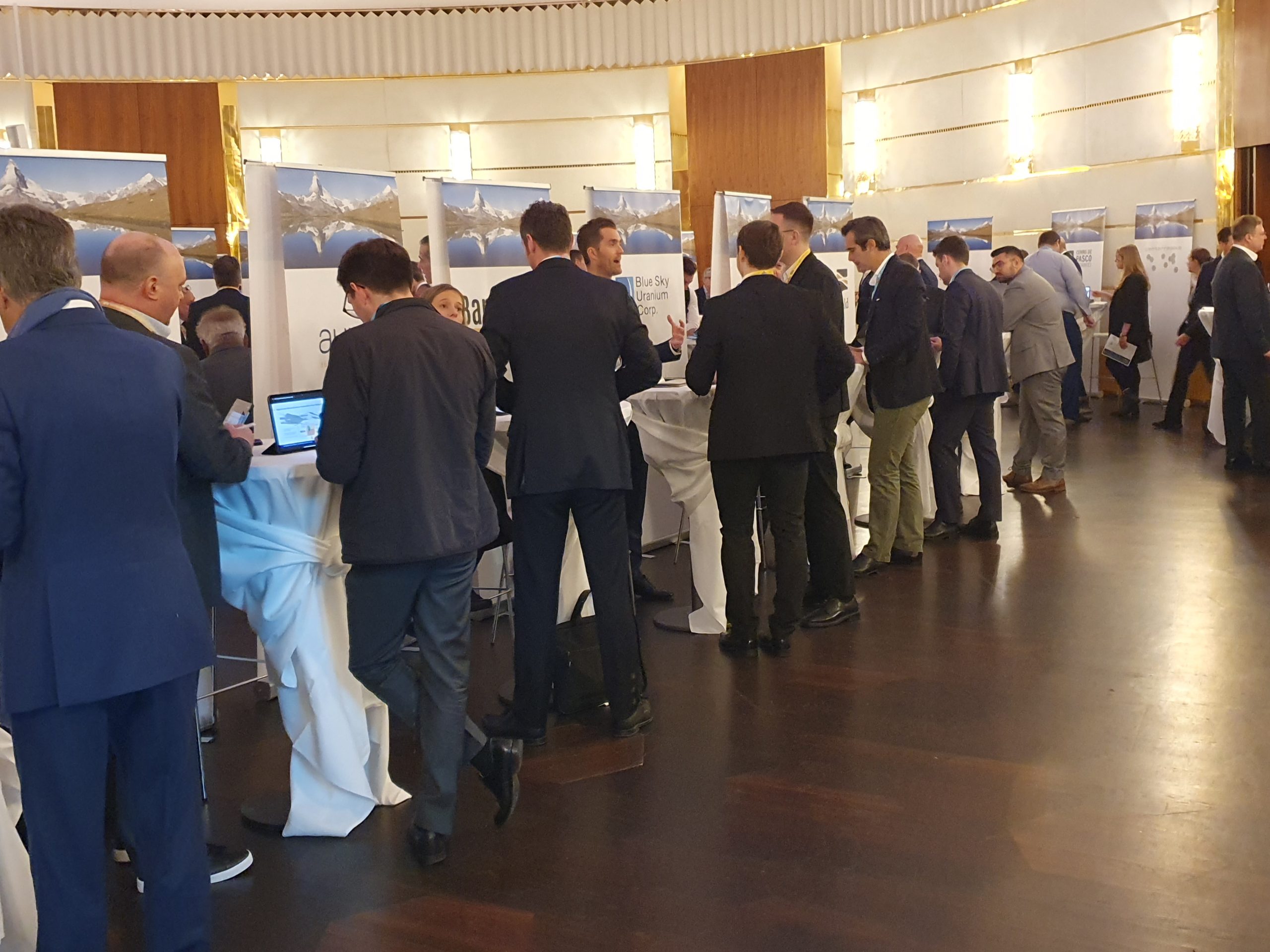

The Zurich Mining Show was the largest to far, and filled the room. What I like about this show is that, unlike the PDAC, you can meet the company CEOs on their stand, rather than a university student filling in for a pittance.

All the companies at the show have substance, it’s not cheap to participate here, so early stage explorers in moose pasture are nowhere to be seen.

This makes for a good show and I had numerous meetings with solid companies. As a result I am reviewing three potential investments in new companies that look to have my key criteria, Tier 1 jurisdiction, strong management, funded to near term production in a project with scale.

Once I have reviewed the companies I will add any I think deserve inclusion into the watchlists.

——-

A list of all the significant news releases from our watchlist companies last week is below, please click on the link to be taken to the full story.

Colonial Coal Continues Talks With Interested Parties

Pacgold White Lion Drilling Intersected Gold Mineralisation

Orla Mining Generated $93 Million FCF in Q3

Omai Gold Drilled 20.33 g/t Au over 5.3m and 2.72 g/t Au

Mining Review 16th November 2025

——-

Market Data

Weekly Price Changes

(US$ unless stated)

| Metal Prices | 231125 | Weekly % change |

| Gold price in UK £ | 3107 | 0.19% |

| Gold in AUD$ | 6299 | 0.82% |

| Gold | 4067 | -0.44% |

| Silver | 50.16 | -1.26% |

| Palladium | 1375 | -2.27% |

| Platinum | 1519 | -2.00% |

| Rhodium | 8000 | -1.23% |

| Copper | 4.98 | -1.39% |

| Nickel | 6.52 | -3.41% |

| Zinc | 1.42 | 3.65% |

| Tin | 16.82 | -0.36% |

| Cobalt | 22.03 | 0.00% |

| Lithium | 12659 | 5.74% |

| Uranium | 76.2 | -1.68% |

| Iron Ore | 103.9 | -1.05% |

| Coking Coal | 195 | -0.51% |

| Thermal coal | 114.5 | 2.23% |

.

.=======

.

City Investors Circle is based in the City of London

We present interesting and exciting junior mining companies listed on the ASX and TSX stock exchanges to a group of city professionals, and private investors, all of whom are active investors with a mandate to invest in junior mining companies.

Our audience is selected and invited individually to ensure interest and relevance for the presenting company.

Meetings are non-deal, small group, highly focused and engaged, with a lively Q and A to follow the main presentation.

We create awareness and maintain interest in presenting companies by disseminating their future news to our entire investor group via email, social media, and our Monthly Review newsletter.

If you wish to present to our select group of active mining investors, please email andrew@city-investors-circle.com

.

=======

,

This website is not sponsored, we are truly independent, and will always remain so.

Companies featured here have either presented to the Circle in London, or have been selected because they are considered to have interesting projects, in good jurisdictions, run by an experienced management team.

All information used in the preparation of this communication has been compiled from publicly available sources that we believe to be accurate and reliable, however, we cannot, and do not, guarantee the accuracy or completeness of this.

These articles are for awareness and informational purposes only, and are not recommendations in any form. Always consult an investment professional.

.

Declaration

At the time of writing the author may hold positions in any of the stocks mentioned.

.